Filing late in a hurry, took a chance on this software. It seemed to work, all data entered, preview looked ok. I just needed it to print so I can mail it. It prints an empty form.

Wasted an hour with this garbage. Not free, charges $15 for state. Says it will print but it wastes paper and ink on an empty form. This site would get a lower review if allowed.

I'm a young adult, filed my own taxes for the first time last year. I used FreeTaxUSA. I didn't have much of an idea what I was doing, but this service held my hand the whole way. It'll ask you ALL the questions you need to maximize your return and feel confident you're not missing anything. Anything you don't understand, it'll have a little "?" question mark to click on that gives you all the details. I will say, you will need to be proficient in reading comprehension and have the patience to take your time with it. Other people in these reviews seem to be victims of their own human error. I've once again used this site this year, and it went off without a hitch. I specifically took the time to write this review because I love it so much, it makes tax season practically stress free.

Hello Kali! Thank you for your kind and honest review! We strive to provide an affordable, user-friendly, tax filing service. We are happy to hear that our software helped make your tax filing less stressful. Thank you for your continued support!

I usually pay hundreds of dollars for our taxes to be done every year and never fails there's more than a few people sharing how much money they saved "doing my own online... It's super easy..." So I used freetax USA highly recommended from the IRS too! Its been over 5 months and still no refund. Ive gonna letters about id verification and refund is being reviewed, I reached out to freetax USA for help since I thought I added it on just in case turns out they have no idea and can't help. Never use this company horrible and you'll be left in the dark and it's seriously affecting me mentally because I've put my family in a financial bind and the burden of using this company is making me suicidal. God awful feeling knowing I've caused my family to struggle because I trust a company to complete my simple 1040 return.

Hi Elisa, I am so sorry to hear of the struggles you are facing. Once a return is accepted, the IRS determines the order, processing, approval and timing of the refund disbursement. If you were sent an ID verification, the IRS sends those and you will need to contact them to verify the identity and to determine why they are sending the verification. It sounds like you contacted us and did not receive assistance. I would like to follow-up with you on this, will you please private message me your email address so I can review the assistance and see what can be done? Thank you for being our customer this year. I look forward to further assisting you.

Finally a free tax site that is legitimate! I found no hidden fees or expenses! I do a simple return and this site is perfect for me! They do offer other products for tax returns a bit tricky but their prices were a so reasonable compared to other sites that offer that type of products. The first year I didn't have state taxes so it was completely FREE to file! I now live in a state that I do pay taxes,and exactly as they promised 14.99 no more! Awesome job 👏

Hi Terri! We're so happy you've had a good experience using our software. Thanks for sharing your positive review. We appreciate having you as a customer!

These pieces of trash have no phone number because someone, like me, would call them every day to remind them of how worthless they are. They charged my card just to let me know afterwards, that all they could do is give me a print out. I am reporting it to my card company on Monday as theft. If my card company decides to pay it, that is up to them. Maybe if enough people reported this, the card companies would notice the pattern. This is a scam site. I will be posting this on yelp too, under at least four accounts. Does anyone else have any ideas on how I can hurt this company? Are there any other websites where I can try to convince people they are scam artists?

Hi Johnny S. We are truly sorry to hear of the frustration. The IRS does not allow self-preparation software companies to e-file prior year returns. The fee we charge is for the preparation of the return regardless of the method used to file the returns. We do try to alert customers to the inability to e-file prior year returns and do appreciate your feedback regarding this. It sounds like you do not wish to use the return and would like a refund. Please login and select to contact our Customer Support. We will be happy to assist you. We do not currently offer phone support but do respond quite quickly via email. Thanks!

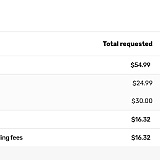

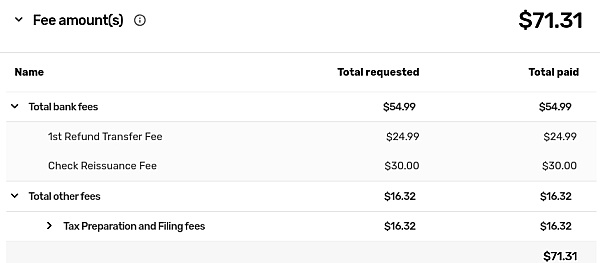

They've somehow decided to send cashiers checks instead of direct deposit, through some 3rd party, although I set my refund for DD (and all of my banking info is correct). A $30 "check reissuance fee" has been taken from my refunds, on top of $40+ they've already taken--and of course I haven't received my refunds although they were posted on 2/22. Absolute scam, this is criminal.

