They have provided wrong address for paper filing of the return which I was require to do for my specific case. I waited for 8 weeks to receive my refund. Then I came to know that the address appearing on their website for Iowa return is wrong so I was required to resend on correct address. On complaining about the same, they just came back with correct address, didn't also feel for apology. Had I not crosschecked the correct address, I would have kept waiting for months together. Support team doesn't go in deep to your question & just reply by seeing first or second line of your query. I wouldn't recommend anyone to use this service...

I have done my taxes for years on turbo tax. Last 2 yrs I used Free tax USA. Both times delayed my refund. 1st time banking info incorrect. I asked for direct deposit to prepaid they were providing. The account # on my tax form was not the same as the direct deposit form they made for you to get the card. 2nd time I was told my Ss info on w-2 was incorrect. Well I know u entered it correctly when filing. I paid close attention. The amount that they put on my return was not what I entered. How do I know? BECAUSE I DOUBLE CHECKED WHEN FILLING OUT. THE AMOUNT THAT WAS ON ACTUAL FROM WAS AN AMOUNT NOT EVEN ON W-2. WHERE DID I GET THAT AMOUNT I GUESS I PULLED OUT OF MY $#*!!

I've used FreeTaxUSA for many years and never had a problem. I now work for one of the major tax prep companies filing other people's taxes for money, but I still used FreeTaxUSA to complete my personal tax return. It works great for the vast majority of people. But if you have a complex return or an unusual situation, you might want to hire a real person to file your taxes for you.

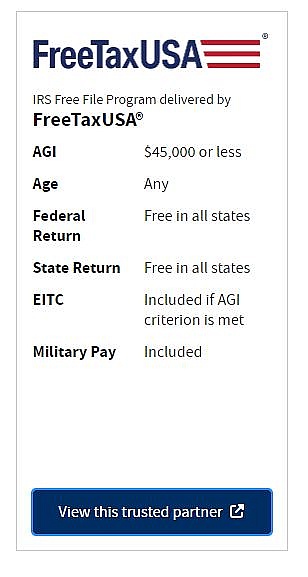

One year I worked a temporary job in the summer and the company erroneously withheld taxes for the wrong state. Using FreeTaxUSA I wasn't able to figure out how to file a nonresident return to West Virginia to get back the money erroneously paid to them. That was an unusual situation, and the software couldn't handle it. But other than that, it's always worked just fine. I don't mind paying $12.95 for the state return because it's still a lot cheaper than any of the commercial tax prep stores.

I will never use freetaxesUsa! The Federal sent my money to free taxes usa and I was only supposed to have $32 dollars tooken from doing my state! I fell on extremely hard times last year in I'm a single mom in my tax money was supposed to save everything we own. At 3am only $1635. 26 was deposited into my account... I'm missing $1238. 74! I called my bank to find out what's going on in they said that your site has keep my money... I need my money and it's horrible that you can't even have a number to get in touch w someone. If I don't receive my Money tomorrow my daughter in I am going to lose everything we own

Hi Rufus, I’m sorry for any frustration you may have experienced. If you did not receive all of your refund, it usually means that the IRS adjusted the refund or garnished it to pay a debt of some kind. Usually, you'll see the reason for the adjustment when you check the status of your refund on the IRS website. You can do this by going to www.IRS.gov and clicking on the "Refunds" option. Check the status and you'll see a message about the adjustment of your refund. If you need additional assistance, we are always willing to help, so please reach out to one of our customer support agents by signing in to your account and clicking on the "Contact Support" link.

