Not a good company to deal with. Aggressive at applying fees. Unfair business practices. Bad Customer Service.

They bought my loan and now I am stuck with this lousy company …. Piss poor reviews …. I'll seem em in court!

I would never use this company to purchase a home. High rates, talks in circles, no good customer service.

Worst mortgage lender ever. Very dishonest, put hitting fees in your loan documents, run from this company.

Start with Dallas Morning News Article from 3/29/18, gist is name change didn't change anything. You will also get a couple of pictures of top executives celebrating name change at NSE, and Bray and his flunky congratulating themselves of their market wizardry of changing name.

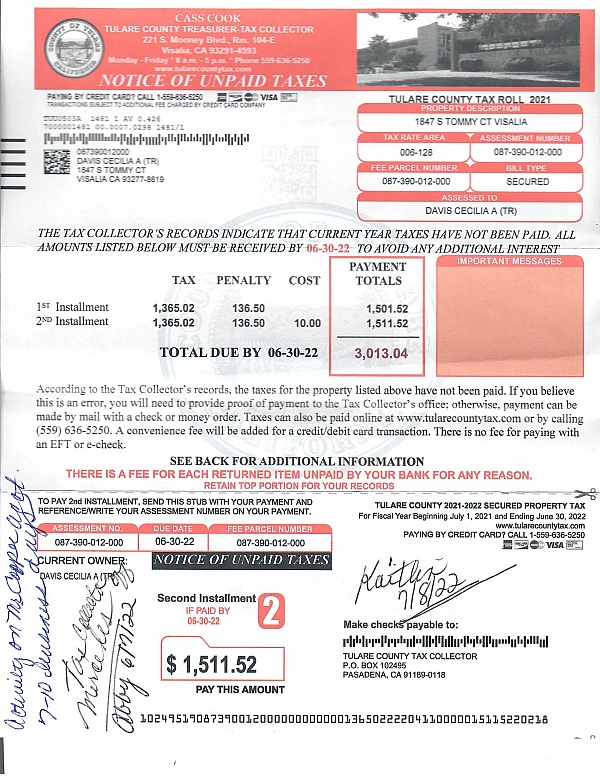

More helpful are stories of lawsuits, particularly Mr Harmon an engineer from TX suing them for 10 million. They foreclosed on him claiming he hadn't paid taxes, but he had, had proof and was never late on anything. Remember this is a blood sport. Many more like him. Go to YELP for horror story after horror story.

They managed to be the first 10 answers if you just google them- DONT BOTHER READING ANYTHING THAT HAS MR COOPER OR NATIONSTAR AS ITS ORIGINAL SOURCE, JUST PROPAGANDA.

Politicians love to talk about middle class, working folks etc, but we know that's horsewomen poo right? From what I've seen only New York has sued them as a state, but I'm just beginning this f. G rabbit hole.

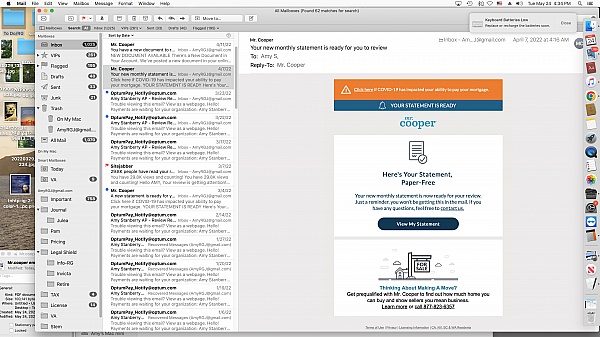

People pay off mortgages just to get away from Mr Cooper, (btw start calling them that so they get as many negatives as Nationstar online), guess what happens-that's right Mr Cooper then reports them as over 30 days late on their mortgage, screwing up their credit.

Looks like pressuring politicians, Stare AG's to go after them and finding a good Law Firm for a massive class action is the best way to slow their roll.

Look up stockholders of Nationstar, they consist of about 20 individuals and 6 hedge funds. Start complaining -emailing to them about disastrous operations of Nationstar.

Amar R Patel, Anthony L Evers, Brett Hawkins, Chad Patton, David C Hisey, Fid Lou B He Blkr LLC, ( and its many cute iterations to avoid taxes), Harold G Lewis, the contemptible Jesse K Bray Kal Raman and several others.

These are Bray's bosses. If you really want to stand up for the " little guy" this is one way. Brady's workers don't mean anything to him. The more complaints he gets the better. His job is to squeeze home owners. His customer service people are using a script to be ready for any angle hardship with the goal of more $ for Bray and CO, for which the customer service workers get bonuses. It's a blood sport.

