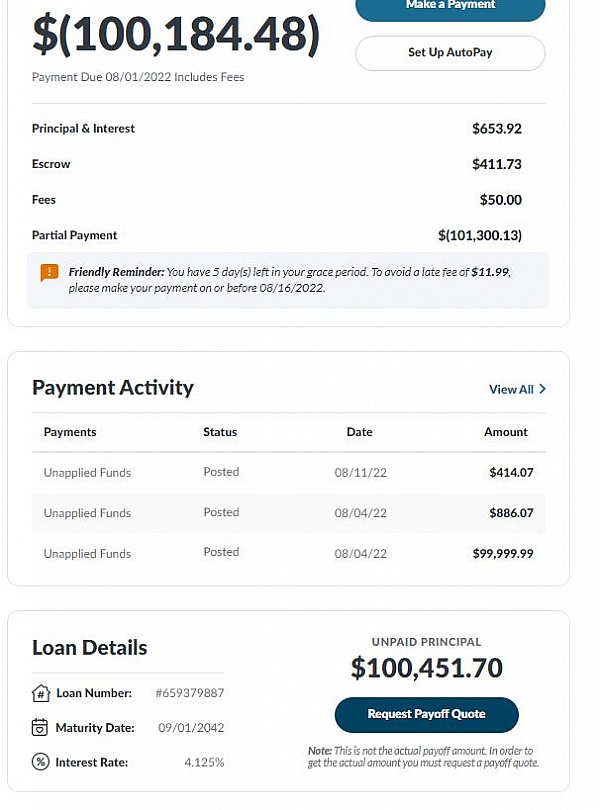

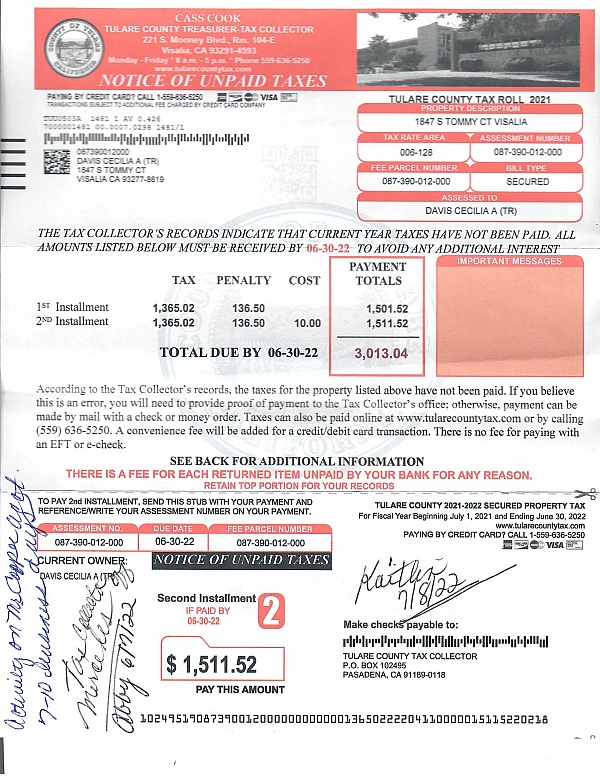

Do not use this company. Mr. Cooper was previously Nationstar Mortgage, who back in December 2020, agreed to a $91 million settlement for mishandling foreclosures and borrowers' payments. They added a false escrow account (I pay taxes to the city separately) to my mortgage under the pretense that the city sent them a bill for past due taxes (lie). The first few times I dealt with them it sounded like they were going to assist, but it ended being a complete runaround. Can't call anyone - always by email (which ended up being fine by me since I just kept throwing their lying emails back at them). Kept telling me they were waiting for the city to refund the escrow they paid, but I had to go to city hall to pay the taxes before a refund could be generated. In the meantime, I kept paying my mortgage and then they said I was in arrears. Tanked my credit rating. After 7 months and emailing them the same documentation, I finally got the escrow removed, they reinstated my credit rating where it should be and I refinanced elsewhere. Total scam artists. Customer service is useless and obviously told to lie to the customer.

The master the art of third party.

The bought my loan then the hassle started. They never informed me of that and my automatic payment kept going to the previous lender and come back.

Three month later while I am not home they invaded the house, stole all valuable electronics, had parties left pizza boxes, beer, liquor and used male contraceptive garbage behind and changed the lock.

When I came back they didn't want me to call the police and promised to handle and reimburse... Etc however they transferred me to the insurance company and claim they have no knowledge of what happened and (now) they don't have police reports. At the end of the year they added more than 3 K to my escrow claiming it was for the third party company to secure the house.

They repeated this several times and faked it on paper when I started to sell the house just to get rid of them and actually they added those illegal transactions to my total and twisted my neck with passion.

They then claimed that they failed in charging me for taxes and added 7K plus when I was leaving.

The icing of the cake was tons of discrimination comments and other very narrow minded uncalled for acts.

