2023. Would not let me e-file. Federal and state. Never had this problem with you before? What's up with that? We'll be changing my platform next year.

Do not use free tax USA under any circumstances to file. You are better off filing your return with a druggy on the street for a crack rock.

Hi, we do ensure the security of your information. Please see the following link for our security details: https://www.freetaxusa.com/safe.jsp. If the IRS has informed you of an identity theft issue, please use the information on the IRS website for steps to do next: https://www.irs.gov/identity-theft-central Regarding the refund, once a return is accepted by the IRS, the IRS determines the processing and issuing of the refund. If you have further questions regarding your return, please sign into your account and select to contact support. We would be happy to assist.

I'm having trouble on making the payment free tax USA charges for my state returns it keeps saying decline card I have funds I called my bank and they said it has not even tried to be charged at all?

Hi Wendy! We're sorry about the frustration this has caused. Customer Support would be happy to look into this. Please log into your account and select 'Support' for further assistance.

They added a credit to my to my tax that I knew was not right, then they charged me $20. Plus to stringhten it out for me, The IRS just told me, after 45 minutes waiting, I was correct!

Hi William! We apologize for any frustration this has caused you. We would love the chance to look into this and see what is going on. Please log into your account and click on the "Support" link in the upper right corner of your screen. You can also choose to email us directly at support@freetaxusa.com.

I have used thus site for the last 4 years and u have never had an issue I submit it gets accepted and u get my money normally within 7 to 8 days and its true once it is accepted by the IRS it up to them to pay you not the site you can have this issue with any if the sites ultimately the IRS IS IN CONTROL OF YOUR RETURN NOT THE SITE. I LOVE TGE SITE I ALSI DI OTHERS TAXES ON TGE SITE TGEY HAVE NIT HAD ANY ISSUES EITHER.

I have received my state but they purposely changed there accounting and routing # over *******$ gone that they stole don't not use there a scam

Hi Brent, we are happy to help with this! If you selected the option to pay for your order using your refund, a temporary bank account was printed on your tax forms. Your refund will be sent to the temporary account, the fees withdrawn, and the rest deposited into your bank account.

We apologize for any concern this caused. We are happy to provide more information to you. We encourage you to log in to your account and select to ""Contact Support"" on the right of your screen and we will be happy to assist you.

I filed my tax returns on May 1st, and because I was filing as married filing separately, I had to mail my tax returns in. But it's interesting because my husband also used FreeTaxUSA to file his returns as married filing separately, but he was able to file electronically and has already received his refund. But that's not my issue. My issue is once I filed my returns, my federal tax return documentation noted that I had to mail my paperwork to the IRS in Fresno which I did on May 3rd. Over the past 2 months, I've been checking my refund status and it always comes back unavailable. So I go back to FreeTaxUSA's website and the mailing address for the federal tax returns now shows a Utah address for the IRS which is not what was on my original paperwork. I still have the pdf to prove it. When I messaged FreeTaxUSA, I was told the Utah address was always listed and that they didn't know where I got the Fresno address from. That is a lie! He also told me to mail out my tax documents again to the new address! This is the worst customer service, especially in a time when people are being hit hard because of COVID. I will never file with FreeTaxUSA again!

Hello Jasmine! I apologize for any confusion. The IRS has been behind in processing certain returns and refunds this year, which is most likely why you see the status as unavailable when you check the IRS site. You can be assured that they are working to process your refund as quickly as possible. Depending on what state you live in, the IRS instructions do have you mail your returns to an address in Fresno if you mail in the returns before June 19. However, the address to mail in the returns starting on June 19 does change to an address in Utah. Our software has been updated to reflect that change in case you hadn't yet mailed in your returns. However, the returns you mailed in during May this year will still be processed at the Fresno address, since you mailed them before June 19. Again, we apologize for the confusion and will make sure our agents are aware of the address change.

What a time to do maintenance. Right in the middle of the business day. You guys have got to be kidding me with this crap

Hi Terry, we did have a brief interruption this morning but everything is up and running. We're sorry for the inconvenience.

I have used this site to do all my

Family for 5 years but this year they would charge me sometimes twice for one return.

Hi Virginia, whenever a payment is submitted, the charge is automatically pre-authorized by the credit card company. This charge shows up as a "pending" charge on your bank account. If the credit card company ends up declining your payment for some reason, then that charge will not be fully processed and the pending charge will go away within a few business days. It is possible to have a charge rejected and then retry and have it accepted which could look like a duplicate charge for a few days. If you still have an extra charge showing on your statement, please contact our customer support and we will be happy to remove it. support@freetaxusa.com

I have not received my 2019 tax return yet! It's January 2021 and they told me I could receive my stimulus in a rebate!