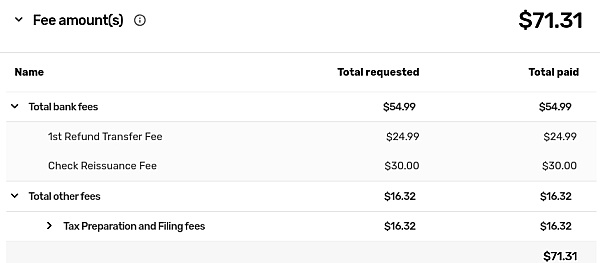

Filed with them last year. Which I had to amend! So which it took a little bit longer. So they sent me a bill to pay my fees. I did! So then they turn around double charge me. Sent my refund to SBTPG they claim they couldn't deposit my refund. Because some area. I don't know what bank they sent the funds too. Because my bank said they never received anything. So when I contact both parties they claimed. It was sent back. It's past 12 weeks still no refund. My next step is filing lawsuit against both parties.

Hello Juwanna. I sincerely apologize for the frustration this has caused. It sounds like you chose to pay our fee with your refund. This option allows a temporary bank account to be set up with Civista Bank, a division of TPG. The refund is sent to the IRS or state to process and then sent back to TPG and then sent on to you. If for some reason your refund isn't sent on from the IRS or state, issues can come up. We would be happy to follow up on the assistance you received from our support team. Can you private message your email address?

Fast free and easy. I've used this place for a few years and I will say that I've not had an issue with any aspect of this site. I started using FreetaxUSA when my brick and mortar tax preparer didn't send my return and I didn't receive my refund until September. Last year, I had it by February 15th. This place is so free that I upgraded this year just so I wouldn't feel like I'm stealing.

Hello David! Thank you so much for your review. We appreciate your continued business and look forward to helping you file your returns in the future!

Filed my 2021 taxes but could not file an amendment a week later. Will evidently have to file by mail-in. Also filed 2020 taxes... IRS rejected the entire filing citing I'm not eligible for ANYTHING FreeTaxUSA said I am eligible for. Now entering a fight with IRS because FreeTaxUSA says my refund is over $14k while IRS says 0. Is your software THAT far off? Appears your child tax credit calculations are bogus. Ok

Hi, Penny. I'm sorry your experience has not been what you expected. Our goal is to provide a pleasant experience and a quality product to our customers. This includes our accuracy guarantee, which ensures that your return will be calculated with 100% accuracy, based on your entries. If you have questions about any of the calculations or entries on your return, our customer support team would love to help. Please contact them using the "Support" link in your account.

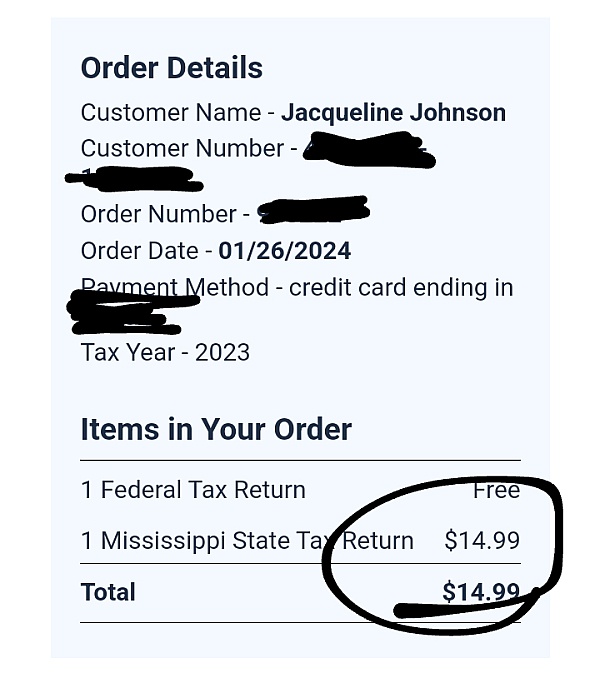

Filing maybe free but if you want your refund, they charge you. My refund was $65 but if you the refund you have to pay FreeTaxUSA so I never got my refund

Hi Ham! We do offer a 'refund transfer' option if you prefer not to pay our fees up front. This does have a fee of $19.99. This is completely optional and not required. However, we would love to look into this and see why you did not get any of your refund. Could you please send us a message with your email address (the one on your account) so we can look into this?