But Bray's bosses don't want there money making days interrupted by irate homeowners bombarding their emails.

By law all the information is on the Internet. So there's that. The squeaky wheel gets the grease Good luck.

We just had our mortgage transferred to this company. First of all, I didn't even get a bill until I called them looking for the bill. Then I received one AFTER the bill was already past due. Then, I was told that I could set up an online account to "make my life easier"... and first impressions are HORRIBLE! I made a payment and set up Auto Pay and even received an email stating "Thank you for your payment". Then I go online 7 days later and see that there is a FEE of $35 charged and my payment that I just made is showing PAST DUE! I call the customer service to find out what is going on and they are telling me that it was an "NSF" (which means Non SUFFICIENT FUNDS"). The payment never hit the account and they said that I entered the number incorrectly?! How do you charge me for a NSF, if you never even tried charging my account? The rep said then said it was a charge because my account "could not be found" by the bank? I verified my routing and account number with them on the line with my bank. I never got any notices that they needed to verify any information that was entered, and slapped an NSF on my account... when in actuality, they didn't even try drafting the payment, which they already said that they had received? I asked to speak to a manager, and they said they will put me in a "queue" for a manager to call me in 24 hours? Maybe that's why you don't know how to take care of customers! Managers are not present? They said enter in automatic payment info again. What happens next time they tell me that "The account could not be found"... when they cannot even verify what numbers i entered in? I think it's a ploy to just charge a FEE and just say that I entered in the incorrect information!

If I could give 0 stars if could. My house was destroyed by the Camp Fire in California on Nov. 8. I received a check to payoff the loan and replacement cost from Farmers Ins (They were awesome) within 25 days of the fire. The check with my name and Mr Coopers name was received by the payoff dept on 12/14/18. At this time my check was send to the research dept. Which the name does not fit them as the did no research to find out why my check was in their hands. Research Dept took my check and filed it away. On 12/20/18 I called the Escalation Dept to confirm that account was paid off and my money was on the way and found out customer service failed to tell me I need a signed Mortgage Affidavit to release my funds and payoff the account. So on 12/20/18 this information was emailed to me and emailed back to escalation which emailed the affidavit to the Research Dept to complete the transaction. Escalation Dept. sent a second email to Research Dept to get confirmation that the payoff was moving forward. Apparently the Research Dept needs to research how to open and read emails because there was never a reply to the emails sent to them. I might also add that there is no way to contact the Research Dept. because I asked ever person (supervisors included) how to get into contact with them. Hmmm! On 1/14/19 I still had not received a check so I jumped through all the customer service hoops only to find out my money is still sitting at the Research Dept. All that needed to be done was for some to upload the affidavit and they process was started. So now I have to wait another 20 days to get my check. This all assuming the research dept has nothing to do with the process because if they gotta actually work I'm screwed!

We were transferred to them from our previous lender. It was extremely painful experience to pay off our loan. After wiring them the money, they did not accept it till the quote expired. They did not bother to let us know the status of the pay-off either. We had to find out on our own that they received the money but never accepted it (for no reason). Their research department was involved but didn't follow up. They did not help us with any findings. We had to go through the pay-off process again and lost several hundred dollars because of their irresponsibility.

We finally paid off our loan in May. Since we overpaid, Mr. Cooper was supposed to refund us the overpayment. They never did. We had to call them in July to find out why they were not refunding the money. They said they sent out a check in May but the check was not cashed. So they had to resend the check. We were wondering what they would do if we hadn't called about it. Keeping my money for good?

Anyway, we waited a couple of more weeks. Still no refund. We called again. They said they never resent the check and they would do right away. We waited another week and this time, they said the first check was actually cashed already, by me. We asked them to send us the image of the cashed check and the date it was cashed and the account number it went into. They said they could send us none of that. It was our job to find out where the money went. They also said if we still want the money, we needed to email their research department ourselves and figured out how to get the money.

Up till today, months after my payoff, I still don't have my overpayment refunded. And during this whole process, they never reached out to me although they owe me money. They did nothing to help out the customer except keeping customer's money to themselves.

If you need reference, the last rep we talked to was Amber, work ID *******.

They didn't pay my insurance from escrow and canceled to replace with there own for 400% more expensive

From a Retired disabled Vet,

These people pray on the disabled VA loans. Be Vigilant, Due diligance.

