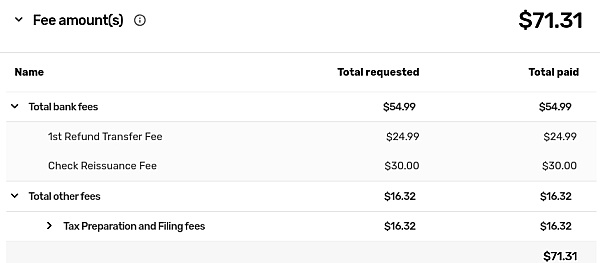

I tried turbotax last year and they wind up taking almost all my refund by charging more than my refund. It took 3 months to get my refund from irs through turbotax which I give 0 + stars, Bad Place. I tried Freetaxusa this year and it didn't cost me a dime and they helped me get a awesome refund back without any lies or hassles unlike turbotax who says that my stimulus check will be on my card ( Never showed up on the card). So yeah Freetaxusa is the only way to go. THANK YOU FREETAXUSA.

These people entered in a fake bank account and stole my 2019 taxes, stimulus and is stealing my 2021 stimulus. Do not use the dumb $#*! thieves im about to get the federal government involved asap

Hi Ariane, we're sorry to hear you have not had a good experience with us. Occasionally, when customers use their Federal refund to pay our fee, there is some confusion about the accounts involved. However, we can assure you that we do not have access to any stimulus payments or refunds, and we want to make sure you receive any payments you are entitled to. Our customer support agents would be happy to look into your specific situation and clarify further. To contact them, please select "Contact Support" while logged in to your account.

Just like many others my taxes were rejected so my taxes could not be completed on time. Now I have to pay a real CPA to fix what ever is going on and they are giving me the run around A rejection means they did not do their job, this should trigger and auto refund. I will be contacting my Bank and I already contacted the BBB. I thought it was a simple mistake on their end but I am believing what others are posting this company is a scam. If I receive my refund I will update this. UPDATED: I did receive a full refund.

Hi C D, I’m sorry to hear that your return was rejected. The IRS system has various checks in place to make sure your return is filed correctly, so if your return was rejected, it means that something on the return might be incorrect. We do have a support team that can help troubleshoot your rejection, but if you decided to file your return elsewhere, we would be happy to issue a refund. Can you please sign in to your account and click the “Contact Support” link?

This has been the most upsetting situation. I e-filed my taxes with FreeTaxUSA, received a confirmation email stating that the tax and amended tax was accepted. Both was charged on my debit card but neither got to the IRS. I have a brain injured husband that I've been taking care of for 17 years and I always have to mail in an injured spouse claim after filing taxes electronically, which I did this year. The IRS received the injured spouse claim I mailed in but never received my 2019 taxes which where electronically filed, so when my husband would have received the stimulus check he didn't, it went to child support because the injured spouse form could not be considered because they didn't received the 1040 form which I e-filed thru you all. I am very upset and disgusted. We are still trying to fix this issue and I am sick. You all have cost my home a financial hardship. DISAPPOINTMENT IS NOT EVEN THE WORD FOR WHAT I AM FEELING!

Hi Michelle! I really apologize for any frustration or disappointment this has caused you. We would really like the chance to look into this for you and see what is going on. Please log in to your account and click the Support option located at the top of the screen. You can also email us at support@freetaxusa.com. If you feel our Customer Support did not assist you, could you please private message me the email address on your account? I would be happy to follow-up on this.

FreeTaxUsa for 2022 was almost seamless. After putting up with all the BS from turbo tax year after year this company was a big relief. Try it... I swear you'll agree.

Hello Heidi! We appreciate the great feedback and are glad that you recommend our software.

I have been with FreeTaxUSA since 2006. No problems with refund. I have compared Free Tax USA to other tax filing systems only to learn refund was less with other systems, not sure why. I'm 100% confident and secure with Free Tax USA.

OMG. I've been reading through some of the one-star reviews and they all seem to be written by people who should not be doing their own taxes.

I have a pretty complicated return with a rental property, investments, my wife's unemployment during COVID, credits for energy-saving upgrades, Health Insurance purchased through the Exchange with Premium Assistance, etc. I have always used TurboTax Premium in the past and taxes took me many hours to do.

