Files on March 10th and still no refund and tried to call no phone number listed I have done the signin and try to get help but not respond

Today it's may 25th already

How are you all getting away with this?

I have used FreeTaxUSA for over 6 years now and have been very happy. When I finished my tax return for 2022, I noticed that NYS had instituted a real Property Tax Relief credit which the 2022 software allowed me to take. Upon reviewing my 2021 NYS Tax Return, I didn't see the credit. After going back and redoing my return using FreeTaxUSA software for 2021, I noticed that the questions that the software asked were not worded properly and led to not getting the credit. I then went and used the 2021 Taxact software and got the proper credit. I now have to file an amended return to get my credit of $269.00. Shame on you FreeTaxUSA.

Hello Steven, I am very sorry for the negative experience you recently had with our product. We would like to look into this for you. Please sign in to your account and select the Support link to send a message or email them at support@freetaxusa.com. Thank you for your business and for taking the time to provide this feedback. I will pass this on to our development team, we are always looking for ways to improve our product.

Sam does not respond 15 days since The state released my state taxes and I still have nothing in my bank account still no response times 10 messages to each TPG bank and free tax USA horrible absolutely horrible horrible service I even sent them proof and that was not good enough from the state

Hello, Sandra. If you chose to pay for our services using your refund, it can take a few days for that payment to process and show in your bank account after it has been released by the state. If you need further assistance, I would be happy to have our support team follow up with you on your secure FreeTaxUSA account if you would please private message me your email address.

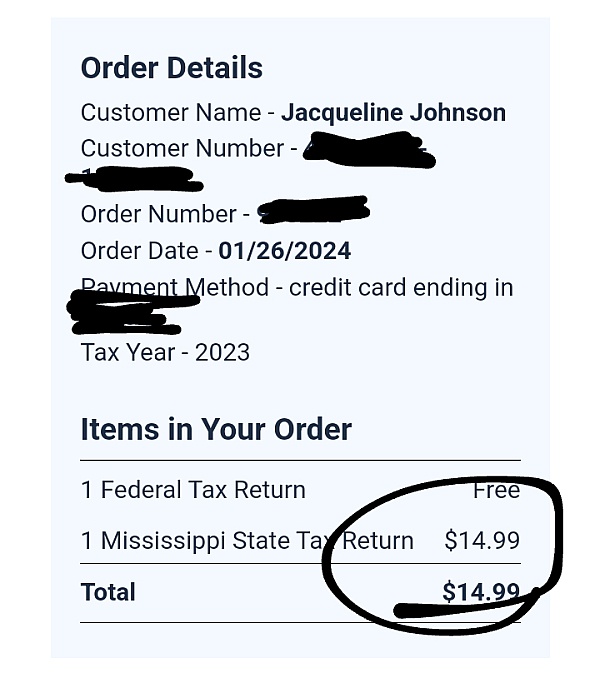

I live in DE, I had two jobs in PA for 2021. One of which only 2 months of the year. Jan and February, the other position split into two segments. Hiring agency used to represent permanent employer from April til october 25th. Then permanent employer. Til the rest of the 2021 year. Received w2's (yes, two from permanent employer because again, I live in DE so taxes taken out there as well as in PA with their office in Crum Lynne PA) in addition to the hiring agency taking taxes out for my residence. Walked through the entire process inputting a lot of time and effort along side with chat viewing my screens. Submit and find that all three - federal, state of PA and state of DE filings rejected. Now told I need to snail mail my return in. There is no help. I get the brush off saying that they cannot infiltrate the IRS software. I"m disgusted. I paid nearly $50 for services. Yeah free for the Federal filing but charges for state filing and assurance with deluxe. And still get told it's out of their hands. I'm thinking of calling my cc company and filing a charge back. Seriously. I need help and nobody not even deluxe payment level personnel is helping me.

Hi Leonora, I am truly sorry to hear you have not had a good experience with our software and support. I would like to assist you with this. Will you please dm me your email address so that I can follow-up?

I have used FreeTaxUSA for federal taxes since 2008 and for federal and state taxes since 2009. Until the 2013 tax year, I absolutely LOVED it - so practical and easy for simple return! However, for 2013, I filed on 2/8/2014 and received their confirmation that the IRS had accepted my return. A confirmation number was provided. Later, I submitted a request to the IRS for a transcript of my 2013 taxes to use for my child's student financial aid, and after two requests, the IRS says it has never received my return.

I contacted FreeTaxUSA via their website and I received a timely response stating that I should not mail my tax return to the IRS because it would be rejected as duplicate, along with a comment as to how I can print a copy of my return. This was not helpful.

As I write this, I am on hold with the IRS Accounts department (*******040). Hopefully, an IRS agent will help me resolve this mess.

Bottom line: FreeTaxUSA is great as long as you don't need support, so be aware.

