Overview

MyTAXPrepOffice has a rating of 4.7 stars from 581 reviews, indicating that most customers are generally satisfied with their purchases. Reviewers satisfied with MyTAXPrepOffice most frequently mention customer service, tech support and new software. MyTAXPrepOffice ranks 1st among Tax Software sites.

Tax year ended 12/31/22 I moved from Intuit Pro Series to My Tax Prep. Change is not always easy, but this conversion with the assist from their technical support team was manageable. A Success!

I had a couple of issues that was troubling me getting set up, but Makailah helped me complete my setup in an instant. She was friendly and courteous!

I am in my 3rd or 4th year using MyTaxPrepOffice. I can not say enough good things about the people that run this company. They are always available and always so friendly and helpful.

Victor helped me with multiple questions today. He was so patient, very knowledgeable

And professional. It was a great experience.

I am so glad I switched to MyTaxPrepOffice!

After early issues, I contacted the company to cancel my service. Despite the fact that the sales manager I dealt with was incredibly rude, I ignored my gut feeling and decided to give this program a shot, primarily on the promise that e-filing would be much easier.

Now here we are, March 15,2019 and the tax forms for filing for an S-Corp in Indiana still are not ready, and not just infrequently used forms, but page one of the Indiana IT-20S. I've been assured that the issues will be resolved before the due date of the return, but we should not be put in a position where we have to explain to clients that we will need to file their federal return today and their state return at a later date.

Additional issues include:

Items that require the preparer to override entries that are incorrectly inserted from elsewhere.

Forms that should be created based on entries are not always triggered.

Required entries on forms are not always required by the program.

I had high hopes for this program, but you'll be disappointed if you go in with even the most modest expectations. This program's shortcomings have necessitated the purchase of our previous package to complete returns. It has cost me extra money and significant time.

I used this software for 2021 tax season. I had many issues when i try to comunicate by phone with the managers. They are so rude and all time theirs answers is: "we do not advise for prepare taxes" but my quuestions all time concerns to problems with the software. The decided do not renovate with me but i paid for sevices for tax season 2021. They have not provide me support by phone so this is not a good process with the clients. I feel so furstrated. Anaybody knows regulations for this issuue.

My name julio picco my phone *******980

Kachjae was great when I called the support phone. I had problems without solutions in the past with an issue. She resolved very quickly to my satisfaction!

Even though they supposedly gave me a 2nd year for free. I will not use this software again. They claimed it was a Client Portal. Not once did it upload W-2s for my clients. To get my client's copies of their returns, if they did not capture it during the signing, I had to DocuSign the return. They could not even file my S-Corp's State return. I had issues with Individual state returns. I did 20 some returns and there was not one of them that I did not curse this program over. I have been doing taxes since 1988 and used Drake, Tax Works, Lacerte, Ultra Tax and more. I'm going back to Drake. Don't buy their story. Their support people were even frustrated with the constant changes and not knowing how to help the client's.

I am wondering if these individuals that recommend this software are employees for Mytaxprepoffice?

I can list a number of reasons why you should avoid using this software.

1. The sales representatives lie and tell you it's a 30 day return policy, after buying the software and requesting a refund that is when you will find out it's only a 14 day return policy.

2. The software has a number of issues, it will either freeze up, miscalculated the return, or give you error messages. The support team can never fix it on the spot, and will tell you someone from their development team will contact you the next day. Hopefully your not like me and have this happen to you while you have a client. I loss 5 clients so far this year due to this situation

3. The Pre Acknowledgement Loans does not work properly and the software continues to try to blame the bank when it's the software. As a result I have loss 10 clients, because I am unable to perform the loans.

4. They have lied to us telling us the client portal will be up and ready, and it is not. They have been telling us this for 3 weeks.

These are just 4 of the issues very early in the season. I am truely upset at myself for purchasing this software.

I would not recommend anyone to use this software it will cause you to loose clients, loose profit, and give you a bad reputation being that your the face of your office.