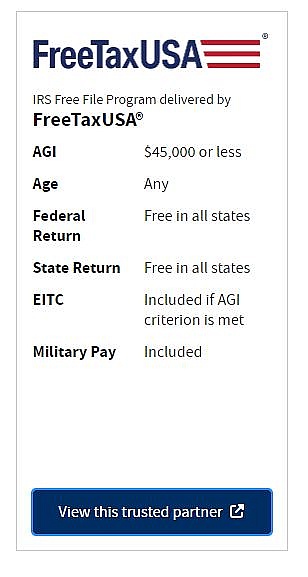

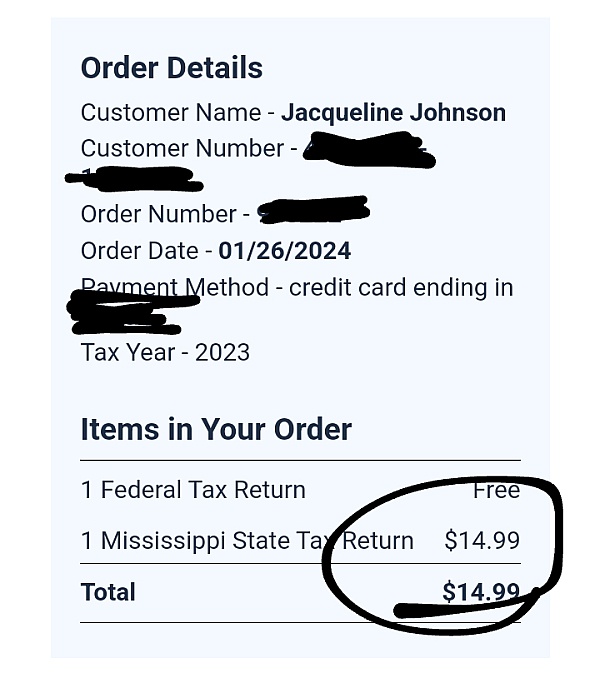

This year I stumbled across an ad for FreeTaxUSA and it said I could do my taxes and efile for free even if I had rental property and other complex issues. I decided to give it a try. First, it allowed me to import my TurboTax file from last year, which sped up the process. It took me less than a third of the time to do my taxes compared to TurboTax. Yes, you have to pay $12.95 to complete and efile your state return, but TurboTax charges more than double that just to efile your state return. I've always chosen to print out and mail the state return instead. So $12.99 is a bargain. And the version of TurboTax that I was forced to buy because we own a rental property was $70. FreeTaxUSA is free.

I will be using this service from now on.

Hi Robert! Thank you so much for your kind review. We love hearing great feedback from those that found the software easy to use. We are happy you found us!

After spending about 6 hours entering data and trying to fix mistakes on TurboTax Premier (loyal TurboTax customer for over 10 years), with absolutely NO HELPFUL assistance from the telephone support I had to wake up at 7 a.m. to speak to, and paying $165 for a Federal and State return with errors that could not be fixed, I gave up. The good news is I went on FreeTaxUSA and did the whole thing easy peasy in about 2 hours. Free for Federal, $15 for State, free for Property Tax Refund (completes but does not file) and even a $7 dollar Deluxe add-on that provides in person support and Audit support if needed. So surprised to see this so poorly rated on this site.

Hi, Jean! We are delighted to have you join us at FreeTaxUSA. Thank you for taking the time to review your experience!

I've been doing my taxes for 4 years now with Free Tax USA. I wanted to try out another software last year which was Turbo Tax. I completed both my returns on Free Tax USA and Turbo Tax and compared them, I found out that Turbo Tax gave me less of a return than Free Tax USA. If your unsure do what I did. It doesn't cost you anything till you file.

I have used FreeTaxUSA for 5-6 years maybe a bit longer with no problems other than the one time I forgot to add some information. One thing that makes me a little upset not with FreeTaxUSA but some of the people that give FreeTaxUSA a bad review. Please, people, take on the responsibility of your own mistakes and stop blaming FreeTaxUSA. The software they have works just fine and have used it for many years and intend to keep using it.

Thanks for the review, Dean! We look forward to helping you file your 2017 tax return.

Did my taxes a few weeks ago and the calculations for Illinois were incorrect. This was for both Federal and State. Do not use them, stay away. They are not CURRENT with tax laws.

Hi Tracy, we guarantee our calculations and would like to help. Can you private message your email address?

This is the 6th year I file thru Free Tax USA. No problems with them. Easy to use, and they provide a link to IRS instructions. I highly recommend this site

Tax person got Covid, went to a second person and those taxes would have sent me to jail. Decide to do them myself, yeah like 13hours. In between the IRS website and FreeTax customer service, I was able to muster through. I also learned alot. I do respect Tax people, because its cumbersome detailed work. If a person has stocks, you also have the option of "summarizing (totaling 1099-B)" so you don't have to list each and every stock since there's no import as of yet. Overall, I was pleased with site and the expediency of their knowledgable, detailed customer service. Will be using them next year. Because the tax people ala-cart you on the forms, you save quite a few bucks. I needed Sch- C, D, 1,8949 and State. 14.99, can't beat that, easily would have cost me 450.00. I won!

Hello Kez! Thank you so much for the review of our software. We are glad that you found our site and that we were able to help you to prepare your returns and save you money! We look forward to helping you again next year!

Hey listen, I never wanted to use an online tax service because I generally get my taxes done for free by the military. But on the day before tax day deadline, they weren't taking anymore clients. I was then faced with using one of tax sharks... won't put any names here, but you know them all so well, and you know their commercials on Tv and radio. A friend recommended me to FREETAXUSA.COM. One of those sharks gave me an over the phone estimation of $300 - $500. Now, going back to FREETAXUSA.COM, remember, I filed on tax day deadline, my federal refund was deposited exactly one week later, one of my two state refunds will be deposited tonight, only 9 days after filing. This is what I call great service. It only cost me $23.31 because I had two state returns to file, otherwise, it would have been half of that price for one state. Federal returns are free. So, if you live in one of those income tax free states, then this is a great service to use. Their online software is very user friendly. Don't be discouraged by the negative reviews posted here, this is my first experience using this service and a very positive one. They get a 5-star rating from me.

