These jokers charged me TWICE for the 12.95 and THEN a message popped up saying "The e-file system is unavailable!" There is no phone number for them so I had to call my bank to have them dispute BOTH charges.

The process is easy but a scammer can never be trusted. I'm not saying don't use them, but please check your bank account afterwards and if they charge you for something you didn't receive, dispute it!

Ive used them for the last couple of years and have had no problems. Recieved my refunds direct deposit within 10 days that I filed. This year was only 7 days Ive even filed previous years and had to mail my paperwork in. Received those in less than 3 weeks and it says its usually 6 weeks!

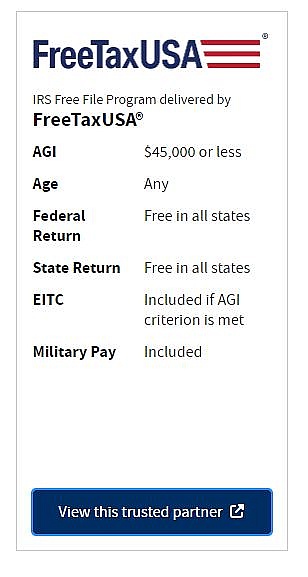

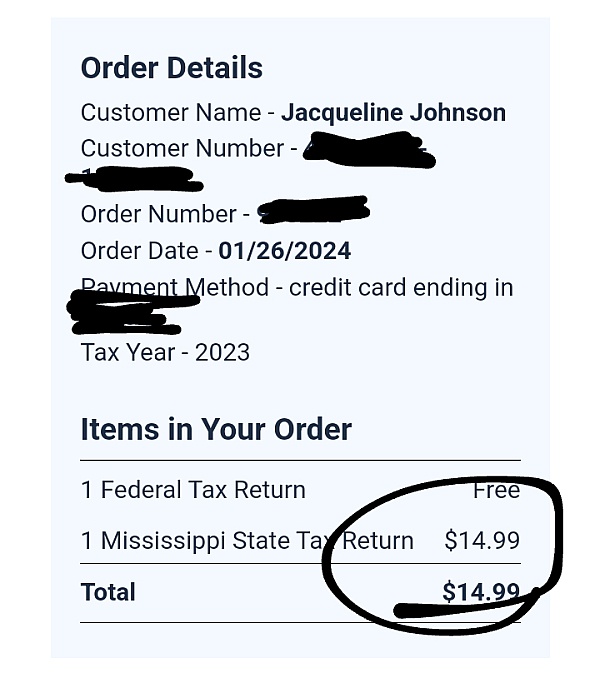

I saw pretty much from the start that filing my state taxes would be $14.99 and I happily paid the extra $6.99 for the deluxe/audit assist option. Not only was this the first time in several years that I've had to file taxes, but it was the first time I had to file as a self employed translator. I expected the whole process to be a nightmare, and frankly, it was until I found this site. I was reading up on what forms I needed to file as a freelancer and was getting frustrated. I saw an ad for FreeTaxUSA and thought I'd just take a look. Glad I did. It was easy to report my income and business expenses, and a huge weight off my shoulders finding a tax filing site that doesn't charge a ton and knowing that doing my taxes next year will be a relatively simple task. I was dreading filing my taxes, but FreeTaxUSA was a great find and a huge help. I really can't stress enough what a comfort it is to have this done and know that someone can help me if any issues do arise.

Hi Trudy! We're so happy you found us and look forward to helping you file your returns in the future!

I just used it for the second time and I find it so easy to use. In part because anytime youi've got a question you can just click and get an explanation. Taxes has been a super pain for me in the past and it took me less than a day this time. Super happy w/ this and that's why I'm taking time to encourage others to try it. Best. :)

Hello Mark! We are so happy to have you as our customer! Thank you for your kind review! We have the best customers around!

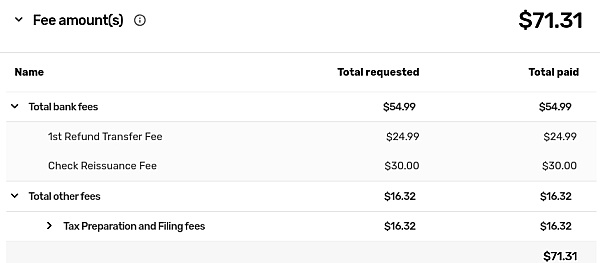

I ve used freetaxusa to file my taxes for years with no problems until this year. I decided to use their service for my state taxes. I opted to have them take their fee, which they advertise as $14, but it's actually $35 out of my returns. I didn't know that it meant my refund would go to them for them to deduct their fees first. My refund went sent to them, but they never credited my account with the money. Not a dime. They don't have any customer service number to call, so I have been sending out emails. They keep sending the response of looking into it.

Please don't use them if you want your refund.