If you see mrcooper RUN away as fast as you can.

I have been with Mr. Cooper for years with no issues until now. In 2019 I requested to delete my tax payments from escrow which was done with no issue. Today I have requested to remove my home insurance from escrow with no avail. I talked with 3 agents that have said that I was not approved

To remove the escrow. I have not been late with a payment since the beginning of my loan. After

30 minutes of insisting that I needed to talk to someone that could help. He said he would have to

Refer the account to the escrow team. The agent initially said he would get back with me in 5 days. After giving the lowest possible score on the phone survey, he returned my call in a day. Nothing changed. They would continue to pull my escrow account even though I have changed insurance companies and it is now paided from December 16,2022 to December 16,2023. He informed me it was 2022 and my taxes were removed in 2019, but the policy had not changed! You cannot get to anyone in the escrow

Department to talk to and all you get is a run around. They hold you hostage especially since interest

Rates have gone up and you can't afford to move your mortgage to another company. I should have read the reviews before signing with this company and now I am paying the price. I am talking with my family

Lawyer this afternoon. It is a shame to have to a legal department involved just to get an escrow removed. How can a company decided to continue without your approval!

This mortagae company has the most INcompetent employees, especially upper management. Do not do business with this company, you will regret it. LOOK at the reviews and ratings!

I've been trying for months to fix their inaccurate reporting. Said I made a payment late. They pass it to new mortgage company I got after. They are awful to deal with. YOU WILL REGRET IT.

LI attempted to do a refinance with Mr. Cooper after Citibank sold my mortgage to them. I own 4 properties and have dealt with many lenders over the last 30 years. This was easily the worst experience and after 3 months I cancelled the refi. The appraiser they chose went to the wrong address, after arranging a time with my tenants. The refi was actually approved and was all set to sign-off, however the notary claimed that she thought the signing was cancelled, she did not contact me beforehand to arrange for an appt., Mr. Cooper mistakenly gave me her home address and I showed up at her home for the time of signing! No docs were prepared so it did not occur that day. Mr. Cooper then sent the refil back to a different underwriter and another month went by of ridiculous questions and doc requests, many the same 3 or 4 times over. They showed a lack of understanding of documents sent to them to review, and were very confused during the entire process. I would not go near them for a new mortgage nor a refi. After 2 months of wasting my time, and their own time, I had to cancel, honestly, to maintain my own sanity.

My loan was sold to Mr Cooper 6 mos ago. I have been trying to buy a plot of land next to me for a year and the owner finally relented but time was of the essense to close. I called a couple of local credit unions (lenders) but none would get back to me. Seeing that all my loan info was with Mr Cooper, I thought this would be a relatively fast transaction. This was my first mistake. The rate I was quoted was a little below what I had been seeing elsewhere which was a plus. I had been asked to submit the typical items to do a refi with cash out until the underwriting phase. After submitting 2 months of pay stubs previously, I was asked to provide a year to date (Jan-March) payroll statement. Why? Who knows. I then had to submit proof of insurance for my HOA. Why? Again, who knows. My relator said this was bizarre and she had never heard of it in her 25 year of selling homes. BTW, my LTV on the loan was excellent so I was understandably irritated by this point. I did get the insurance document they needed which did not expire until May. Well, that was not good enough. They wanted next years statement even though the legal item I provided was still valid. That was my breaking point. NO lender has ever asked me for this and I had already provided everything any other lender would need and then some. I sent an email last night to push this loan forward or I am walking. Oh. And their fees are higher than a typical financial institution. IF this deal goes through, I will be refinancing elsewhere as soon as the rates get better. Save yourself the trouble and go with anyone else.

I refinanced my home with Mr. Cooper in 2019 and my experience was not pleasant. They reached out to me in 2020 and offered to refinance for a better rate. I thought it couldn't be worse than last year. I WAS WRONG! It has been a nightmare. I was supposed to close in May at the latest. It is mid-July and it is hard to tell when it will happen. I had 4 closings scheduled and they were canceled after the appointment times were missed. We did sign all of the closing documents and were waiting for the loan to fund. However, a couple of days later we were told that they made a mistake and all of the docs are voided and we are starting over. I can not express the amount of frustration and unprofessionalism that we had to deal with. I am definitely opening a complaint with Better Business Beuro and CFPB.

I am in the process of selling my home (scheduled to close on 4/1/21). For 3 weeks now, I have been trying to get open liens canceled. We should only have 1 active lien with Mr Cooper, however they have screwed up both refinances and recorded multiple times with my county. We have 2 liens that should not be open, and no one seems to want to help. I have emailed for 3 weeks straight. I have called over 50 times. All they have sent me is a recorded release which is the one I already have. I have asked them to research the records so they can see the liens that still need to be recorded as satisfied. They will not do it. I have attached the deeds of trust that are open,, and they are ignoring those files and just sending what they already have as satisfied. I am running out of options, as I cannot sell my home with multiple liens. Since they messed this up, and will not update the records and cancel the remaining duplicate liens, we are in jeopardy of losing our buyers, and in breech of contract. This has become more than frustrating as it is now putting my family and sale in jeopardy, and we have to sell this home, to complete the purchase of the new one.