CHEERS!

Sam (Newport News, VA)

I have completed the FED+STATE data entries and passed the review. I paid for the ORDER filing fees of FED+STATE ($12.99) and continued with e-filings. The FreeTaxUSA software would not file my tax unless I had to pay extra fees. It is against all FreeTaxUSA advertisements and it is a scam.

Hello David,

We're very sorry if you weren't able to e-File your taxes. If you would like one of our customer service representatives to take a look to see why you were unable to e-File, or what charges have been made on your account, please let us know by signing in to your account and selecting the "Support" tab at the top of the page. We would be happy to help you resolve this.

I used FreeTaxUSA for the first time this year, after using Turbo Tax for years. I was super impressed, & will never go back to Turbo Tax. Turbo Tax has all the bells & whistles & is very cool, pulling in my W2 from ADP so I didn't worry about typing in the info myself. BUT, FreetaxUSA is very easy to understand, & is constantly checking you, so you can double check your answers. It's SO much cheaper than Turbo Tax & lets you print out a nice looking version for yourself. My Taxes are fairly straightforward, but I'm always a little nervous doing them myself. I really felt good about using FreeTax USA. I am their new BIGGEST FAN!

This site is not updated. Other sites allow job related expense deductios for health workers this site do not. Stay away i don't know if they sell information. I paid 14.99 each for two states, federal deluxeversion is $6.99. They send email on 20th my tax was rejected for sill reasons the stae will only get paid on 24th. Now Iam late and they suggest I send manual return!

Hello Joseph, I'm sorry to hear you didn't have a good experience on our website. We value our customers and never sell your information. Our software is updated to the latest federal and state standards. Most employees no longer qualify for job related expenses, due to the Tax Cuts and Jobs Act several years ago. While it can be disappointing to not receive an expected deduction, rest assured your return is accurate and guaranteed to meet current tax law. We'd be happy to help troubleshoot any concerns about your return, please sign into your account and select "Contact Support" from the right-side menu so our support staff can assist.

I have been using FreeTaxUSA for 7 years. Always have been happy with their service. Until 2017 -- now I cannot pay the $23 for the services (filing 2 state returns).

I get

"Authorization was declined. Please verify your payment information or use a different credit card or bank account."

Error, even though the info is correct. I try a different card. Same result.

My girlfriend is doing her taxes, and hit the same issue. Tried several of her credit and debit cards, no luck. The only option is to have the fee deducted from tax return, FOR EXTRA $20 going to their pocket. Are they serious?!

No thank you, going to file with a different provider instead.

Utter frustration.

EDIT: I contacted the FreeTaxUSA folks through their "Support" section and got a fast response, even though it was weekend. It turns out the payment was failing because I was trying to pay from outside the US (traveling in Europe at the moment). The decline would not have been so surprising and frustrating if the error message was actually saying the reason "You cannot submit payment from this country", preferably at the beginning of the process. Once I figured out that this was indeed the problem, I was able to submit the payment -- if you are in this situation you want to spoof your geolocation, e.g. by using something like tor-browser, or ask someone in the US to submit the payment for you.

Changing to 4 stars, as the only issue really is misleading error message.

Hi Miroslav, I'd be happy to look into your payment issues and will private message you for details.

I was looking forward to using the site, but was blocked from proceeding when I hit the SSN for my spouse screen. Without a number, the software will not let me proceed.

As a non resident alien with no US income or assets, who has never been to the US and has no plans to in future, my spouse has no SSN or ITIN and is not required to have one.

Other tax preparation sites don't have this glitch.

Hi Mark, thanks for writing. At this time our software requires that you have an ITIN or SSN for every person that you have on your return. This includes you, your spouse, and any dependents.

Currently, the IRS requires that you have an SSN or ITIN for your spouse if you wish to file married joint or married separate. On the instructions for Federal Form 1040, it says, "If your spouse is a nonresident alien, he or she must have either an SSN or an ITIN if:

You file a joint return,

You file a separate return and claim an exemption for your spouse, or

Your spouse is filing a separate return."

Since we are required to follow these instructions, the software will require an SSN or ITIN for your spouse.

I am so upset! I just filled out my entire taxes and then went to pay and it asked for my 3 digit security code, but there was no place to enter it! I tried 2 different cards and tried at least a dozen times each! Asked me each time for my 3 digit code and there was NO WHERE to put it, Now my taxes will be LATE! GRRRRR I have always used TaxACT. Note to self... should have used TAXACT!

I'm sorry to hear you couldn't enter your three digit security code. One of our customer support agents would be happy to help sort this out for you. Please sign in to your account and click on the "Contact Support" link. Also, the IRS has extended the tax deadline until 4/18/18 at midnight. We can help you get the payment submitted so that your returns are not late.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hi Sherri! Thank you for your review. We're so glad you found us and are happy to help you maximize your refund in a cost-friendly way!