Hello K. B, I apologize that you haven't received your refund yet. The refund transfer service has a $19.99 service fee which is disclosed several times before you are able to finalize your return. When added to the state preparation fee of $14.99, you get the total fee of $34.99 that was deducted from your state refund. In some cases, this process can take up to 5 business days. If you have sent emails regarding this issue, rest assured that our Customer Support team is looking into it and will get back with you as soon as we have more information. If you have any additional questions or concerns about this, please contact our support team again by signing in to your secure account and clicking on the Support link there.

Been filing 11 years and never had a problem. Started using free tax usa in 2014, that's when it seems like I started having problems. 2014 got code 1121, 2015 code 570. I have filed the same for 8 years and always have gotten return within 10 days, but now since 2014 I have been getting codes and it's taking alot longer.

Hi charlie, We can understand some of your frustration. Each year the tax code is updated, the IRS updates how they process certain tax returns, and new security measures are implemented. We try to make tax filing easy using our software. We check for issues before you send your taxes to the IRS and try to help in any way we can. If you need assistance with any of the codes you've received from the IRS our customer support representatives would be glad to help you.

I used them for one return. They charged my card twice. I contacted them several times... via contact page. They dont have a contact phone number. Copy and pasted my card statement that showed I was charged twice. No definitive answer. Do not use them. Go Turbotax or H&R Block

Under the impression I could e file my state tax I went on the website spent about two hours filling out forms, paid and then was told I could only e-file used both federal and state. The whole reason I even paid for this service was to submit my taxes on time since I all ready sent my federal taxes by mail. I can't get a refund for the $13 I wasted and now my state taxes are late.

Hi Fu, sorry for any confusion. You can only e-file a state return if you also e-file your federal return using our software. This is a policy for most tax software companies and is done to add an extra layer of security to all e-filed state returns. Similar to mailing your federal return, a mailed state return would still be considered filed on-time as long as it’s postmarked by the deadline.

Fast, easy and free. I got a bigger refund than I would've got from turbo tax. I filed with Free Tax USA on April 25 and its already posted on my bank account. Won't be able to spend it til April 1, but wow! That was fast!

Thanks for letting us all know about your experience with FreeTaxUSA! We're happy you found us and look forward to seeing you again next year.

I have been using FreeTaxUSA for the past 4 years and I have never had any issues. Overall, the process is easy to follow and straightforward even with more complicated needs. I always "double check" my return by using another online tax service to see if the numbers come out the same. For some reason this year, I lost my mind and ended up doing my taxes on TurboTax, H&R Block, TaxAct and Tax Slayer. I got the same amounts on all but H&R block which was $1,500 off from all the rest. I don't know why anyone would pay $70 for federal and state when you could submit the same thing for like $10.

LIARS! "Free" taxusa is of course, BS> They claim free federal Tax return a thousand times, and to there credit, It may be. But they then force you to file and pay for the state. There is no way to only turn in the federal forms, even though I have no need or desire to file state taxes. I hope this saves someone from getting trapped into a lie after spending an afternoon filling out the forms only to find out that without paying them, you have wasted your time. LIARS!

I am retired rrr. Never received any payment from social security. However part of rrr is listed as social security equivalent. The rest as pension. They threw the whole thing in as social security and can't get hold of anyone at the Free tax USA or IRS to correct

Hello Fred. We are very sorry for the frustration you have had with your pension entry. Can you please log in to your account and click on the Support link? Our friendly and knowledgeable support staff is always happy to assist you via email free of charge. Your message will go to a live person, who will respond within a few hours. We also offer a live chat support option if you would like to upgrade to the Priority Support version of the software.

FreeTaxUSA uses their bank account routing number on your return. No heads up. So, you whole return goes to them instead of you. Therefore, your future stimulus or other payments go to the routing number that the IRS has on hand. No phone number means "SCUMBAG" outfit. Stay away from these $#*!s.

Hi Scott, if you used your federal refund to pay our fees, there was an IRS error that affected the deposit of your second Economic Impact Payment (EIP) or stimulus. The IRS and our banking partners were able to find a resolution and most of our customers received deposits within the last few days. If you did not receive a deposit, it’s because your EIP was returned to the IRS. The IRS announced January 11th, that they will reissue missed economic payments and we anticipate that those affected by the IRS deposit error will receive their EIPs then. If you would like more information, we'd be happy to help. Please sign in to your account and click the "Contact Support" link.

For some reason this year Freetaxusa is holding refunds and not processing them in a timely manner. My refund was sent to them on 4/6 and I have yet to receive my money in my account. You charge all these fees to process through you and you don't issue refunds in a timely manner. Not sure what is going on with them this tax filing year.

Hello Kurt. Our banking partner does generally deposit the remaining refund into your bank account very quickly after they receive it. Please log in to you account and click on 'Support' and send a message to our support team. They can look in to this further for you to help you figure out what is going on.

