I've used this site to file my tax returns for over 10 years and I've never had a problem. I do suggest that if you don't know much about tax laws and filing, you should never do it online yourself. Always go to a professional who can help you face to face. I would only suggest for people to do online filing on this site or sites similar to this one if you know what you're doing.

We have used this site for approximately 8 years now. We found the site very user friendly, and the step by step instructions are easy to follow. Each year we file our federal and state taxes on this site, and we have never had a problem having our forms accepted or getting our refunds.

I love this website. I started using it when I was 18 and had no idea how to do taxes. It really helps you step by step. I also like how it saves your information from last year so it really saves time. I've never had a problem and will definitely be using it again this tax season.

I've been using them for 3 years no and no problems. This year it's taking a bit longer and that's fine:-) hehe it happens! I tell all my friends about it. Will continue to use it! Super easy and they check to make sure there aren't errors as you go along. Highly recommended

Turbo Tax 2014 is not what 2013 was. I have been reviewing complaints on the major services (?) prior to selecting this one (re: "turbo tax complaints" as search line). All of the problems of each are significant if you're the one in pain. Been there with turbo for 2012. Each company has huge numbers of returns processed with insignificant numbers of complaints online.

The type of complaints have taken me to select freetaxusa for 2014.

CT and Federal return e-filing can be confirmed and refund processing can be tracked online. You may not immediately see that success has been achieved as daily computer files need to be merged with the main files first. This prev took about two days.

CT maintains a wonderful telephone help service during the day in the boiler (type) room of their tax bldg. I do not believe there has ever been a wait time. US SERVICE PERSONNEL are encouraged to call so as to get all their credits.

Tell em Jim says Hi!

I filed early and it says my return was already completed on January 31st and that funds would be deposited by February 2nd. I haven't received it and looking at past reviews, it looks like FreeTaxUSA is nothing but a scam.

ETA: They can't even get it right between state and federal. Their customer service is almost non-existent and replies are obviously copy and paste. Then they try to send you to other sites that have nothing to do with the question. Definitely stay away from them at all costs. They charge extra fees that they don't disclose prior and find ways to not give you anything. Nothing but a scam.

Hello Kara, we are sorry for the delays you have experienced in waiting for the IRS to process your refund. Once your return has been accepted, the timing of your refund is in the hands of the IRS. If your return has been accepted, this means the IRS has your return and is working on any available refund. Please continue to check the status by going to the IRS website at www.irs.gov/refunds. If you have concerns about how your return was filed, we'd be happy to help. Please sign in to your account and click the "Contact Support" link.

I'm trying to pay for the service and it's denied multiple cards from different banks. It then tells me I can pay to upgrade for better support?! Why can't you just work the first time? I just want to pay to file my taxes and be done with it.

Hi Britt, thanks for writing. One of our customer support representatives would be happy to help resolve your payment issue. You can contact them by sending an email to Support@FreeTaxUSA.com or by clicking on the "Contact Support" link while logged into your account. Our customer support services are free so there's no need to pay anything or upgrade.

I was wondering where my refund was after a month and a half of waiting, so i logged in and the first thing I see is that my taxes had been rejected by the irs and i needed to resubmit and mail the taxes. Freetaxusa never sent me an email or a notification about this, i guess this is what one gets when you use cheapa$$ services...

Hi Monica, we are sorry to hear you did not receive an email updating you on the status of your return. An email is always sent to notify customers of their acceptance or rejection, unless it has been selected in the software to not get an email. Is it possible the email went to your junk mail or that it was selected not to get email updates? We are happy to hear you were able to sign into your account and get the update. In the future we recommend doing that within a couple days of filing. You can reach out to our Customer Support team from your account any time and we are happy to assist you.

I have used this site two or three times and plan to use it again. My only concern is, could I have gotten a bigger tax return? I will be shopping around to see if I find anything better. This is way better that TurboTax, them, I will never use again.