This is a shame! Will never use them again. I wish I would have viewed the reviews first. Wow.

I have not received any refund. IRS probably do this company's last.

Hello Shon,

I am sorry for any frustration you are experiencing. Your satisfaction is important to us. I would be happy to look into your issue. I can best accomplish this if you would please log into your account and click the "Contact Support" link. The IRS has reported that returns claiming certain credits will experience a delay this year. Here is a link to the IRS that discusses those delayed credits that might be of interest to you.

https://www.irs.gov/individuals/refund-timing

I used FreeTaxUsa to file my tax return. Everything seemed perfect, a little too good to be true. And I think I was right. Forget the ads they keep pushing, and be very careful.

My tax return seemed successful and on the IRS website it was sent, but many weeks passed and I never received it, I know like me (initially) you're probably thinking, it can't be their fault.

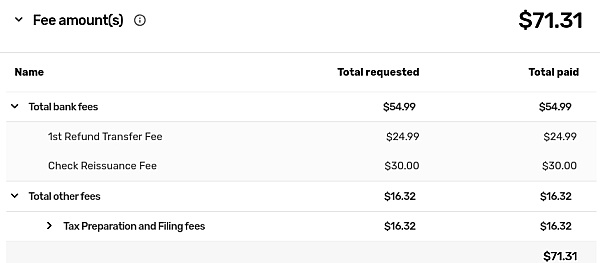

However, I gave them access to the payment, to take out the money I paid for their "premium" service (also don't make this mistake it's pointless) and send the rest to me.

I tried asking them what could be wrong, but FreeTaxUSA failed to mention that their partner financial institution, TPG, who was collecting their payment, could have the money. FreeTaxUSA said they had no idea where my money could be.

I tried calling TPG, but they said my SSN was invalid and wouldn't connect me to an agent (I feel stupid now even giving it to them). I sent them a request and they've refused to respond for weeks.

Bottom line, my money is gone. This also happened in 2018 but I forgot thinking I did something wrong that year and I did it again.

Don't be like me, don't follow the ads. Pay a little somewhere else and get your money. I wish I saw their reviews before I gave them free money. Oh well.

Hello Matthew. I am sorry for the frustration this has caused. It sounds like you chose to pay our fee with your refund. This option allows a temporary bank account to be set up with Civista Bank, a division of TPG. The refund is sent to the IRS or state to process and then sent back to TPG and sent to you. We would be happy to follow up on the assistance you received from our support team. Can you private message your email address?

THIS NEW VERSION OF FREETAX HAS PROBLEMS. SOFTWARE NOT CAPTURE WHAT I ENTER in major records. I ENTERED ALL OF THE DATA 5 TIMES. I USED this software for any years without a problem. WHAT HAS HAPPENED?

PLUS THEY CHARGE FOR REAL HELP.

IT IS A PAIN JUST DOING A TAX RETURN -- AND NOT SAVING MY WORK IS TELLING ME NOT TO USE THE PRODUCT ANY MORE

Hi Marilyn, thank you for being a long-time customer of FreeTaxUSA! I am sorry to hear of the trouble you've had with entering your tax information. Our customer support agents would be happy to look into this for you. We offer quality assistance from within your account - please sign in and use the "Contact Support" link in your account to contact a customer support agent.

I received a letter from IRS this summer (2017) telling me that I had not paid taxes on my retirement income for 2015. I remembered entering the data from my 1099R when I filed my 2015 taxes, but it was not there in my return. Unfortunately, I had not checked the arithmetic myself so I had not noticed the error. When I filed my 2016 taxes, it was easier to enter the 1099R data because the software remembers the payer information and prompts you to fill out the form. When I contacted FreeTaxUSA about the error on my 2015 taxes, the support person insisted that I had failed to enter my 1099R. Now, I had to pay the federal taxes plus interest, amend my 2015 federal and state forms (for a fee), and pay additional state taxes. The refunds I received in 2016 for my federal and state taxes were greater than the amount I had to pay after recalculating. I had used FreeTaxUSA since 2012, but now I cannot trust them.

Hi Christine, thanks for writing and I sincerely apologize for the frustration. We guarantee the calculations made by the software to be 100% accurate based on the information entered and would be happy to look into this further. Will you please private message your email address?

Our federal tax obligation, calculated from the IRS tables and/or tax brackets, were given by FreeTax as about $100 less than what we owe. Then, our Virginia tax calculation by FreeTax assumed that the Virginia standard deduction was a clone of the federal deduction - $24,000 for married filing jointly, which is NONSENSE. This is an egregious failing, and filers using FreeTax will have to file amendments or pay penalties. FreeTaxUSA needs to get their act together.