This year I am really surprised at the speed with which they answer the phone, resolution of the problem, I definitely stay with this software, I have been changing for more than 5 years and MyTAXPrepOffice, it is friendly, with less expert preparers like me, I recommend it 100%

This company told us we had to renew with them or not get the Add on Fee... mind you that happened after we renewed...which was shady but I went for it because I didn't have many problems out of the software, had been with them at least 3-4 years... then for 2022 it was a hot and cold mess... problems everyday... it didn't get sent to the bank...oops... it didn't get sent to the state... oops... people had to wait 10 week to get their money because the bank bounce it back...I lost a lot of money and customers...now we just charge higher prices and forget the add on fee... no only you don't get the 15 percent... you lost customers... how is being greedy little people going for you... I sent all the tickets numbers to the BBB with my complaint, and I plan on talking to a,, That's like going to store for milk, give them 20 bucks and they tell you...if you want your change you can only buy milk from us... after I gave them my money... what the difference...I am also contacting my State Rep... and anyone else who will listen

We appreciate that a policy change can be upsetting which is why we informed all our Add-On-Fee customers in an email in May of 2022 before the policy went into effect. You checked a box and agreed to the new conditions in June 2022 when you claimed your Add-On-Fees. The policy had not gone into effect yet, but we were making everyone aware of the upcoming change. This was not done after you renewed as you stated and was done with complete transparency well in advance of the next renewal date. When the policy went into effect, you had the choice not to renew or decide not to participate in the Add-On-Fee service. The automatic renewal terms and conditions are not hidden in the fine print. It is clearly stated on the bank enrollment screen and you must check a box to agree to the terms before being able to complete the form. The sentence next to the checkbox reads "I understand that my renewal fee will be automatically deducted from my Add-On-Fee balance. The remaining balance will be sent to me upon request." Our records show that you checked the box when you enrolled with the banks to use our Add-On-Fee services for Tax Year 2022 and since you used two banks you had to check the box twice.

You did not lose the balance of your Add-On-Fees. After renewal ($470), your Add-On-Fee balance of $2,233 was sent to you. You could have chosen then not to use the software for the 2023 tax season.

Many software companies in our industry have been taking renewal fees from Add On Fee balances for years and we are just adopting a standard practice. We started the automatic renewal to give our Add-On-Fee customers the advantage of paying for their renewal from their fees (which most do anyway) and making sure that they receive the absolute lowest early renewal price for their software.

We understand that it must have been frustrating for your customers to have to wait for their refunds. However, once the return has been transmitted and accepted by the IRS, the bank that you chose and the IRS are responsible for getting the refund to the taxpayer. While we often work in conjunction with the tax preparer and the bank to try to understand the reasons for the delay, the results are out of our control. The funds bouncing back to the bank and the consequent delay was due to a mix-up between the bank and the IRS.

We have also reviewed your support requests for this season and there have been 12, not 100 as you have stated, and all of these have been addressed.

Good App MyTAXPrepOffice is awesome software. It is easy to navigate. I have been using it for the past couple of tax seasons and am very pleased with the functionality

