I've been using FreeTaxUSA for 4 years now and love how easy and streamlined they've made the process. Prompt screens are clear and concise. If I'm not understanding something they have info bubbles on each item to give a little more background information.

Unfortunately, FreeTaxUSA is being given negative reviews based on the time it's taking people to get their refunds, which has nothing to do with them! So please people, pay attention to the reason why your return has not come yet. This service is just the mailman delivering your package to the IRS. Well, your package was delivered, so why are you getting mad at the mailman after he did his job? Simplified analogy, but you get my point.

Used their services for filing income taxes for federal and state. I used the website every year for about 6 years. Was good and easy for me.

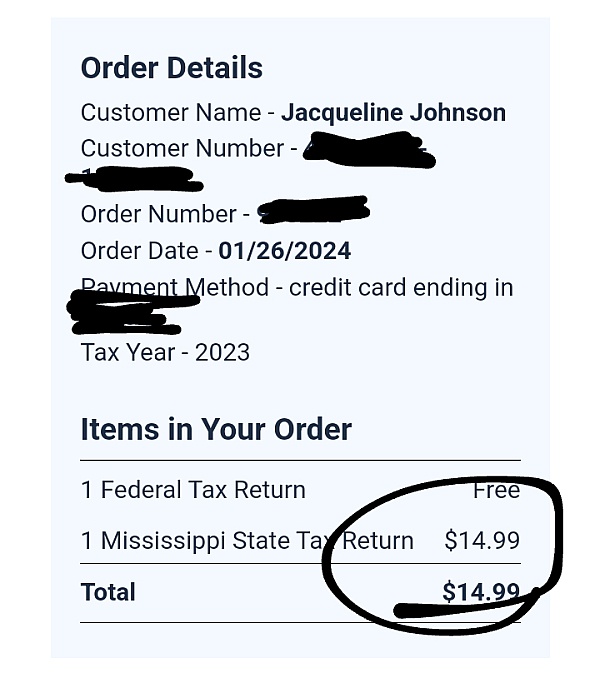

The problem arose when I filed for 2019 1040 forms at the end of January. I filled out the forms, as usual, and got the amount that was due back to me. I entered my debit account information to pay for the service, as usual. Everything done with, I thought. Over 2 months later, I received emails (3) stating I owed $14 for services and it would be deducted from my bank account. I kept sending messages saying it was done in January and received my return in 2 weeks time.

The company and the employees who run the business of accounting should have the info at their fingertips and the tools to use them. A few minutes to fix, but lack the initiative.

Well, it's April 15th, Tax Day. This is the big dance. D-Day (or T-Day). FreeTaxUSA has a message on their site that says they're down for "Scheduled Maintenance." Really. Did that genius consult the calendar when scheduling maintenance for their website?

Probably that's just a canned message that means, "Sorry. We're operating out of our garage and really don't know how to run a website. We got more users than we expected and don't know when we'll be back up."

If you're an IT Director looking for a job, you should fix up your resume and send it to FreeTaxUSA because they'll probably be looking for a professional IT director after this debacle.

The marketing director is probably safe though. They did their job. Brought the people in. The infrastructure just couldn't handle it.

Going over to TurboTax now...;-)

Thanks for writing, Patrick. We have been filing tax returns for 19 years (and as many Tax Days) and have yet to experience any downtime. Our website was unable to accommodate the additional traffic on Tax Day and we are very sorry. We are working closely with the IRS and states to resolve any issues for those who might have been affected. We are committed to our valued customers and will do all we can to make sure this doesn't happen again. If there's anything more we can address, please reach out to us by sending an email to support@freetaxusa.com.

I have used this site for 3 year with no problems. This year I ca file my state taxes it keep saying credit card decline on all 10 of my cards. I have entered all the info correct & all card have cash on them. I can't file my Louisiana state with another software due to the federal was filed with freetaxusa. Freetaxusa customer service haven't tried to resolve this issue with their software so many people are having the same problem it needs to be repairs asap. Or tell us how to go about filing our state tax.

Hi S. J., sorry to hear you’re having trouble with your payment. I’m happy to help. Please contact me at sam@freetaxusa.com with your username so I can take a closer look at what is going on.

The company advertises "File advanced and simple federal taxes for free". Might be great for simple returns but definitely not for advanced: it cannot import information from brokers. That makes it totally useless if you trade stocks and get dividends: try to enter all this info by hand. Better spend $100 and save many hours. Also, because it's only online app - you cannot use it for modeling your taxes: how much to withdraw from retirement accounts, what to sell, etc.

Hello Vlad! Our website can currently file returns with most investment scenarios but we do not have the capability to import stock transactions from a third party. We are always looking for ways to improve the software and appreciate your feedback. If you have more questions about what our website does or does not support, please contact a member of our support team by signing in to your account and clicking the "Contact Support" link.

Used this company past 2 years. Never received 2020 refund and now my 2021 refund is missing. The IRS site says my refund was deposited on March 9th. Cannot get any answers from Free Tax or get thru to Irs of course. Could not need this $ more. I am permanently disabled and in process of getting a divorce. I do not recommend using them

Hello Kathy, I am truly sorry to hear you have not had a good experience with our software and support. I would like to assist you with this. Will you please dm me your email address so that I can follow-up?