Hi Mariana! If you haven't received your 2019 refund yet, please contact the IRS directly by calling 1-800-829-1040 or you can reach out to your local IRS office. To find their information, please go to https://www.irs.gov/help/contact-your-local-irs-office.

If you haven't received either of your Economic Impact Payments (EIP), also known as stimulus payments, you can claim it on your 2020 tax return as a Recovery Rebate Credit.

My taxes say I was accepted from irs but now it's saying waiting to be processed, what do I do? Some one please help me it's horrible

Hi Robert, that’s perfectly normal. Your tax return will go through various phases. When the IRS receives your tax return and if everything looks okay, they will accept your tax return. They will then process your tax return, most are processed in less than 21 days after being accepted. Once your tax return has been processed, if you are receiving a tax refund your status will change to “Refund Approved” followed by “Refund Sent”. The most up-to-date information about your tax refund will be available from the IRS Where’s My Refund? Tool. If you have any other questions, please send an email to support@freetaxusa.com and a member of our customer support team will be happy to assist you.

Still waiting been saying still processing. Now looking at the reviews i don't know what to think. This crazy. Wishing the best

Hi Brandy, I understand your concern and the frustration in waiting for your refund to be sent to you. Unfortunately, since your tax refund comes directly from the IRS, FreeTaxUSA has no control over how long it takes the IRS to send your refund. Once a tax return has been accepted, we do not receive any further information from the IRS regarding your tax return or tax refund.

However, a common complaint this year is that the IRS is processing and sending refunds slower than normal. I recommend that you continue to track the status of your refund, please go to the IRS website (www.irs.gov) and click on the "Get Your Refund Status" link. You can also call the IRS at 1-800-829-1040 or 1-800-829-1954.

If you have any further questions, please email us from inside your account by clicking, "Contact Support."

Minutes after I was notified my return was rejected because my SSN was already used I was called and put through threats from DEA and IRS for? Charges of money laundering etc. and my acccounts were being witheld from banks etc. funny because afte freetax informs me of IRS return I was SCAMED? All I can say is be careful of a good thing.

Hello Ronald! We apologize for any frustration you have experienced. We would be happy to look in to this for you. Did you enter in any information on the IRS website regarding payment information for the Economic Impact Payment? Please email customer support at support@freetaxusa.com. We assure you that our company takes your security very seriously! The IRS will typically send you a notice in the mail if there is a problem with your return, they generally will not call. The following IRS fraud link can be helpful as well: https://www.irs.gov/newsroom/irs-warns-of-new-phone-scam-using-taxpayer-advocate-service-numbers

Waiting for check, just used them today; I have heard from a friend they were good to use and not so damn expensive.

Mistakes in their software and they don't stand behind it. Look to a different filing company that is honest.

Hello JD! I apologize for the trouble you have had using our software. We do guarantee the accuracy of the return based on the information entered in the software. We would love the chance to look into this and see what is going on. Please log into your account and click on the "Support" link in the upper right corner of your screen. You can also choose to email us directly at support@freetaxusa.com.

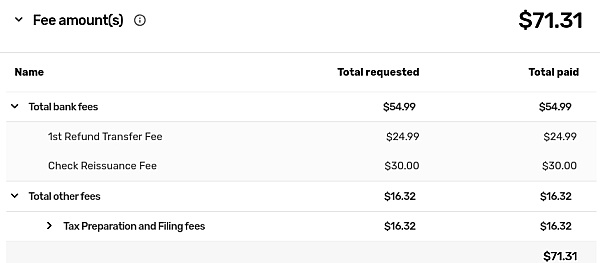

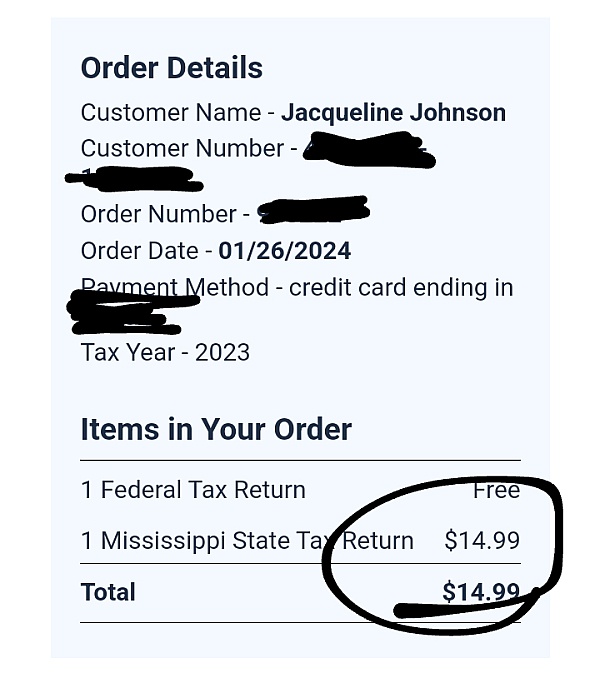

You charge $14.99 for state tax, yet you took an extra $161 from me. The IRS informed me of this! Why?