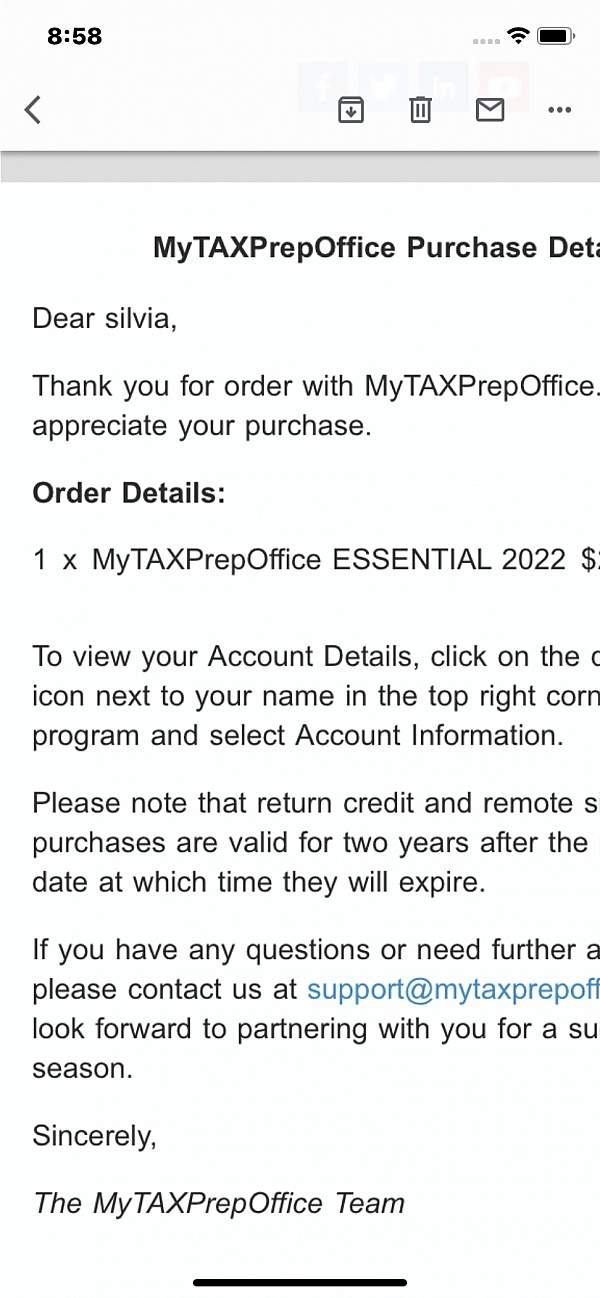

I purchased the program this year. It was good price. Very helpful representative. The program itself has a lots of build-ins. Looks like a good investments so far.

Great training! My trainer was knowledgeable and skilled. She took the time to answer question and to make sure I undrestood every aspect of this software.

Me and my wife were very excited on switching to MyTaxPrepOffice as it was cloud based and it's interface looked very good and prices were very attractive. However, when we started using it, we had a feeling there were some errors based on our experience with the clients and returns. We still had access to our previous software that we were switching from because of it's price, so we decided to test. At that point we started preparing tax returns in both software and it was shocking to see multiple errors in the returns prepared on MyTaxPrepOffice. Their customer support is very good that I acknowledge but they are not very familiar with the errors we notified and they had to submit the ticket and then after a few days someone from expert team will contact to resolve the error and 'fixed' the software. Overall they are fixing the software gradually as people notifcy them of errors but this has been a continuous drill. We are not sure how can we rely on such a software as it's not worth to keep preparing returns in two different software just to see if there were any new errors that auto review / edit check did not catch. Most errors we came across were in the corporate tax returns. I hope they fix all their errors and this become reliable and we'll be happy to use it but for now we are trying to find some other reliable software for next season.

Although I have yet to start the 2020 tax year with the new software, I am very happy with the one on one training and the training videos. If you have used another tax software, many features are very similar. I was peviously with TAXWISE. I think that it was a very good software, but MyTAXPrepOffice has more features for a better price. I used to have a separate portal for my clients to use for security, but the portal is built right in to MyTAXPrep. There is also an after the fact payroll feature that looks very handy for quarterly reports.

Customer Service and sales has been awesome to work with! Additionally, being cloud based allows me to do anything I need to do for my virtual office.

I had a few questions/issues related to using the 2020 software for the first time and call was answered immediately, and issues were corrected on the spot. It was incredibly appreciated!

MyTaxPrepOffice is a great software and as i get more familiar with the software the returns get easier to complete but they have very good customer service. I would recommend them.

I always get great customer support with MyTaxPrepOffice. Support team always patience and knowledgeable about the product. They are extremely helpful!

Q&A (13)

Why am I being asked to renew. I thought I paid for 2019 when I bought this. Did I get double-talked?

Answer: Hello Joy, If you purchased the 2 for 1, you may already have 2019. Please contact our team at 307.414.1211 to verify, and we will activate your license. Sincerely, The MyTAXPrepOffice Team

Hello my name is Maria I'm interested in this software but I don have an efin number just my PTIN number, can I use the software without the efin?

Answer: IF YOU WANT TO TRANSMIT YOUR RETURNS ELECTRONICALLY, YOU MUST HAVE AN EFIN.