I used them twice, once last year with no problems and this year I filed my taxes in early April thinking everything was fine, but never received a refund. After contacting them multiple times in a friendly manner to be sure everything went through okay, they completely ignored me. As though ignoring me was not enough, they finally started rejecting all emails with a message stating the email did not go through. I have not been able to access my account and received no help with that as well. The only way to contact them is via email. The one number I found on the internet leads you to voicemail, which was also disregarded.

We are very sorry for the frustration and would like to help. Can you private message your email address?

T use this site. I was supposed to get $141 in federal return. I got $69. Any they said call irs because I might have a debt. I called IRS and there is nothing I owed.

Plus it was supposed to be direct deposit they have my bank details.

NOt good at all

Hello Eleanor, we are sorry for the frustration you are experiencing. Did you by chance choose to have your fees withheld from your refund? If so, that may be why the refund is less, however, we would be happy to follow up and review your account to provide assistance. Can you private message your email address?

I've had no issues. Its been about 5 or 6 years now. I use to give a way money using Jackson Hewitt. It matters when you are a single mother now I get ALL my money back. Simole user friendly its thorough and my information is still in the system for a smoother transition the next year.

This is the first time I have used this service. I had overpaid social security tax which was credited back to me on federal form. However since the state tax numbers are automatically placed from the federal, my social security tax for state tax schedule A

Was incorrectly calculated. When I contacted support, they said "it would not affect my state taxes"I double checked this with Turbo tax and HR Block which calculated correctly. This error was serious and the support group was not knowledgeable enough to understand or tell me how to correct issue... Do not use free tax usa... They will get you into trouble!

Hi L T., I'm really sorry about the frustration and would like to make this right. We guarantee our calculations and would be happy to make sure that your state return is figured correctly. I will private message you for details.

I completed my federal tax, but after I paid to have state taxes filed, an error pops up stating I can not efile... but it only happened after I paid. It seems that once they get your money, then you're off looking for stamps and envelope. It totally defeated the purpose. Forget calling, I couldn't even get through. Since they can't keep their end of the bargain, why don't they put your money back on your card, since you didn't get the service you were promised.

Hi Jea, as a company we have e-filed millions of tax returns with the IRS. Unfortunately, not all tax returns can be e-filed and must be mailed. The fee associated for state returns is for the preparation of state forms and if e-filing is available, it is included at no extra cost. We apologize for any confusion and hope to see you next year.

I filed my taxes back in April and they were rejected... fixed the error and refiled. My return was accepted and here I am almost 2 months later with no stimulus payment nor my refund. I sent in 8 emails and got a reply from Zendesk in India with some nonsense reply. I asked for a manager to email me and she told me she

She's been working for the IRS for 20 years and once it's accepted it's no longer her issue contact the IRS. She then went deep into my private file and told me that she saw didn't care if I reported them to the BBB because she's confident in her company and her 20 years at the IRS... this company is run by the government or good" friends" of the IRS. They track what you submit even though I did my own taxes they spy on you. And have all of your information. I seriously hate this company use h & r block instead they have real CPA and an accuracy filter guarantee. Online scam business. Government bullies

Hello Bebe! I really apologize that you have not received your refund or your stimulus payment yet. Are you sure that the emails you sent in were to our customer service? We are not affiliated with or use Zendesk, so I am worried that you spoke with someone other than our company. To contact our customer support, please send an email to support@freetaxusa.com. Please keep in mind that once your return is accepted, the IRS does not give our company any information about your refund. Additionally, we are not involved in the distribution of economic impact or stimulus payments. You would have to contact the IRS directly for information about those. It’s possible that there has been a delay in the processing of your refund and your economic impact payment because of the COVID-19 pandemic. Again, if you have questions or concerns about your return, we are always happy to help. Please send an email to support@freetaxusa.com.

It seems simple enough. Fill in the box matching the box number from your W2. Somehow, this software has failed me every year since 2017. Now I owe state taxes from the last 5 years plus interest. 2019 I submitted my tax health insurance under 1095-A instead of 1095-C and I didn't get any of my stimulus checks or my tax returns since the beginning of the pandemic because of that. I lost a lot of money on Game Stop (GME) last year and freetaxusa says I should get some money back that the IRS doesn't agree with, so now I more again. Honestly, $#*! this site, I'm going to continue using it because it has all my documents for the last 5 years, but $#*! the IRS even more.

Hello B B, we're sorry to hear you have not had a positive experience using our software. Our Customer Support agents can be contacted anytime if you have questions, and they would be happy to help address your concerns. Please sign in to your account and click "Contact Support" or send a message to support@freetaxusa.com. We will be happy to assist you in resolving any concerns you have.

I have used them for the past 4 years. I used to be a dedicated h&r blocker, but they charged more for the same service. Mind you, i have not ever needed customer service for any of them, but i have NEVER had a problem filing or getting a very timely return.