Do Not Do Business with These People

I lost my job in May due to Covid restrictions. The company will not be reopening. Back in early October 2020, I decided to pay off my house. I had received a severance pay from my company and I wanted to pay off the house so I didn't have to worry about getting a job during covid. I contacted Mr. Cooper/Nationstar Mortgage (MCNM) to get a payoff figure. I knew it was in the area of $7000. I told them that when my payment was due on November 1st, just take whatever was owed out of my account to pay off the mortgage. I had automatic payments. MCNM refused to do that. They HAD to send me a payoff quote and charge me $20 for it. Included with this payoff quote was directions on who to send the money to either via Cashier's check or wire transfer. I wanted to use a wire transfer so it would be quicker and safer (so I thought) than putting a check in the mail. I went to my bank on Oct. 13 and had a wire transfer sent with the payoff amount. I kept watching on line for the pay off to show up. It never did. On Oct. 26th, I started making calls to MCNM to find out what happened. I have made calls at least twice a week every week since then and they cannot find my money. They then took November's payment from my account even though the house was paid off in October. MCNM had me send the payment to Wells Fargo in care of MCNM. I have called Wells Fargo every week since October 26th also. They will not give me any information since I don't have an account with them, but I keep calling. I notified MCNM that they would have to work with Wells Fargo to locate my money. I have talked with at least a dozen customer service people at MCNM and get different answers from each of them (Problem will be cleared up within 48 hours, send proof of payment, contact Wells Fargo yourself, what account did you put it in, etc.) Now they want December's house payment or they are charging me a late fee and probably put it on my credit report. They have my money from October. I even filed a report with the Better Business Bureau and MCNM has done nothing. My bank is getting a lawyer involved to try to help. I contacted a lawyer and they want $1500 up front and 25% of what they get me. I don't know what else to do.

Hello. I need help with this mistake that has been plaguing my life for months.

Mr. Cooper claimed that I had late payments on my mortgage on 1107 Varela street, Key West, Florida *******. This is not true because I set up automatic bill pay with Bank of America, which pays Mr. Cooper each month. I ended up paying three weeks in advance which was mistaken as a late payment.

On May 25th I paid for the month of June. This was thought to be a late payment for May, even though I paid on time for May. I ended up paying a $40 late fee. I had another issue because my payment date was switched to the 1st and when I paid on the 31st for the next month, they thought it was a late payment. Eventually after paying $40 a month in late fees I paid Mr. Cooper $2,600. After all of this confusion, frustration and wasted money I switched my payment to the third of the month. I'm trying to prevent this from happening again.

I have never been late on a payment and I have continued to pay on time each month despite what Mr. Cooper's statements may say. I have the records from Bank of America proving my payments have been made. I've included this to further shed light on this situation.

Through this mistake, my credit score has been ruined. Before this misunderstanding my credit score was over 800. Now I am struggling to refinance my house because of Mr. Cooper's lack of attention to details. I am stuck paying Mr. Cooper because of his carelessness.

I have worked very hard my whole life to build my credit score to what it was. I've never paid late on anything, and you can see that in my records. Now my 78 years of building my credit is ruined by Mr. Cooper's mistakes. I am so distraught.

I really need this corrected soon so I can take advantage of the low interest rates. I am trying to give my children the best inheritance I possibly can. Thank you for your time and efforts.

Joan Thoman

Loan number *******-011D

Nationstar mortgage

I was very pleased with this company in the begining using there app, until i got a call about refinancing. The guy told me it would cost me 5k for the refi. Next thing you know, tom sheridan sends me a closing document which i signed a lock in agremnent might i add. Sends me the closing disclosure and its about 8-9k more than what i was thinking and gave me a run around and something about escrow why it was so much more. And i asked why my escrow was going to be financed in the loan made no sense to me. So he starts sending me other loan options on a 15 year and a 20 year which i never asked for. So i ended up wanting to go back to the original proposal come to findout rates have went up by this point. Now its crickets, they wont get back to me or follow thru with the refi now the rates are higher, which i locked in at a lower rate. I even emailed his supervisor and called his supervisor twice and his name is randy tabor. Neither one of them have gotten back to me. Currently going thru someone else to refinance my loan, and going to be done with these people. Very unprofessional and it seems like its hoax. Seems like a bunch of people running around an office throwinf out numbers then when itndoesnt benefit them, they back out and ignore. Thats exactly whats hapoening in my case. The other people ive dealt with were very professional eslecially mario boone. Hes the original guy that got my attention. Tom sheridan says hes no longer is with the company. I can only imagine what happened there.