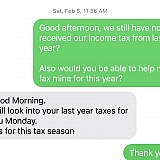

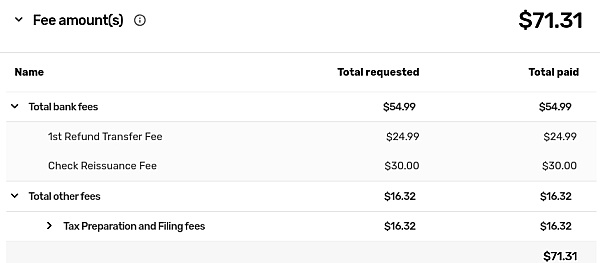

Did my taxes a few weeks ago. Received an email from FreeTax last night to file an amendment because there was an update done to their software due to itemized deductions for state not calculating properly. In my case it was 170 error in my favor. Needless to say after 5 years of using FreeTaxUSA I will no longer use their software. Errors of this kind when dealing with a customers tax return is not acceptable. Especially when State is the return we are paying them for. When expressing my displeasure with having to file an amendment due to their error Free Tax customer care was not apolgetic at all. Their answers to questions about the amendment were "its probably fine". Anyone who has had dealings with IRS knows "probably fine" doesn't cut it. Its black or white so a definitive answer is essential to correctly filing a return and or amendment. Goodbye FreeTaxUSA that was never really Free anyway.

Hello Michelle, we are very sorry to hear that you did not have a positive interaction with both our software and support this year. One reason for the recent update to your state's calculations could have been new direction from the state. We would love the opportunity to make this right, though, if you could please private message us your email address.

I filed for my tax return on the 29 or the 30 either way I'm still I'm still waiting for it to come. Here it is the middle of February and I'm still waiting. Easy was easy to do but I definitely will be using turbo tax next year. This matter have put things on hold for me.

Hello Laquita, do you know if your tax return has been accepted by the IRS? The easiest way to find out if your tax return was accepted is to sign in to your account. Once you are signed in click the 'Check E-File Status' link. If your tax return has been accepted by the IRS they are actively processing your refund. The timing of your refund is determined by the IRS. Due to updates in their system, changes in the tax code, and other factors your refund can be delivered at different times from year to year. If you would like to know more about your accepted tax return visit the Where's My Refund tool http://www.freetaxusa.com/wheres_my_refund.jsp. If you need assistance or have any questions please don't hesitate to contact support@freetaxusa.com.

After you spend all the time filing it out you can't save it and go back to it because it clears out everything - start from fresh! Then after your done and pay for it $17.99 for the FREE state tax and want to file it won't let you e-file you have to print it out and file by mail! What bullS*** if they would have said it right away or before I paid I would have never used them, of course it says right on there filing by mail adds 6 weeks to the refund. Worst tax site ever used for sure! Did not get the notice until I tried to file it at the finish!

Hello James, we're sorry for the frustration you experienced while using our software. We would be happy to help you resolve these issues and file your returns! You can sign in to your account and click "Contact Support" or email us directly at support@freetaxusa.com.

Horrible, don't do it. Its one step away from filling out yourself in the library. The system is antiquated and I got charged twice and they were no support. I had to get information on how to get help from TurboTax. DON'T DO IT!

Hello Carmel, I'm so sorry to hear about your experience. Our customer support team is standing by, and would love to help you resolve any incorrect charges or transactions. Contact them at support@freetaxusa.com

Best and when I say best. I mean it since I'm not easy to please. Been their customer for 6 years noe and it fail me once because I put the wrong information. Anything incorrect its up the user. If you have not receive your taxes on time it's because you probably did a mistake. I was missing a number on the routing number direct deposit and I still got my taxes safetly thru the mail. These guys are trustworthy and they just never have fail me. For being free is really efficient. I would recommend this to anyone who takes their time to read simple instructions. Have it double check by a close family member or friend before you file it inn to make sure everything is correct. Usually it takes 2 weeks for direct diposit which is the best option. Months thru mail. Any reason why it takes more its up to the IRS and their turtle speed.

I have used this site for years now and never had a problem! I have received my taxes each year within 2 weeks. Last year, 2013 it took 6 days to receive my 6,125 return and only 2 weeks to get state! I would absolutely recommend this site!

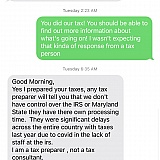

We used this income tax lady and this is the site that she used. Because I keep on asking her what's going on our 2020 income tax return that we still have not received, she called me today being rude and calling herself a Christian that she supposed to mean something to me and told me that she will never works with me anyone and hang the phone up on me. Ms. K is very rude and unprofessional but to her I am the unprofessional. This lady called me and was yelling at me because of me asking questions smh

Hi Guerfalone, I am so sorry that you had a bad experience with your tax preparer. Our software is able to be used by individuals as well as paid tax preparers, however, we do not hire the paid preparers and they are not affiliated with our company. If you have had problems with your paid preparer, please work with them or you can report them to the IRS by going to the following link: https://www.irs.gov/tax-professionals/make-a-complaint-about-a-tax-return-preparer

Last year I even won $300 in their giveaway contest. I love FreeTaxUSA and tell everyone I know about them. Easy to use, easy to access years later; never had any problem. I have no state tax, so yay for me, but I'm so glad I found this company through the IRS website. They don't hound me like TurboTax does with spam galore, and I find this site much easier to navigate as far as special circumstances. Thank you FreeTaxUSA!