My only complaint would be that sometimes when they tell you to fix a problem, you dont know exactly what needs to be fixed.

They import my information from year to year and for me, thats the best part! Easy!

Filed my return with an anticipated refund of $2756 and received notice from the IRS that I had miscalculated the tax due. Instead my refund was $1130! Seems there was a glitch in the software affecting the taxation of nominee dividends. They told me of a "workaround" to make it calculate correctly and offered me a free amended return plus a $50 Visa card... oh boy! Inaccurate software cause me to make improper decisions about my IRA contribution and they offer a free amended return? If you use this software double check their math!

We regret that you had an unsatisfactory experience with our software. We stand by our guarantee that all calculations are 100% accurate or we will reimburse any penalties or fees due to the error.

I have used this site for the last 6 years and have been relatively comfortable with processing my tax returns. I'm usually good about getting them in mid-February however this year with the changes in the tax laws it required a bit more to do the taxes. I had done all of the preliminary work had verified that my information was correct and was ready to file however when logged in today the system was down most all of the day. I had to then find another software program that I could put all of my tax information into and file my returns before the deadline. If this is the only business that they are in is filing tax returns then make certain that you have the bandwidth to support the volume of users that you have projected. Very disappointed

Hi, Beau! Over the past 19 years we’ve taken great pride in both our software and our technical infrastructure – especially its ability to get through the rush of Tax Day. Despite our effort to plan and test for the estimated traffic level this year, we experienced our first technical failure. We feel terrible about the stress and hardship it created for our affected customers. It’s the last thing we wanted to have happen to you on Tax Day and the last thing we expected. We will continue to improve our capacity and we hope you’ll forgive the technical failure. We are communicating with the IRS and making them aware of anyone that may have been affected by our service outage yesterday. We hope to see you return next year. If you need further assistance or have questions, please sign in to your account and click the "Contact Support" link.

Used it for the first time to file my sole member llc. Seemed pretty simple and straight forward. I e-filed my federal and state taxes, however, I incorrectly entered my date of birth. It immediately got rejected for e-file. I got an email from FreeTaxUSA to try again. I fixed the issue and it went smoothly. I liked it. The only reason I wouldn't give it 5 stars is that, it was a bit confusing when filing for my llc. I like this business though and will definitely be using FreeTaxUSA in the future.

Thanks for the review, Guy! We are always looking for ways to improve the tax-filing experience for our customers and would like to know how we can improve. Can you send details about what was confusing to support@freetaxusa.com?

This software is approved through the IRS website so I assume it is safe to use. The program itself is great and I've used it for years. Last year after I filed my taxes I had a notification from my employer that someone was trying to file for unemployment using my information. I went through all the motions to file fraud everywhere, my worst nightmare, how did my personal work information and social security number get in the hands of a thief? Now I am filing my taxes again this year and guess what! Someone has already filed their taxes using my sons ss#! Wow fraud again!? How could this be happening to me again? Well the trail of bread crumbs leads back to FreeTaxUSA! They have all my personal information especially my sons ss#! This is the only logical explanation for this nightmare! So thank you TaxHawk Inc. and FreeTaxUSA you have severely messed up my life and now my sons. This is criminal and I will be filing a tax fraud claim against your company. Customer #**************.

Hi Nicole. This sounds like a very difficult experience. I can assure you our program is secure and there have been no data breaches. We also never sell our customers' information. You can see more about our security measures at the following link: https://www.freetaxusa.com/safe.jsp If you believe that your tax return information has been used improperly in a manner unauthorized by law or without your permission, you may contact the IRS Identity Protection Specialization Unit, toll-free at 1-800-908-4490.

For more information, please consult the following resources on the IRS website:

- Identity Theft Central

https://www.irs.gov/identity-theft-central

I filed with freetaxusa on February 12 2021 I finally got a status change on where's my refund only to find out the sent the deposit on February 24 so where the hell is my money because it never made it to my account. I dont know what to do because you cant call anyone this is ridiculous. Please help!

Hello, Cindy. I'm sorry to hear you have not yet received your refund. That must be very frustrating! One of our customer support agents would be very happy to look into this with you. Please sign in to your secure account and click on Support at the top of the page to get in touch with them.

Loved the process, simple and easy until its time to file and after you pay your 14.99 it errors out and say IRS systems are down and you have to mail it in, which leave me the customer confused as to what's the point and how will I receive my returns if I mail them in myself. Whole process left me uneasy.

Hi Jarvis, I apologize for any confusion regarding the returns. The IRS will not accept prior year returns through e-file. Even with a mailed return, you can choose to receive your refund through direct deposit. The state fee is for the preparation and calculations of the return. We charge no separate fee for the method of filing. Please message our Customer Support by logging into your account and selecting Contact Support and we would be happy to help you with any of your questions.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hi Vernon. We are sorry for any frustration you have experienced. We do strive to provide a service that is easy to use and sincerely apologize for any errors on our part that have caused you additional time and concern. If you would like us to look into this issue further, our Customer Support agents are standing by to answer any questions you may have. Please log into your account and click the "Contact Support" link.