Hi Matt. I am sorry for your frustration. It sounds like you chose the option to pay for your state tax preparation using our pay with refund option. There is a fee associated with this as well as a disclosure page stating that if the 3rd party bank is unable to deposit the funds for any reason, they will send you a check for the balance, less the fee of $30 for having to resend. All of this was agreed to when choosing the pay with refund option. I am happy to look into this further if you send us a message with your email address.

I helped my grandson do his taxes on this website. When we were done, I said well he would get a $63 return. Next thing you know we're being told his refund will be $22 because they took $41 for the state taxes which we never approved having done And they never even processed the Pennsylvania State return after they took the money and we still have not gotten his tax refund. Stay as far away from these people as you can because they rip off artist and they will never get back to you after you contact support.

Hi Nancy, we're sorry to hear you did not have a good experience using our software. We do not require that state taxes are paid for or filed through our website. They are added or removed from your order on the "Filing" > "Order Products and Services" page before filing. If you have contacted our support team already and are not satisfied, we would be happy to look into this directly. Please private message us your email address.

This is the second year I used this site. Last year worked ok, but this year it will not let me show that my Schedule C net is not subject to Self-Employment tax. I am a notary, and that income is exempt from SE tax. Also, it computed deprecation on my car incorrectly. I am a retired tax professional, so I don't need tax help, but you can't even get hold of them regarding technical problems with their website.

Hi Scilla! I am so sorry for the frustration that you are experiencing with our site. We do have a way for our software to exempt notary income from SE tax. I am also very sorry that you are having trouble getting a response from our support team. I would like to personally look into this and see what has been happening. Could you please send us a private message with your email address (the one on your account) so I can get this figured out?

I did my taxes on April 6th and so far nothing is even showing up on the wheres my refund page. I can't find anywhere to contact someone either. It says my returns have been accepted and there's no issues like as of April 10th. Its now almost been 2 months and I want some answers. This is ridiculous and obviously a scam. Someone needs to reach out to me asap in regards to this please and thank you very much.

Hello Lila, we are sorry for any frustration this has caused. Our customer support would be happy to look further into this. Please contact Support from within your account, so they can give more information regarding the return. If you are having trouble signing in, they can also be contacted by email at: Support@FreeTaxUSA.com.

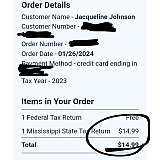

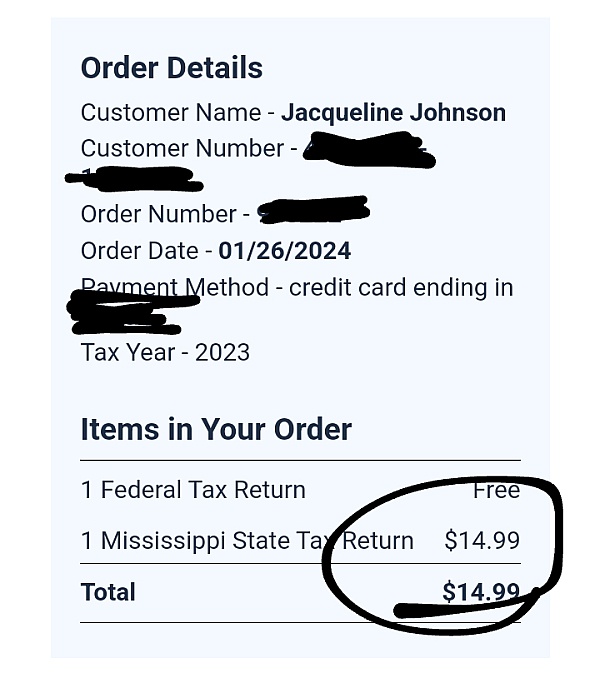

I paid the $14.99 upfront and that was a mistake. I tried to login to the account and it's giving me an issue with that. My federal taxes wasn't filed and the fee was to file my state taxes but that didn't happen. It's too much. Don't use this site please

Hello Jacqueline. We are sorry for the frustration this has caused. That is correct, our software does offer a free Federal return and has a small fee of $14.99 for the state return. Customer Support would be happy to provide further assistance in logging back into the account and helping determine why the return was not filed. Please email them at support@freetaxusa.com

I used freetax this year and after receiving notice that irs had accepted I tried to get back in to the site to check on it, since no arrangement had been made to pay what was due to the irs and after two hours of changing user name, password and getting codes to supposedly get in.Im still unable to get to access it. I have now left my phone number and they are supposed to call back but after all the issues I have my doubts on

Hello James. I am so sorry to hear you are having a hard time getting into your account. We are committed to helping our customers gain access to their accounts. Please email support@freetaxusa.com so that our Customer Support team can help you gain access to your account.