Hello David, we apologize for the frustration. We guarantee our calculations to be accurate. We are aware that Virginia has made some recent tax law changes as well. We would love the opportunity to take a look at your tax return, if you could please private message us your email address.

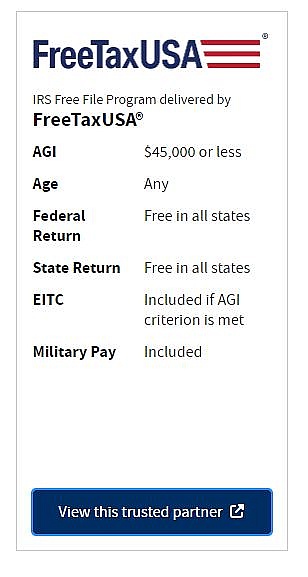

Per the NYS Tax website, FreeTax USA can be used to file my state taxes FOR FREE if your federal Adjusted Gross Income (AGI) was $51,000 or less and your age was 17 through 61 as of December 31,2017. I have met this criteria, and yet their website still insists on charging $12.95 for the State filing. Emailed support and have yet to hear anything back.

Cindi, I apologize for the confusion. One of our customer support agents can resolve this for you. Can you send details to Support@FreeTaxUSA.com?

They allowed me to file my federal refund, but to submit my state refund the sit "went down, due to scheduled maintenance". Now I cannot submit my state return until the federal return is accepted or I have to mail in my return. The best part is they charged me for this. I was charged for their site to be shut down due to "scheduled maintenance". WARNING DO NOT USE FREETAXUSA.COM!

Hi, we are are working with the IRS and states to resolve any issues for those who might have been affected by our outage last night. We encourage you to sign in and send your return as soon as possible. If you need assistance or have more questions, we are happy to set things right. Please sign in to your account and click the "Contact Support" link.

I decided not to use the service and was charged any way. That is theft. For a company that wants to stay in business. They should keep the bad news off the reveiws.

Hello Cory, thanks for writing. We guarantee our service, so if you have decided to file your return elsewhere we can issue a refund. Please send an email to our customer support team at Support@FreeTaxUSA.com.

First, everyone should remember that FreeTax, Turbo Tax, etc. have NO CONTROL over when you receive your refund. Once your return is accepted by the IRS (mine was accepted within 30 minutes), it is up to the IRS to process and transmit any refund.

As for FreeTax itself, it is fairly simple to use, and unlike other "free" services, you can use this even if you have more complicated returns that include stock sales, etc. Sometimes the explanations are not as explicit as they should be, but if you just stop and think for a second, you'll most likely figure it out yourself. For example, there was a very simple way for me to enter information for a tax credit, but Free Tax didn't tell me it was there. My brokerage information was not automatically entered for me, but FreeTax made it simple for me to enter myself.

After 3 years of usage, there's never been a problem with calculations, nor have I received any inquiries from the IRS.

I really didn't mind paying $12.95 to file the state return, I understood going in that there would be an extra charge for this. It was worth it, as I was able to complete the state return in about 5 minutes. All and all, I believe I spent about an hour doing both returns. It probably would have taken 3 to 5 times that to do them myself. I found you can shorten the process by having all the paperwork/forms you need organized and at your fingertips.

I have recommended FreeTax to others and will continue to do so.

Yes I can't gain access to the site from my home computers only my cellphone. Am I blocked from the site? Doesn't make since been using this site for years an always received great service.

Hi Dorian, that is an unusual problem. Customer support will be in a much better position to help you with this. It would be best if you sign into your account and send in a support issue from there. That will help support answer questions specific to your account. You said you can still access the site with your phone, correct? You can also contact them by sending an email to support@freetaxusa.com.

I teach tax law in law school so i know the basic rules although I am not a return preparer. I have been using Turbo Tax for years and not enjoying how much time it takes me to finish a return. They ask too many questions for me and I'm not sure how to skip them although override is sometimes successful.

FreeTaxUSA took me half the time and was much clearer to me -- not to mention cheaper. I balked at using Turbo Tax this year because the edition I had been using year after year suddenly eliminated the full Schedule C. I'm an employee but I have enough consulting income to warrant a Schedule C -- but I don't need a full bells and whistles self employment option for almost twice the price.

And is was great that they could import all my information from my prior filings via Turbo Tax.

I signed in yesterday, completed my return today -- and have word that both federal and state have been accepted,

Everyone has different needs but for my needs this option was terrific. Not perfect -- they did insist that I go back and make entries for things i had left blank because I had nothing to report this year -- and it wasn't clear where the deduction for self employed long term health care went -- but in the end it all worked out.

Thank you for the review! We appreciate your analysis of the software and look forward to seeing you next year.

