How are you complaining freetaxusa is one of the best and if you have not got your money that on the irs, not freetaxusa idiots

Used this site yesterday and today the debit card I used on their site yesterday was robbed. I did not use that card for any other purposes recently.

I paid a fee to have my return e-filed. After I paid the fee, they advised they would not e-file. I am not pleased and won't be using them again.

Hello Deborah. I am very sorry of the frustration this has caused. The fee we charge is for the preparation of your state return. The method of filing is always free. In general, the IRS determines if a return is eligible for e-file or not. For instance, if it is a prior year return, then the IRS requires those who file through self-preparation sites to mail in their returns. Our customer support team would be happy to review your account and discuss any questions you have regarding your return and why it cannot be e-filed. To contact them, please log into your account and use the "Support" button in the upper right corner of the screen to send a message. You may also contact our customer support team by emailing them at Support@FreeTaxUSA.com. Thanks

They $#*!ing. Sucks and liar's talking about I had no account with them I just filed my taxes no more with them bad business.

Hi Thomashia, sorry you didn’t have a good experience. I would love to look into it further. Please contact me at sam@freetaxusa.com with your username so I can look into your concerns.

Awesome service. I have been using free tax usa since 2006 and have been very happy with their service

Easy to file and affordable. I feel like the site is easy to file and navigate this year. I filed my 2021 tax with them this year. Fee is affordable.

Hello Karlo. I am glad to hear you find our software easy to navigate and appreciate the feedback. We hope to continue to serve you in the future!

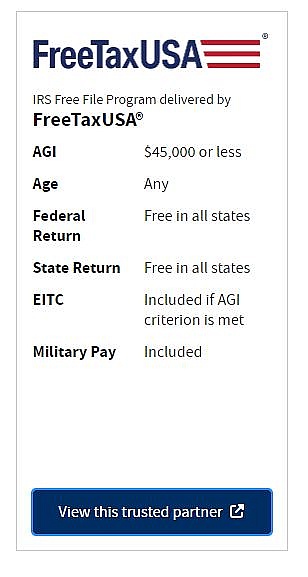

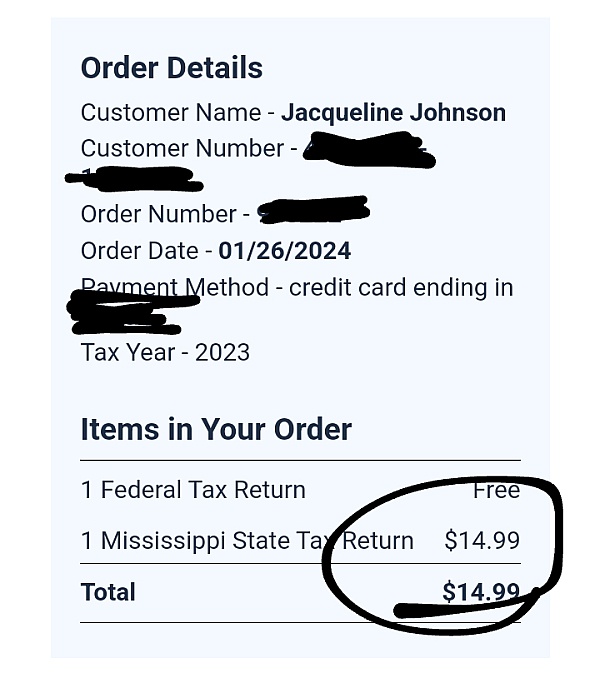

Your federal is free but your state is not free. My state owed me $25 and they want to charge me $14 to send it...just ridiculous.

Hello, Michael, Our federal returns are always free and we never charge to e-file. We do charge a small state preparation fee. Our aim is to provide a wonderful product at a low price.

Been waiting going on 3 weeks in a few days do workers filed same day turbo tax got their stuff already I will never again use this

Hi DeAngelo, I would recommend signing in to your FreeTaxUSA account and clicking on the 'Check E-file Status' link. If there aren’t any additional instructions there and your tax return has been accepted by the IRS, the rest of the process is in their hands. Including the timing of your tax refund. It really just depends on how fast the IRS system can process your refund. The IRS says they expect to issue most refunds in less than 21 days, but tax situations vary and some returns take longer to process than others.

This year is my first time using FreeTaxUSA. I thought it was fantastic. Easy to use... and free for federal even with business income.

I've used this site for 3 yrs now, 1 with no issues. I've seen where pple say "it's not free they charged me for state " duh it says $12 or something for state. But my state was free. I've seen "it's not free I had to pay $30 and could not efile " well the whole truth of that AND IF YOU READ is that if it is a prior tax refund, that the irs no longer allowe efiled prior year tax returns so if u got a prior year, fed and state will BOTH have to be mailed in and paid a different fee then free!... I know bcuz I had to do this... H and R block prep. Person told me $300 for prior year taxes.

OoKay!

Just do your reading! They clearly list every fee that you will ever be charged! Nothing is hidden!

This year I paid nothing$0 for state and federal! By far the best I've seen yet! I seriously wish you guys would do referrals... for example... if I got 5 pple to join u i get $10 off each person or whatever. So maybe do it like in amazon gift cards...(1=$5)(2=,$10)(3=,$15)(4=,$20)(5=,$25...)... and so on cap it off at 10 referrals idk... just a thought to get some extra business. Thanks again! See yall next year hopefully.

