I e-filed my tax return on FreeTaxUSA. I filed before the deadline. I even paid their fee to have my state tax forms filed electronically. My Federal was rejected because I had "already used my ss# on my state return". Their web site indicated that my state form were accepted by the tax board, I also received an email stating that my state forms were accepted. As I had filed electronically with direct deposit I expected my refund within a month. 2 months passed still no refund. I contacted the state tax board to follow up. They informed me that they never received any tax forms from me, neither e-filed no other. Now I am going through the hassles of trying to get the money I paid to "free" tax usa. Of course I have yet to find a way to even contact them. Look look I'll need to call the BBB.

For years i always got my taxes on the first irs release date this year 2016 I filed January 18 it was accepted the 19 of January but I have still yet to be approve from the IRS it never have took them this long next Wednesday make the 21st day I been waiting for my tax refund. Why with this system it's taking them so long? Even my husband fill with you guys he haven't even been approved by the irs, I just think you guys have been flag by fraudulent returns so irs is making the legit customer wait also

I used FreeTaxUSA to file my federal extension and was caught very off-guard by the process. I was never given a chance to review the input nor was I asked for a digital signature before the return was filed. I was not ready nor did I intend to file the extension but I clicked a "Next" button and the following screen said my extension had been filed successfully. THEN I was given an opportunity to review and the form was wrong, or at least it appeared wrong, as it put my spouse's first name as my middle name on the form. When I inquired with the "support" team, their answer did not address the name issue and further said the return had already been filed and I would need to wait for the IRS to reject it. I used a competitor's product to help my mom file her extension and it was MUCH better! Bad experience... won't be back.

Greg, I'm really sorry for the confusion and would like to follow up on your concerns. Can you private message your email address so that we can do that for you?

My taxes were straight forward, but my residency status wasn't. I spent many frustrating hours on TurboTax and H&R block trying to make everything work out but had no luck. My H&R block experience was actually terrible and TurboTax was too expensive. Neither could do what I needed. Enter FreeTaxUSA. Everything inputted and sorted out in just over an hour and the calculations were the same as the other two platforms. A friend recommended FreeTaxUSA to me, now I'm recommending it to everyone I know.

Welcome to FreeTaxUSA, Rob! We are happy to hear you found us and look forward to helping you file next year.

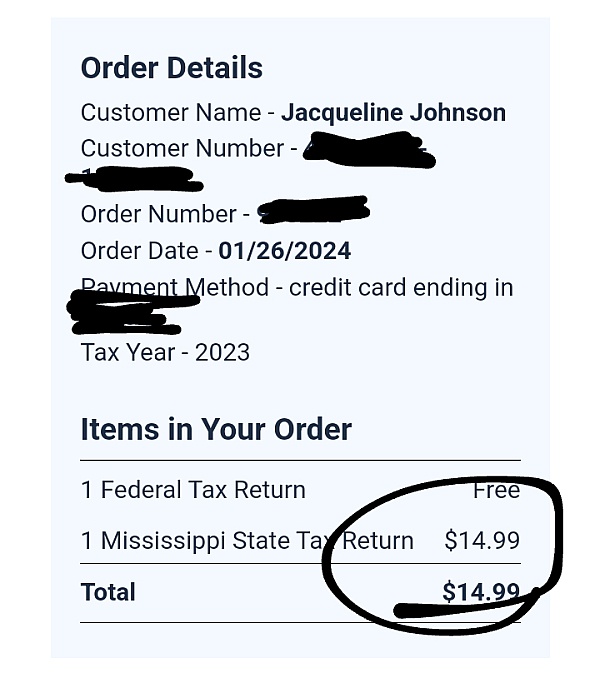

, this site claim free, it is not free it will charge for the state $12.95 even do they don, t file it nor you able to print because of errors also when you ask for your refund of charges they do not respond. I am in SSI so it wasn't lthat

Difficult

I went to another co. And had no problem filing free of charge

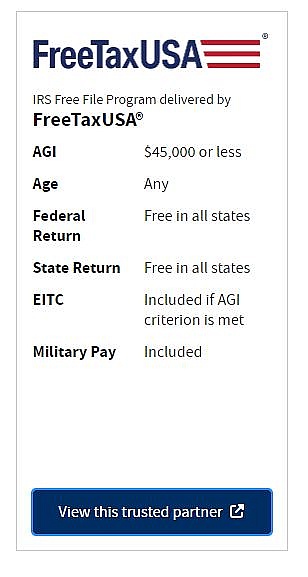

We try to be upfront about our prices by displaying them on our home page at www.FreeTaxUSA.com. The federal return is 100% free, regardless of what you need to file or the age of the taxpayer. This is not always the case with some of our competitors who are known to add additional fees after you have committed time to their website. We do charge a small fee to prepare your state return, but feel that our direct pricing, ease of use, and access to customer support make our product the best value in the industry.