The worst and most unethical mortgage company I've ever worked with. I've had my fair share of buying and selling houses. So this ain't my first rodeo. Last month, I started a refi and 2 weeks ago the title company ordered a pay off good for 10 days. Two days after payoff was requested Mr. Cooper mailed out my mortgage insurance that was due. (Mind you, usually any escrow payments are put on hold when a payoff is ordered!) so I get to closing day on the 9th of May and the wire goes out to Mr Cooper ok the 13th, due to the 3 day remorse clause. On the 19th, Mr Cooper rejects pay off the because it's missing the same amount they paid for the house insurance. Of course, my new mortgage company also paid for the mortgage insurance. So now there's double payment for mortgage insurance which will be refunded to me, and after a phone call with Mr. Cooper the plan was to return the money to them. But instead they rejected quarter of $1 millions Because they wanted their thousand dollars mortgage insurance refunded. Fine we'll play their game, title company ordered a new payoff 5/24 with an additional $1200 added to the original payoff (to cover mtg insurance, fees and interest)

Title company wired Mr. Cooper the new pay off the very same day, on 5/24. Needless to say 12 hours later we find out Mr Cooper rejects the second payoff because now they say they calculated the fees wrong and I owe still another $136. Yep, you heard that right Mr. Cooper rejects quarter of $1 million because they were short $136 that they miss calculated and not honor their ten-day pay off. This company is beyond on ethical and ridiculous. They do not play by the rules, as they like to make up there's rules as they see fit. They are a joke for a mortgage servicing company.

They told me I qualified for a Refinance. Had me do all the things, paperwork. Had me talking to one guy, named Avery. We had it all figured out. Going to out my credit card debt in there and just have one payment. I had one credot csrd with nothing on it. He told me i "had" to do an appraisal for paperwork and it was $500 but no biggie cause I was approved and we would pay it off with my loan and i would get at least $2,000 cash back for the vacation I was about to go on with my son. So I took days off work to get appraisal done and paper wkrk6 together. Maxed out my open card and the $#*!s checked my credit 3 times, dropping my score almost 60 points between maxing the open credit card and chexking my score. Then all of a sudden I was speaking to another guy who I wasnt even told I would be talking to. Then we went back and forth for a couple weeks then nothing!?!? I called, emailed. Nothing! Then I got on my mr cooper app and there was a denial letter on there? Wtf! Now my escrow was messed up too and they want to raise my payments by $150 some dollars! I am refi with abother company right now! Thank god! Hoping someone goes after these $#*!s!

Never in my personal or business life have I EVER encountered the level of indifference, ineptitude, dishonesty and lack of care for the customer.

Horrible emailed same info over 5x... they cant get act togethere, nothing but excuses and dropped balks by them

We worked to refi our two mortgages through this firm and the experience was worse than I should have imagined --DO NOT USE THIS COMPANY

Q&A (10)

Why do 39 of 41 reviews give your company one star?

Answer: BECAUSE 1 STAR IS THE LOWEST THEY CAN BE RATED-IT SHOULD BE -0- STARS. THEY ARE HORRIBLE.

How can they continue to do this to people?

Answer: They are the worst company that ever existed. Quickly refinance your mortgage elsewhere. I am. They conveniently lost my payment and damaged my credit as soon as I started the refinance process. Go figure. Make public complaints. CFPB, BBB, Yelp, Twitter, Facebook. Everywhere. They need to be shamed out of business for treating people the way they do.

I have made 7 calls, (about 9 hours involved), in trying to get resolution on my escrow account moving from Pacific Union to Mr. Cooper,

Answer: Good luck. Mr cooper will not help you. They are the worst

What made you choose Mr. Cooper over similar businesses?

Answer: And all of my 61 years I have never experienced such an unscrupulous company. They have ripped off so many customers I cannot believe that they are still in business. They can change their name but they have not changed their practices. I hope To be involved in a class action lawsuit against them. I will hire an attorney to fight them.

Can you share a success story using Mr. Cooper?

Answer: None None None None None None None None None None None None

I keep trying to call Mr. COOPER AND THE CALL KEEPS GETTING DROPPED! PLEASE CALL ME AT 210 362 0329

Moving home in foreclosure said they would fine 1000 a day if anything left behind. Can this happen?

Have a question?

Ask to get answers from the Mr. Cooper staff and other customers.

Overview

Mr. Cooper has a rating of 1.3 stars from 440 reviews, indicating that most customers are generally dissatisfied with their purchases. Mr. Cooper ranks 236th among Mortgages sites.

- Visit Website

- Coppell, Texas, United States

- Edit business info

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Similar businesses you may also like

See more Mortgages Businesses- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members