Before I submitted my final tax returns, I checked the paperwork to ensure that my checking account numebr and bank routing number were correct. Unfortunately I didn't check them again after submitting the filing and found out the hard way that there was a glitch leaving off the last 5 digits of my bank account number! Now I have to wait an extra two weeks for a paper check.

Hi Leanna, I'm sorry to hear that your return was sent with the wrong bank account. The good news is that the IRS and states have procedures in place to make sure that your refund does not go to the wrong bank account and will send a paper check instead. It can take a little longer to receive your refund, but you know the refund is coming directly to you. If you are sure you entered the correct routing and account numbers, we would be happy to investigate this for you. Can you sign in to your account and click the "Contact Support" link?

I have filed my taxes and my husband for years. Never a problem, but now the state is after me and my husband for 2012, 2013, 2014. I enter what is on our W'2's and they calculate the rest including my state. Has anyone else had this problem? Were talking thousands of dollars.

Hi Vivian, each tax year our software goes through a rigorous testing and approval process with the IRS and each state. Accuracy is important to us and we'd like to help answer any questions you may have. I would like to personally assist you with this issue, please contact me at sam@freetaxusa.com.

I have used this site for several years with no problem until this year. Their program is easy to use and I was satisfied until this year. For a weird reason I had to mail my state forms rather than efile the state. Trouble is that they do not tell you that until you have paid the $12.95 email fee for the state return. And they refuse to return the payment-just a lot of double talk. I will find another program in the future.

Hello Sherry, I apologize for any confusion. We do have a preparation fee for state returns whether you e-file or mail your return. The fee is a flat $12.95 and there are never any hidden fees like many other sites. If you have any questions about why you needed to mail your state return, we will be happy to look into that for you. Please contact our Customer Support by clicking on "Contact Support" when you're logged into your account and our support representatives will be happy to assist you.

First of al IT IS NOT FREE!

I filed my taxes with bad information from Freetaxusa.com. The IRS found errors so I thought I would check to see if I amended my return the problem be fixed. I used their amend process and low and behold it showed an error on the part of the IRS so I went ahead and purchased the amended return for an additional $15. After I paid, my return showed that the IRS was actually correct. So apparently Freetaxusa pulled some kind of software scam to get me to pay for something I didn't need. They refused to refund my money although I had proof it was their software and ignored any further emails I sent them. Stay clear of these crooks!

Hi Jeff, we are sorry to hear you have not had a satisfactory experience. We guarantee our calculations based on the information entered. The Federal return is always free, however, there are charges for any additional services. We would be happy to follow up on the assistance you received from our support team. Can you please private message your email address?

I used them last year, all went fine. This year, I go along, entering all the data, and then AFTER I pay them, I go to file and it kicks me out! Now every time I try to log in it just says "Request Rejected" and gives me some dumb number?! I wrote to customer support email address on the site but judging by these reviews I doubt that will do anything. I really either want them to let me in and finish my taxes or refund my dang money! This is unacceptable. You cannot screw with someone's federal taxes or their debit card information like this! I really hope someone reaches out to me ASAP. I simply cannot get back in their site and I KNOW my credentials are correct.

Hello, Ryan! We completely understand your frustration and are doing all we can to assist our customers. Can you please sign in to your account and click on the "Contact Support" ink? If you are unable to sign in, please send an email with details to support@freetaxusa.com.

I met the criteria for a free file for federal which I did. They said state was 12.95. After I completed all the required information including my credit card info, they informed me that my state wouldn't accept my return and would have to file a paper copy. They went ahead and charged my credit card for the 12.95 anyway. Thanks for nothing. Next year I am going back to filing paper taxes. It gets worse every year. This is the worse e-filing company yet and should NOT be recommended on the IRS web site.

Hi Anne, sorry for any confusion. The $12.95 is for the preparation of your state tax return whether e-filed or printed to mail in. Some customers choose to just print their tax returns to send through the mail. Some choose to e-file the returns. Others, for a variety of reasons, are unable to e-file their tax returns and need to print the tax returns to mail.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hi Inze, sorry for any confusion. Whenever a payment is submitted, the charge is automatically pre-authorized by the credit card company and will show as a "pending" charge on your bank account. If for some reason the credit card company or our system declines the payment, then that charge will not be fully processed and the pending charge will go away within a few business days. It's possible to have a charge rejected and then retry and have it accepted which could look like a duplicate charge for a few days. Also if you click multiple times on the Pay Now button it may look like there are duplicate charges. Only one transaction will be fully processed, the other will go away within a few business days. If you still have an extra charge showing on your statement, please contact our customer support team and we will be happy to remove it. support@freetaxusa.com

In regard to the e-file system being unavailable. E-file is the recommended method for filing your return and we utilize that method whenever possible. However, for a variety of reasons, e-file isn't always available and a return may need to be printed and mailed instead. The fee you paid is for the preparation of your state tax return, whether e-filed or printed and mailed. It sounds like that could've been communicated in a better way. We are always trying to improve and your feedback is greatly appreciated.