Freetax claims its up to the IRS once the return has been accepted: but I highly disagree because if that was the case; there are TURBO TAX users who has gotten their money within 4 days and they're linked to the IRS as well. So this site is complete bull$#*!. I filed feb 4rth we are two weeks later & I haven't gotten my money back YET. I'm pissed I normally do h&r block & ive neverrrrr had an issue. But me trusting someone who uses this site frequently. I will never NEVER use freetax again. Turbo tax for me next year.

- sincerely, a pissed off woman

Hi Tiara, once the IRS accepts a tax return, from any source, they are in control of the rest of the process. That includes the timing of processing and issuing of tax refunds. The IRS process can vary from year to year and tax situations vary from person to person, both of which can have an effect on the exact timing of when a tax refund is issued. The IRS expects to issue most refunds in less than 21 days, but the exact timing can vary.

When do people typically receive their federal tax return when they've chosen direct deposit? It's not even that much only like $100, why does it take so damn long?

Hi Syrena, the IRS has said they expect to issue most refunds in less than 21 calendar days. The exact timing can vary with different tax situations and from year to year as the IRS makes changes in their processing system. The IRS works hard to process your tax return as fast as possible. Once your tax refund has been approved, direct deposit will help you get your refund in the quickest way possible.

I filed my taxes 02/2013 and I have still not got a refund. First off while doing my taxes on this site the recommeded credit they were trying to force me to claim I wasn't even allowed to claim. So I got it send back saying I need to fix it. I fix it then it was sent back again! This time the IRS says that they did the math wrong!. WTF then when you try to call customer support for this site, all they have is email and says they cant get to you until 48 hours!. I hope no one ever uses this site again.

Was a little worried based on some reviews, but worked out better than a few of the other tax services I've used in the past. Will definitely use them again next year.

We appreciate your balanced review, Randy, and look forward to helping you file your return next year!

Last year I opted to use FreeTaxUsa for the first time because I missed TurboTax's free file window. Honestly I would have SAVED money if I chose to pay for TurboTax.

FreeTaxUsa took an unrelated code and stuck it as an additional tax, this got missed by both me and my advisor, and resulted in me having to pay over 5 grand, I almost didn't make rent that month because of it and I have yet to recover. Now I'm facing a nationwide recession without any savings.

Use at your own risk, check *EVERY* stupid little box because they *WILL* try to scam you! I'm still trying to fight to get those stolen funds back!

Hello Everett. I assure you that our software is not a scam and we strive to provide a trustworthy and accurate filing option for our customers. We are a self-prepared service and although our software will alert you to possible errors, it is up to the customer to verify that the information entered is accurate. The software will not add things to the return that the customer has not entered. I am sorry for the situation you are in and would like to have a Supervisor review your account to see how we can assist you. Please private message me your email address so that one of our supervisors may reach out to you.

For several years in a row, I have used FreeTax and my wife has used TurboTax, and we don't quit until we come up with the same number. The interesting part is when we sit down and try to figure out our differences. Based on this I can say with certainty that FreeTaxUSA is better (and cheaper).

Having said that, FreeTaxUSA has some issues that I find almost unbelievable. Things like having to enter information from a single K-1 up to three times. And far too many times, if you don't click the little question mark to get more information about something, you'll enter a wrong value. Taking an example from the Colorado deductions page, this sounds very clear: "Enter your total charitable contributions made during 2021:". But it's not. If you clicked the question mark, you'd find out that they really meant "Enter your total charitable contributions made during 2021 AND NOT ALREADY DEDUCTED ON THE FEDERAL FORM:".

Hello, Ken! Thank you for taking the time to provide us with your valuable feedback. We are happy to hear you find our software superior, and we sincerely appreciate you bringing these areas for improvement to our attention. I will make sure to pass along your suggestions to our development team.

I did my return in Turbo Tax but Turbo Tax wouldn't efile it because it was past Oct 15,2021. IRS says they are accepting efiles through November. I looked for hours. This site accepts them through Oct 20,2021. I needed efiling so I can update my tax filing for student loan recertification otherwise payments will go up to over $1000 per month and I don't have that kind of money. If you mail in the return, it may take months for your records to get updated to the other agencies.