State fee of 14.99 is charged to you for the preparation of the state taxes. So if in the end, when you go to actually filing, and for some reason they say they can't file for you (happened to me), you still get charged the fee.

So be aware that the filing is free, but if they don't file, you still have to pay.

Hello, Pam. I am very sorry of the frustration this has caused. The fee we charge is for the preparation of your state return. The fee is the same whether you e-file or mail the return. In general, the IRS determines if a return is eligible for e-file or not. Our Customer Support team would be happy to review your account and see why it cannot be e-filed, as well as answer any questions you have. To contact them, please log into your account and use the "Support" button in the upper right corner of the screen. If you aren't able to sign in, you may also contact our Customer Support team by emailing them at Support@FreeTaxUSA.com.

There is a reason Free Tax USA gets a 2.5 star rating - uber confusing site! Despite many time wasting messages to their CS no one suggested or explained state tax could be free and I do NOT need to pay $15 for filing my state return! Very confusin product site with their varous options and upgrades. They could save staff payroll by having phone support! It's too complex a subject and does not lend itself to electroinic CS - it just wasted our and your time! Two different log in requirements for their deluxe, pro, or free service! Would NOT refund my $15 in spite of my bad experience!

Hello Rob. We apologize for the frustration you have experienced and for any confusion. We do offer a Free file version, due to IRS regulations an account must be created from the IRS link or your states website. Our Federal return is always free. We do also offer several upgrades so our customers can speak to customer support through Live Chat or over the phone. However, we reply to our customers via email very quickly as well at no additional upgrade. We would be happy to look further into this. If you have contacted us through our Customer Support team, please direct message us your email address here so we can look into the issues you experienced and help come to a resolution. Our Customer Support team strives to provide an excellent Customer Support experience and we would like to help make this right. For further questions, please contact us at support@freetaxusa.com.

There products are uber confusing! Two different log in requirements for their deluxe, pro, or free services?! Very user unfriendly! I unwittingly paid for state returns by using their upgraded version despite multiple messages to CS - no one pointed out the uber confusing structure and that I could file state for free on their free site! Not even a HQ number, or contact to voice complaints! And of course no phone support whatsoever on their free version. Different CS reps respond to you making for more confusion to an already UBER confusing product ( and subject in general) They could afford to staff up less if they actually had phone support. The multiple emails back and forth are VERY time consuming

For customer and CS rep! They refused my request for a refund, even after pointing out the totally confusing nature of their structure and user unfriendlyness of it and lack of CS.

It was easy to use could not put my paperwork up to print it. Can't get in touch with anyone. I do not know if it was filed or not. They have all of my personal information which I do not like since they aren't responding.

Hi Jennie! I understand your concerns. Customer Support will be happy to help you. You can contact us by signing into your account and sending a message by selecting 'Support' at the top of the page. Customer Support will contact you within 24 hours. You can find the status of your return by going to the 'Final Steps' menu and selecting 'Check Status/Print Tax Return'. You will also be able to print your return from this screen. Please be assured that the information entered in your account is safe. You can view how we keep your information safe at this link: https://www.freetaxusa.com/safe.

Pathetic company. Don't use their software. I spent hours preparing a federal and state return. At the time of payment, I saw my card got declined. I checked with bank and they confirmed there was no attempt from merchant and therefore error is on merchant's end. Then I tried four more credit cards from different banks on two different machines, it didn't work.

I contacted support and was surprised and upset to see their answer: "I apologize, at this time we cannot determine why your credit card will not authorize. If you wish to file a tax return, you will need to find another service to do so. Again, I apologize for the inconvenience."

Not only they were unable to help, they posed as if error was due to my credit card when the problem is in their portal. Now they suggested me to spend all that time again using another software. Instead of bypassing the payment requirement for me and letting me file, they are sending me to find some other software? That's absurd.

Hi Jehanzeb, thank you for writing. I'm really sorry to hear that you had trouble paying and will contact you directly to find a resolution.