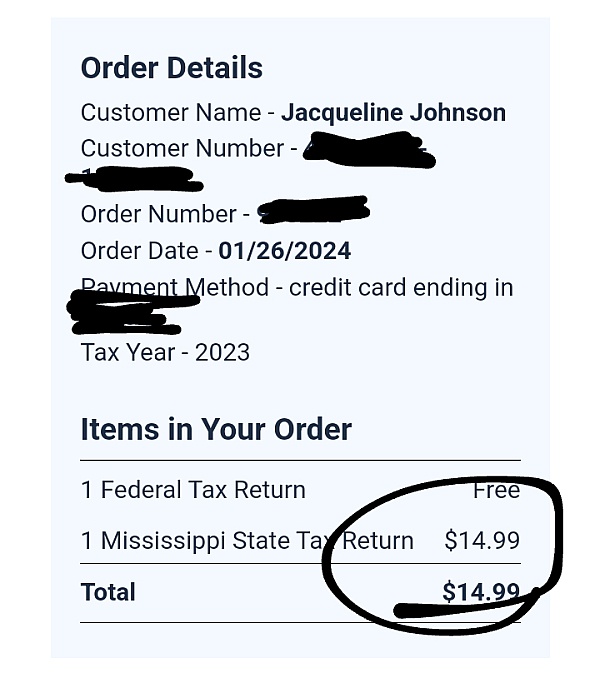

I have used Freetaxusa for many years. We use the service and pay for at least 3 returns each year for at least the past 5 years. I've never really had and issue. This year is different. I had to file an ammendment for both state and federal. Its not until after you have paid that they tell you the 14.99 they charge does not allow you to efile state. So you still have to print and mail your return. They know the State you are amending so it really should alert you beforehand. If I knew I'd have to pay for ink, paper, envelope, stamp etc. I'd of just printed the form, filled it out myself and mailed it. I was paying for the convenience. So much for that. Contacted customer care and no response yet.

Hello Michelle. Prior to 2020, the IRS and all states did not have the option to e-file amendments. The ability to e-file an amendment is new this year and many states are not setup to do this yet. We anticipate that we’ll support all states that allow e-filed amendments in the future as they allow this option. I am sorry hear that your experience has not been positive this year, as it has been in the past. We do appreciate your business. Would you please direct message your email address through sitejabber so that we can be sure your concerns are addressed? Thanks!

I've used this site for my Federal taxes for the past 3 years and have been very happy with it. The accountant at my firm actually recommended this site to me. I highly recommend it! It saves your past tax information for you and it's quick and VERY easy to use!

Yes! You are refusing to recognize or help me even though I paid extra for assistance. I cannot believe what a bad service you are. I am still waiting for my tax refund or even for SOME INFORMATION as to what the status is! The Facebook rep for your company knew nothing and when I try to access your main site, you make it so complicated i cannot get through. You should not be allowed to have such a service and cheat and lie to your customers

Hi Bernadette, sorry for any confusion. Our software helps you prepare and file your tax return. You can order the Deluxe Edition for priority customer support while preparing your tax return, among other things. However, once the IRS has accepted a tax return, regardless of how it was prepared and filed, they are in control of the rest of the process. The IRS will have the most up-to-date information on the status of your tax refund. After 21 days you can call the IRS and have one of their representatives research the status of your tax refund. Their number is 1-800-829-1040 and representatives are available from 7am-7pm local time. Security measures were increased industry wide to provide additional protection for your personal information. If you are having trouble signing in to your account you can use the Forgot Username and Forgot Password tools to help.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

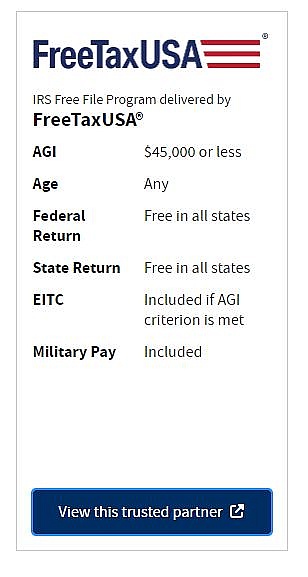

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Thank you for the review of the software. We appreciate your loyalty and hope to continue to earn your business for many years to come.