Please be legit. And I am getting a refund. If your aren't then... Winter is coming.

Hi! We're glad you found us! Yes, the IRS is allowing returns to be e-filed through October 20th. After that time, the e-file season is closed for 2020 tax returns as required by the IRS.

Feel free to read our customer reviews here: https://www.freetaxusa.com/reviews.jsp?thn=C2CF09BE0C20D19735133A89892700BF

For the last two years I have had trouble logging into FreeTaxUSA.com. Last year I had to create a new password each time I wanted to log in. I finally got my taxes done. This year I had to create a new account because after about 20 trys I could not log n. Each time I created a new password, and it was accepted. But it would not allow me to log in. I had nearly finished my taxes but had to log out. I have since not been able to get back into the account no matter how many new passwords I have created. I have also tried another browser with no better results. I have jused FTU for years, but the last 2 it has gone to pot. The company is not fixing it, only responding in such a way as to imply I am stupid and it is my error. I now have to find another program that works.

Hello, Miriam, I'm sorry to hear you've had trouble accessing your account and would like to follow up with you on this. Can you private message me your email address?

Their software sent my refund to a closed account and it ended up costing me 1/4 of my total return then they chat back via message that i did something wrong and sent it to.the old account?! Zero accountability and I'm filing complaints with the attorney General DO NOT USE FREE TAX USA THEY TAKE YOUR MONEY BECAUSE OF THEIR FLAWED SOFTWARE THEN BLAME IT ON YOU! BUYER BEWARE PAY WHAT TURBO TAX CHARGES AT LEAST YOU WONT GET RIPPED OFF LIKE I DID!

Hello Mario, we are truly sorry for the frustration you are experiencing. Our Customer Support team has received your messages and will continue to correspond with you through your secure account. We are committed to helping you resolve this issue.

No support, no reply to e-mail/chat questions, worthless help screens, no ability to view state returns UNLESS you pay money for what they say is FREE-DO NOT USE THIS TAX SOFTWARE PROVIDER-You will be very unhappy. Try Turbo Tax, H&R block, Tax Act or any other company.

Hi Lia, we are truly sorry if you did not receive the Customer Support you had expected and would like to follow up on this. Please feel free to message your email address so that we can follow up. At FreeTaxUSA, the preparation and e-file of your federal return is 100% free, regardless of what forms you need to file. We will not surprise you with an additional fee if your return is more complex like some of our competitors have been known to do. We do charge a small fee to prepare your state return, but there is no obligation. We guarantee customer satisfaction and would like to make this right so please private message your email address.

I looked into this site as an alternative to H&R Block, since they charge high prices. At first it looked promising. Filling in information was easy, and it provided helpful information about what info you may need and helped me find a missing form. But before finishing I felt that the calculations may be off and could skew the end result. I decided to delete my account. I search everywhere until checking the support section. It states in the support answers YOU CANNOT DELETE YOUR ACCOUNT AND SENSITIVE DATA! This would seem to be a severe lack of security if we can't remove our own data. Be aware once you create an account and start to enter data, you can't remove it.

Hello Charles, I apologize for the frustration you experienced while using our software. We are not allowed to delete accounts, however, you as a customer are allowed to go through the software and delete information. Information that cannot be deleted can be changed to irrelevant information. Please email us at support@freetaxusa.com if you have any other questions.

I admittedly had a rather easy tax return, but they are as good as the more expensive services and don't hit you with a fee after you've entered all of your tax information.

Hello Mitchell! We appreciate you taking the time to provide positive feedback and for being a valued customer.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hello Charlene, I am very sorry to hear that your refund was delayed multiple times. I certainly understand that is extremely frustrating. We would be more than happy to help you figure out the issues with your tax returns. Please contact Customer Support within your account and we will look into these issues for you.