Hello Amy, one of our Customer Support agents would be happy to look into this for you. Could you please sign in to your account and select the Support link to send a message, or email them at support@freetaxusa.com?

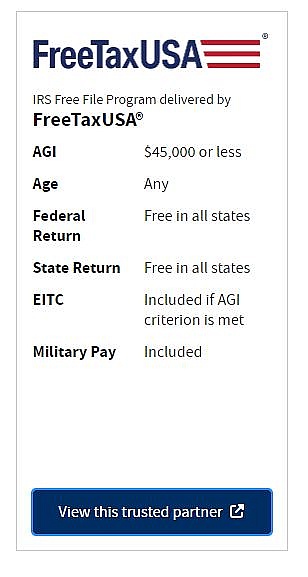

For years I used TaxAct to file my taxes as a self employed business (1040, Schedule C). For the first few years it WAS free for the Federal tax return and I paid $12-14 for my state return, which was acceptable. Then in 2015 they wanted $30 for both the Federal AND State returns! Turbo Tax was more so I paid it. I got on TaxAct this year and it would've cost close to $70! Unacceptable!

That's when I googled and found FreeTaxUSA. Like TaxAct USED to be, they had a FREE Federal return regardless of whether you run a business or not and a very reasonable $12.95 State return filing fee so I went with them.

The website was very intuitive and easy to use. I was able to review and fix things and then download and print. It says ALL OVER the site that the IRS and state returns and refunds will take some time. If you do the EIC the IRS CAN'T pay until Feb 15 at the earliest and probably not until Feb 27. That's not FreeTaxUSA's doing. It's the government. I'm just glad I was able to file hassle free and am impressed it wasn't painful and it REALLY WAS FREE.

Highly recommended and since this is the last year I'll be in business I look forward to a greatly simplified process next year.

I have happily used freetaxusa for the last three years and have even referred five people to use it. I have never had a problem until filing this year. I filed my returns on the last day (no one's fault but mine). I prepared my federal and state returns and thought that I was getting ready to file them BOTH. I paid $12.95 for the State; the federal was free. I hit the submit button to only find out that only my federal was e-filed. I tried to go back and e-file my State return but was given an error message stating that I had to wait until my federal return is accepted, which could take an hour or a few days. At this point, I'm like oh my God, I will get penalized because my State return is going to be filed late. I sent them an email asking for an explanation as to why my returns did not get filed together and why no alert button came up to let me know that I was ONLY filing my federal return. I also let them know how upset I was. I let them know that I am not blaming them for me filing on the last day; I am blaming them for taking my money and not alerting me that I was only filing my federal return. Customer service emailed me back within an hour with no explanation only to say HOPEFULLY THE IRS WILL ACCEPT YOUR FEDERAL RETURN BEFORE THE DEADLINE SO THAT YOU CAN E-FILE YOUR STATE RETURN. Are you kidding me? That's it? No explanation whatsoever. Needless to say, I won't be using those scum bags again!

DO NOT USE! WASTE OF TIME AND MONEY! WHEN YOU THINK YOU ARE FINALLY FINISHED THE SITE GIVES YOU AN ERROR WHICH CAUSES YOU TO START AT THE BEGINNING AGAIN! THIS HAPPENS OVER AND OVER!

Hello Selena. I am sorry to hear of your frustration in completing your tax filing. We would like to look into this for you. Please sign in to your account and click "Contact Support" so that our support agents may help you.

Rechecked with employee who said it is valid. Communicated with free tax twice and free tax still refused to correct their system.

Hello Richard. According to the IRS an Employer Federal ID is a 9-digit number that is assigned by the IRS as an identification tool for each business entity. We would love to look further into this. Would you please direct message us your email address so that we can be sure your concerns are addressed?

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hello Victor, I am sorry for the frustration you have experienced. If you are unable to e-file, there's usually a specific reason. The IRS might require that you mail a paper return if your circumstances require it. We'd be happy to look into this for you. Please send an email to Support@FreeTaxUSA.com.