This is a follow up to my review from a few weeks ago when I lamented that the Free Tax USA software did not rollover my NYS pension from the Federal tax form to the NYS tax form, nor give me an alert to consider. As feared, NYS did not catch this mistake, so I was forced to complete an amended NYS tax form. Free Tax wanted $15 for a completed amendment, which I complained about, but received no response to a request to not be charged. I finally decided to go ahead with the amendment procedure, only to find it was nearly impossible to complete! I sent a question to them about this and basically the answer I received was that I have to make sure that my NYS pension amount was not added into my tax form. WISH I'D THOUGHT OF THAT! Long story short, I ended us printing off a blank copy or the amendment form and completing it by hand. NEVER AGAIN WILL I USE FREETAXUSA!

Hello Wayne, I'm sorry to here you weren't happy with FreeTaxUSA. Since many different types of pensions can be entered in the federal portion of the software, we don't automatically subtract the pension on your New York return. However, we do ask you for the amount of your pension that is eligible for the full subtraction on the Subtractions from Income screen in the New York portion of the software. I'm very sorry that your experience did not meet your expectations. We do appreciate the feedback you have given.

They suck, i used them last 3 years. They are terrible and getting worse. They lose pass words pass years income tax returns, stay away. Use turbotax.

Hi Chris, we value our customers and their information and do all we can to keep it secure. Part of this requires that we strictly protect your returns with a username, a password, and security questions. If you are unable to recall your account access information, we have "Forgot Username" and "Forgot Password" features available on the sign in screen. If you need assistance, we do have a friendly support staff that can help. Please send an email to Support@FreeTaxUSA.com. If you'd prefer to private message me your email address, I'd be happy to have someone look into this.

I used FreeTaxUSA to do my taxes for 2014 and 2015. In June of 2015 I reciecved a letter from IRS stating my taxes were wrong. The taxable social security was calculated wrong. I went over everything I had entered. All was correct. I took my tax copies to H R Block. Sure enough it was wrong. I had to pay another $2,000 plus a $90 penalty. Now if the federal tax is wrong, and the state tax is figured from federal tax information then state tax is wrong. Sure enough I owed another $900 and a $19 penalty to the state.

After some thought I decided my 2015 was probably likewise wrong. Had it checked. The 2015 taxes were wrong for the same reason. Miscalculated taxable social security. Thr results were much the same. $2000 plus owed to Feds and slightly over $1,000 to the state. Had to pay H R Block to file an amended form to each Feds and state plus had pay penalties to both.

This mistake ended up costing me almost $7,000 in back taxes, penalties, and fees to H R Block.

If you are on social security Do Not Use Free Tax USA!

Now to top it off site is 100% guaranteed, but there is no way to reach them. No phone, no email. Tell me how to get their guarantee!

Hi Kaylene, I'm sorry to hear you weren’t happy with FreeTaxUSA. The taxable amount of your social security income can be tricky because it's based on the other income that you have claimed on your return. If all of your income is not included with your return, then the taxable amount of your social security income will not be correct. We do publish worksheets in your account to show how this amount is figured. You can view them by selecting the Summary menu option. In regard to our guarantee, we do stand by our calculations and one of our customer support representatives will be more than happy to find a resolution. The best way to reach Customer Support is to click on the “Contact Support” link while you are signed in to your account. You can also send an email to Support@FreeTaxUSA.com or click on the "Support" link on our homepage.

I sent a message to FreeTaxUSA's support, and they replied back saying my prior year's AGI can be entered after I entered my payment information and ordered my tax returns. I was a bit skeptical but followed their instructions, and it allowed me to enter my prior year AGI on literally the final step before it was filed. It would be a lot better for my peace of mind if I was allowed to enter my prior year AGI prior to ordering and paying.

Hello, thank you for your feedback. We will pass this on to our programmers for future software consideration. We appreciate your suggestion and want to thank you for being a customer of FreeTaxUSA!

In 2020, I filed my taxes with TurboTax. I wanted to switch to FreeTaxUSA for the 2021 tax year. However, there is no way for me to manually modify my 2020 AGI from the default which is 0. The FAQ isn't helpful at all, it only tells you how to find last year's AGI if you didn't file with FreeTaxUSA last year but it doesn't ever say how to enter it on FreeTaxUSA. I know my tax return will be rejected if I don't enter the correct 2020 AGI. It seems the only way to have a non-zero value for last year's AGI is if you did your taxes with them last year. That makes it literally impossible to switch from another tax preparer to this one.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hi Jones, we have seen a lot of delays with refunds this year and completely understand your frustration! Once your return has been accepted, the timing of your refund is in the hands of the IRS. If your return has been accepted, you can rest assured that the IRS has your return and is working on any available refund. We recommend that you continue to check the status by going to the IRS website at www.irs.gov/refunds. If you have concerns about how your return was filed, we'd be happy to help. Please sign in to your account and click the "Contact Support" link.