I went to Turbo Tax first and after putting in all my info they wanted me to pay$40. So I tried FreeTaxUSA and they said I would get $79 less. I can pay the $40 and still be $39 ahead. I think that Turbo Tax is a better deal!

Hello Colleen, we are very sorry that you did not have a good experience with our service. We guarantee the highest refund possible. Customer Support would be happy to look into this. Please log into your account and select 'Support' for more assistance.

Preparing my taxes with Freetax usa was easy, but it seems like anyone who used them for 2015 taxes, are waiting a lot longer to receive their refund from the IRS. I filed on January 19 2016, along with several of my coworkers and friends, and still have yet to get any refund, or accepted by the IRS. Rhe people that i recommended, also have not received anything yet, but anyone that used turbo tax or H&R block and even filed later than i did, have received their taxes. This is just crazy..

Hi Jennifer, Once the IRS has accepted your tax return the rest of the process is in their hands, including the timing. It really just depends on how fast the IRS system can process your refund. Tax situations vary and some returns take longer to process than others. If you want to check whether or not your tax return was accepted you will need to sign in to your FreeTaxUSA account and click on the ‘Check the status of your 2015 return’ on the ‘Home’ link at the top of the screen. It will either show a message of steps you still need to take to file your return, or it will show the IRS has accepted your tax return.

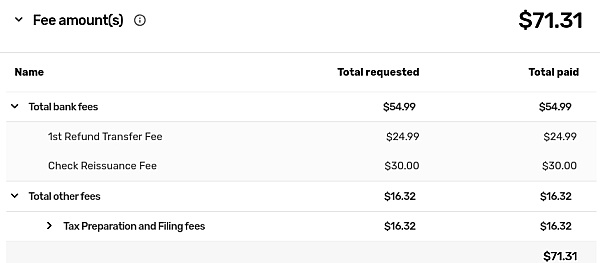

If you're on Google researching this place just turn around and never enter the website. My friends also had the same problem last year charged 15 dollars for putting his taxes online for a service called tax preparation which never efiled his taxes just copied what he already had printed out. Same situation that has happen to me. Im done ----- this business. To the fullest extent. I feel the need to go to the Better business bureau or a lawyer at this point. They are scamming costumers who never clicked agree to paying to only a 15 useless service. They also are aware that it cost more to get your money back which hurts the lower income families that rely on that 15 dollars.

Thanks for reaching out to us, Bert! We do all we can to make sure that our taxpayers can e-file. There are some cases, however, when the IRS will not accept returns through e-file. We guarantee our service, so if you are unhappy with any charges, one of our customer support representatives would be happy to investigate and set things right. Please send an email to Support@FreeTaxUSA.com.

This year is my 10th year using FreeTaxUSA. I got an on line coupon code for 10% off so I paid only $11.66 for my Federal and VA State returns to be prepared and efiled. I had my Virginia tax refund directly deposited into my checking account after only two and a half days. In the past I have gotten the Federal refunds in 7 to 10 days. Best of all, I am confident that were I to be audited I would come out clean. Because I have my old returns on file the soft ware automatically did a carry over stock loss from a previous year which saved me a pile this year. Works for me. I have always found the site soft ware user friendly.

I do not understand all of the negative reviews because a refund was delayed. Once it is accepted by the IRS it is on the IRS. I always... make that ALWAYS, receive my refund within one week of submitting it using freetaxusa. They maintain a record for me of all of those ten prior years returns. This year makes the 11th I have used them. And they pre-fill the W-2 part except for the dollar amounts and pre-fill my and my wife's information, making filing as easy as it can be. Their price is the best I have found and the app works great! I will continue to use them as long as I can.

This is the second year I have used this service, which overall is a great site. I realized this year that there is a glitch in the way maine state tax is calculated, the program uses the tax tables instead of using the tax rate calculation like other sites do. Not alot of money but a couple dollars is a couple dollars. Now if your close to the top of the 100. Tax table bracket you make out and pay less.

Hi Wanda, we guarantee our Maine calculations and would be happy to look into this for you. Can you private message us your email address?

6 hours of site downtime on tax day! The first error message stated they were doing scheduled system maintenance on tax day. The most recent system message:

"We Are Having Technical Difficulties

We sincerely apologize for the inconvenience. FreeTaxUSA is currently experiencing heavy traffic but don't worry we are working on a fix now and we will be back up and running shortly.

FreeTaxUSA will return shortly.

Thank you for your patience."

The response from Customer Service 6 hours after I first emailed them:

Hello,

Thank you for your patience. Due to heavy traffic on our system, it may take you a while to login to your account. Once you can, you should be able to continue to work on your tax return. If you submitted your tax return late you may have a small late fee if you owe taxes. If you are receiving a refund, you will be okay and don't need to worry.

Regards,

Liesel

Customer Support

Backup your records as I doubt this company will be around to do 2019 taxes!

Hi Heather, thanks for writing. Our website was unable to handle the increased traffic on Tax Day and we are very sorry. We understand that this is very frustrating and would be happy to make things right. Can you sign in to your account and click the "Contact Support" link?