Hi Nickkat, thanks or the great review! We have a referral program where we do weekly drawings. Login to your account and go to the View Return Status and Print Your Copy screen. If you scroll to the bottom, you can refer your friends to be entered into our weekly drawings and even a grand prize.

The creation of my return seemed to go very well. However, I outsmarted myself in the password department, and I accidentally threw the password away.

So fast forward to August. I'm trying to get prequalified to buy a home and I need my 2010 return. Forgotten password, no problem, use the forgotton password link. I opened the email they sent to me when I filed my return which has my username clearly listed. I enter my username as they provided it in the email. I entered my SSN. Bzzzzz. I get an error that they do not match. What?.? It IS my SSN and it IS the username they provided. I try several times and double check the username.

Customer service refuses to help. They continuously tell me I must have the username wrong. Will if I do, then its wrong because THEY told me the wrong one. After 4 exchanges of emails with them its clear that I'm baning my head against a brick wall. So I'll have to order a copy of my return from the IRS. That will take 7-10 weeks. So much for pre-qualification.

I guess you get what you pay for. Next time I'll use someone reputable like HRBlock or TurboTax.

I went threw freetaxusa n I didn't receive all my state funds it says it went threw sbtpg I like what mine

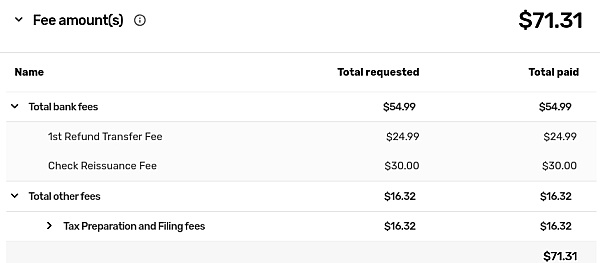

Hi Selena. Thank you for reaching out to us. It sounds like you may have used the refund transfer option to pay for our services. When you select to pay our fee with your federal or state refund, you set up a temporary bank account with Civista Bank, a division of the Santa Barbara's TPG group. This bank account information is printed on your federal and state return and e-filed to the IRS and your state along with your direct deposit information. The IRS and your state will deposit your refund into the temporary bank account, our fees will be extracted, and the remainder will be deposited into the direct deposit account you provided.

Our customer support team would be happy to review your account and discuss any questions you have regarding your refund. To contact them, please log into your account and use the "Support" button in the upper right corner of the screen to send a message. You may also contact our customer support team by emailing them at Support@FreeTaxUSA.com. Thanks.

Free Tax USA is worthless. You do not have to worry No more of my buisness plain and simple. I mean this Turbo only

Hello Annette. I am sorry to hear that you are not happy. We would like the opportunity to look into your situation and work to make it better. Please log into your account and select "Contact Support" to send us a message regarding your concern.

$#*! is full of bad companies like this $#*!ty $#*! mother$#*!ing slut bag who steals 14.99 from people for nothing

Hello, I am so sorry that you ran into issues while preparing your return. Please contact our support team at support@freetaxusa.com and we would be more than happy to assist.

I'm pissed cause my taxes said refund sentinel the 10th but it's nothing in my account and it's the 12th. Where is my money?

Hi Ty, that’s a good question. Once your tax return is sent to the IRS they are in control of the timing of your refund. I would recommend following up with the IRS and your bank. The number for the IRS is 800-829-1040.

I sold my business. How and where do I enter the sales amount as income?

"Hi John, the sale of business assets are reported on the IRS Form 4797. If you are using our software, you’ll select ‘Income’ on the menu bar, ‘Business Income’ on the drop-down menu, then follow the prompts from there.

The IRS website gives some good guidance:

“The sale of a business usually is not a sale of one asset. Instead, all the assets of the business are sold. Generally, when this occurs, each asset is treated as being sold separately for determining the treatment of gain or loss. When sold, these assets must be classified as capital assets, depreciable property used in the business, real property used in the business, or property held for sale to customers, such as inventory or stock in trade.” https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Sale-of-a-Business

Filed my taxes and I haven't received my return yet it has been a month and a half I'm very upset

Hi Lasheka, sorry to hear your tax refund hasn’t been received yet. I would recommend signing in to your FreeTaxUSA account and use the ‘Check E-File Status’ link to verify your tax return has been accepted. If your tax return has been accepted, the IRS is in control of the remainder of the process. If your tax return has been accepted for more than 21 days, you can call the IRS at 1-800-829-1040 and a representative will be able to research the status of your tax return.

I've been using them for years... never have a problem... highly recommend!

I haven't received my refund its been almost a month

Hi Tina, sorry to hear you’re still waiting. The timing of tax refunds is controlled by the IRS. If it’s been over 21 days since the IRS has accepted your tax return, you can call the IRS at 1-800-829-1040 and have one of their representatives research the status of your tax return. They have representatives available from 7am-7pm your local time.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hello John, we apologize that you have had trouble with our service. Our Customer Support team can help you resolve any issues with your card as they pertain to purchases used for our service. Please log into your account and select 'Support' for more assistance.