This company screwed up my taxes by not informing my resident state (Ct,) of taxes I paid while working in a neighboring state.(NY) The result was an overpayment of $4,215 to Ct. There was no live person I could talk to to resolve the issue. I had to negotiate with Connecticut tax authorities to fix the problem-a long drawn out process. I had been using TurboTax in previous years with no problems. Their (Turbotax) system automatically stops the whole process if there is missing or incorrect data. Do not use this company to file your taxes!

Hello Daniel. We're sorry to hear you did not have a good experience using our software. We care about our customers' experiences and strive to create a software that assists customers in getting their maximum refund. Our software does provide a place to enter credit information for taxes paid to another state. In many circumstances, we also provide an alert reminding our customers to double check that section. Our Customer Support agents can be reached by selecting "Support" while logged into your account, but we would also be happy to look into this further if you would like to private message us your email address.

They charged me for state tax returns, then only after being charged, informed me that efile was not available and I have to print it out and mail it. Guess what? Printing it out and mailing it is free! What the $#*! did I just pay for? They will tell you it's for "preparing" my documents, but I sure feel like I'm the one who did all the typing. All I wanted them to do was efile for me. That's the whole point of these efile sites, right?

We need a public tax filing site, no more of this private bull$#*!.

Hello Daby. I am very sorry to hear of your frustration. We value you as a customer and want to do all we can to make the tax filing process as smooth as possible. We do try to make the inability to e-file prior-year returns clear to customers on the prior-year launch pages with the statement 'Please Note: Prior-year tax returns must be mailed.' and again as you start a prior year return in the software with a notice stating 'Important Note: The IRS e-file system is no longer available. You can still mail your tax return(s) to the IRS and your specific state.' Many of our customers find value in the simplicity and ease our software provides in helping them self-prepare their prior-year tax return(s) even when the IRS e-file system is no longer available. Our federal return is always free. However, prior-year state returns are currently $17.99 each. We sincerely appreciate your feedback.

I'm a penny pincher. So when they asked for the $15 for state taxes before even seeing my return, I was optimistic. Doing my taxes prior or turbo getting an idea i heard this was better, only for them to tell me i owed my state over $1300. At this time obviously incorrect and a waste of $15. Also they have no customer support number.

Hello Jamin, I am sorry to hear of your frustration. Our customer support agents are happy to help in assisting with your state filing and we do guarantee our calculations. We would love to look into this more for you. Please sign in to your account and select the "Contact Support" link in the upper right-hand corner of the page.

My first and last time filing with them. Because of the absolute mess that is the IRS backlog (they still have not processed my 2020 and 2021 tax year returns because I mailed paper as I have for 44 years), I decided it best to do electronically. For additional ease, I paid to have the state done at the same time. Within moments of completing and logging off I received a text that both were rejected. I twice corrected what they insist is an error (Previous year AGI and/or PIN---- which I have recorded and verified) only to keep getting the same exact rejection. I paid for nothing. I want my money back.

Hi Debra, thanks for writing and I'm sorry for any frustration you had with submitting your return electronically. Please note that if you filed your prior year return by mail, you should enter $0 as your prior year AGI. The IRS e-File system does not generally update with mailed information.

Once you have entered or corrected your information, please re-submit your return again to the IRS. There are no additional fees for re-submitting. If you have any additional questions, one of our customer support representatives would be happy to sort this out for you. You can contact them by logging into your account and clicking on the "Contact Support" link or by sending an email to Support@TaxHawk.com.

First time user. I used FreeTaxUSA for my 2020 federal and state returns. As a former TaxAct user I can say from my experience this product is much better. Simple and thorough. They had all the bases covered. The process is a breeze and their prices are very good. They have a new customer for life in me.

Hello Thomas! Thank you very much for your kind words and your review. We are so happy that you found our site and look forward to assisting you in preparing your returns again in the future.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

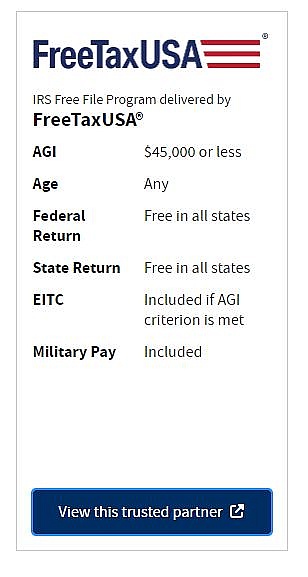

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hi Mark, we are sorry to hear of the inconvenience you have experienced with our website. Federal is always free and there is a fee for the state return, just as it states on our website. It sounds like you may need an update to your Adobe program for the return to print. Please reach out to our Customer Support team through your account and they will be happy to further assist you.