I would rather have a root canal than do my taxes! I used FreeTaxUSA because my brother recommended it and this was the easiest return ever, I had a W-2,3 1099's, vehicle depreciation and itemized deductions which are enough to make my eyes roll back in my head so naturally I waited until the last minute. Entering the info for my return took less than 1 hour and the system prompted me through every step, finding deductions and credits I wasn't aware of and I'm getting a refund:-) I live in FL which does not have state returns so my transaction was totally free. Love this site!

They messed up my routing number and I was charged penalties for late filing and insufficient funds. They promised it wouldn't be a problem ever again but it was. I will never use this process again. You get what you pay for and this is crap.

I would be happy to follow up on this issue personally. Can you please private message your email address?

Federal Taxes went fine. Wouldn't let me e-file State taxes until paying first (no prob there), After paying, it said there was an error on the W-2 (a box that should have a ZERO instead of being blank). Since I had already filed Federal, it wouldnt let me change that box! Said I would have to mail instead. Cust service refused to refund, saying I paid for the service they offered! So tell me all is good, pay them, then tell me there's a problem?!?! Scammed me outta 13 bucks. Went and e-filed on the state site for free. Took 10 minutes. What a rip off...

Claude J., sorry to hear you had an issue with e-filing your state return, we'll certainly look into it and make improvements as necessary to avoid any confusion in the future.

When you aren't told until AFTER you pay that your INELIGIBLE to efile... after posting my not so supportive review, i was very pleased to get a response from FreeTaxUSA. I am waiting for a direct call or email from them to hopefully remedy the situation. Will keep posted. Changed rating from 1 star to 3 as i am impressed they got back to me so quickly! Billy

Hi Allan, I'm really sorry! Unfortunately, the IRS and states will no longer accept prior year returns through e-file, so the only way to file your prior year return is with paper forms. We appreciate your remarks and will use them as we look for ways to make the software better for our customers. We will contact you directly to find a resolution.

Tired using a different "free" tax filing service earlier today. Got all the way through the "free" returns only to be charged at the very end. Did not process the returns. If there was going to be a charge that should have been explained upfront.

Then used FreeTaxUSA and it was actually free. The website was very easy to use, the instructions were clear and understandable. There were messages to help the process along. Very easy to use and will use this serice again in the future.

Thank you for your kind words and for filing with FreeTaxUSA!

I just found out that FreeTaxUsa has made an error of not filling for child tax credit on my state return. Having three children that oversight cost me 1.6k a year. I was able to amend the three years but because of the state limitations am not able to do four more years back- the total of the credit equals to 3k. And what does the customer service do- tells me sorry for your inconvenience! When I inquired about the realibility of the software going forward, all I got that lines 12-15 are not supported (!) and who knows whether it will be fixed. Don't file your taxes with them- if they make a mistake it will cost you a lot of money and they are not responsible for your loss!

Hi Victoria, we guarantee our calculations and would like to follow up on the support that you received. Can you private message your email address?

I would give ZERO stars if it was an option. Filed a return in 2013, I now need access to the file but their system keeps kicking me out even though I have entered ALL the correct info. I have gone back and worth via e-mail and they STILL will not let me access MY information(I doubt their server was big enough, so they did a dump). They do not have a telephone number. This kind of activity doesn't seems legit and I am reporting them to the attorney general, BBB, and news outlets.,

Hi Adam, sorry to hear you’re having trouble logging in to your account. The security of personal information is our top priority and we take every precaution to protect the information of our users. Access to your personal information is protected by a password of your choosing, only you can access your account to make changes to your return or account information. If you've already tried the Forgot username? And Forgot password? Tools, you can email me directly at sam@freetaxusa.com with the email address you use in your FreeTaxUSA account. I’d be happy to help where I can.

Its kind of strange that I filed my ex husbands tax return with turbo tax and his was a 1040A his was accepted and has already gotten his refund. I filed mine the same day with free tax usa and mine was a simple 1040 and it is still processing. Just kind of makes me wonder! Can't call the IRS for 21 days which sucks. Is it 21 days from the date you filed or 21 business days?

Hi Liz, once the IRS accepts a tax return the rest of the process is in their hands, including timing. The timing can vary year to year and person to person. The IRS has said they expect to issue most tax refunds in less than 21 calendar days after accepting a tax return.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hi Grace, I would recommend signing in to your FreeTaxUSA account and clicking on the 'Check E-file Status' link. If there aren’t any additional instructions there and your tax return has been accepted by the IRS, the rest of the process is in their hands, including the timing. We’ve had customers reporting they’ve received their refunds, and other like yourself who say they are still waiting. It really just depends on how fast the IRS system can process your refund. The IRS says they expect to issue most refunds in less than 21 days, but tax situations vary and some returns take longer to process than others. The most up-to-date information about your tax return will be available from the IRS Where’s My Refund tool. http://www.freetaxusa.com/wheres_my_refund.jsp