I have had trouble getting setup assistance. Still requesting help for conversion for almost 2 weeks. Is this indicative of what to come?

Answer: They have instruction tutorials that I participated in several years ago. I too had a learning curve initially but I now seem to feel competent plus they have a good Chat line support that I use for technical and some tax prep advice. As I recall it was easy to set up online for me I would try to reload it. Richard

A rep called a set up an online demo with me but never called. Is this the kind of service I can expect from this company?

Answer: Hello Tyson, We apologize for the sales rep missing the scheduled demo. Please call us at 307.414.1211, so that we can re-schedule that demo appointment for you. Customer satisfaction is always the number one priority for us. We hope you will join our thousands of happy customers that enjoy our low prices, expert support, and powerful features. Once again, we apologize for the inconvenience. Sincerely, The MyTAXPrepOffice Team

Is there a way to access TY 2018 Software as too much has changed to evaluate based on TR 2016 for Scorp 1120s returns

Answer: Hello Herbert, We offer a demo version of the software on our website that allows access to the year 2018 (https://mytaxprepoffice.com/democenter). If you have questions about specific forms, please contact our support team at 307.414.1211. Thank you. Sincerely, The MyTAXPrepOffice Team

When I purchased the software for 2018 I was promised a lifetime subscription. But I have been seeing ads to renew. is my subscription locked in?

Answer: Hello, The Lifetime Price Guarantee means that your subscription renewal price will not go up as long as you renew by April 15th for the following tax year. It is not a lifetime subscription. We do offer multi-year subscriptions where renewal is not necessary for up to 5 years. If you have questions about your renewal and Lifetime Price Guarantee, please contact our Customer Relations Department at 307.414.1211 and press #3. They will be happy to answer any questions you may have. Thank you for being a loyal MyTAXPrepOffice customer and we look forward to speaking with you.

I just signed up BEFORE reading reviews and found many negative ones. Is this company based in the USA and reliable? What will they do with my cc?

Answer: You really should not read negative reviews because most negative reviews are from disgruntled consumers based on their own faults.

Can you convert returns previously prepared on HR Block software?

Answer: No only if file with mytaxprepoffice the year before or any year before

Can you help me compare between MytaxprepOffice and other tax softwares such as TaxAct,,,

Answer: I would go with TaxAct over 100 times than to even get close to mytaxprep office. This company's tactics should be reported

Have a question?

Ask to get answers from the MyTAXPrepOffice staff and other customers.

Looking for Lower Fees? You've come to the right place!

• $15 Bank Product Fee

• $1 Remote Signature ID Verification

• 15% Administration Fee for Add on Fees

• NO OTHER FEES!

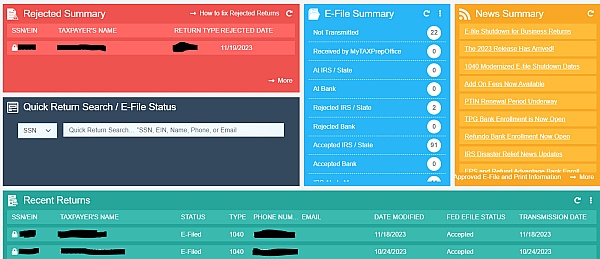

Powerful productivity tools included with our plans:

· Unlimited tax preparation

· Free unlimited e-filing

· Federal and all states

· Integrated bank products

· Client portal with a personalized link

· Remote signatures

· Individual and business returns

· 1065, 1120, 1120S, 1041, 990, 706 & 709

· After-the-Fact Payroll

- Visit Website

- Cheyenne, WY, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hello Loyce,

We enjoyed speaking with you today on the phone and we are glad that we could resolve everything to your satisfaction and that we could agree that the bank loans and software are working correctly. We sometimes do offer an extended 30-day refund policy and we honor that when it's offered, but our normal refund policy is 14 days. We are glad that you decided to continue working with us and we will do everything in our power to make sure your tax season is a successful one. We appreciate your cooperation and are happy to include you in the MyTAXPrepOffice family.

Sincerely,

The MyTAXPrepOffice Team