We had the terrible misfortune of having our mortgage sold to Mr Cooper actually Nationstar, years ago. We set up bi weekly payments on auto pay to pay down our mortgage faster. The company would constantly send us impending late notices and urge us to sign up for auto pay. They would would send us emails, overnight letters, website messages. This company had set up our payments and did seem to know that we were paying every 2 weeks and in fact were paying MORE than what was due every month! NOW try, just TRY calling the customer service if you want a laugh - not if you really need to speak to someone - *******432. You will be barraged with innumerable ads for disability payments, free gift card scams, i think there was even a boner pill thrown in for good measure. This company is the trashiest POS company that I have ever had to deal with. We are now in the process of refinancing and my number one requirement of our new mortgage will be that they will NOT sell our mortgage to anyone.

Why would they tell me my escrow is 670? Short And I pay it. Can I send me an escrow overage for like $67? That's why My payments go up like $40. And I can explain why.

I wasn't sure about the forbearance plan but they said it would just pause my payments. I made some payments while I was on it. I paid $122,000.00 five years ago for this house. When I went to get off the forbearance they got me for $126,000.00 in a modification plus the past due escrow. They said that the unapplied amount of $657.00 would be there for my first payment and I would only have to come up with the difference. I went to make a payment and the $657.00 is gone. It's like the last 5 years of payment never happened. The department that handle this refused to call me back, they refused to answer my emails. They just waited me out till I signed or foreclosed. They didn't tell me that I could not refi or get an equity loan while in forbearance. So they know I would be trapped and would have to pay the extra. This is how they are worth $6 billion dollars. Ripping people off. I can't wait till the 3 months goes by so I can refi and get away from them for good. They both my loan from chase bank. No one let me know. So thank chase bank for doing business with thieves.

My loan sold to Mr. Cooper. I received a statement and noticed that they had an error on my property address. They had it listed as east instead of south. I called customer service and they told me that I needed to send documentation to them to document it. I told them that my address was correct with the other mirtgage company and that I should not have to prove anything as they obviously entered the wrong address when my loan was transferred to them. They told me sorry but that's how it is and no I cannot call the research department I need to email them and tell them my address is wrong & send them documentation to back it up. So basically it is my job to do the leg work to correct their mistake. Unbelievable! They should be able to pull up the transfer paperwork and see the error they made or look at the appraisal or title work in my file. So once they receive my documentation are they just gling to say, "oh ok!"and just change it? Of course not! In my email I told them to look in their imaging system for any additional documentation other than what I sent. I already have a job.

They do not do biweekly payments for free and even if you do biweekly they will not apply the payment till the end of the money. What a crook of a company.

When loancare sold my loan to mr cooper I had such a headache and my stomach hurt so bad. I went on forbearance for 6 months and after which time got a loan modification (sucky one at that, up'd the term from 30 years to 40 year same high interest rate) thought I was ready to move on with my life until I made my first month payment. My payment is $1300, paid in full on the first day it was due Oct 1st. But my account was still showing a balance of $900 for October? I called and chatted with many uncaring customer service people all with a different explanation though most recognizing it was an error and it would be fixed as long as I sit on my $#*! and wait. It has still not been resolved and mr cooper sent the credit reporting agencies negative late payment information. My stellar credit score took a deep nose dive thanks to these incompenent thieves even though I've been all over it and pro actively asking for this to be fixed/resolved. This was just the first payment, I wonder what it will happen to the second payment, third, 480th... Please sell my loan to anyone else please!

Our mortgage was sold to Mr. Cooper and it's been a nightmare ever since. It takes them over a week to take our mortgage payment out of our bank account. Several times, we have not realized it hasn't come out yet and end up over drafting our account or having to pay a fee from our bank for insufficient funds. We changed from automatic payments to selecting the date hoping this would fix the issue. It hasn't. Currently, our mortgage payment STILL has not come out of our bank account and it's the 7th of the month. With our previous mortgage company, it was out by the 2nd or 3rd business day like clockwork. It's maddening to think you have paid your mortgage and have plenty of funds left over only to realize it actually hasn't come out yet, and you've over-drafted your account because you moved that extra to savings or paid for something you might not have otherwise purchased. We've reached out to customer service multiple times about this and nothing. TERRIBLE company and wish we were still under our previous mortgage company.

Let me tell you a brief story. Our home was always in my name. They bought our mortgage, we did a rifi in 2013. My husband died in 2016. After 3 years I wanted to sell. Two days before closing a defective deed was discovered. I had sold the home in 2 days, we could not close and we were promised a quick resolution, that was November 28,2018. They left out two things on the new deed, in it's entirety and with rights of survivorship. They have been covering their $#*! ever since refusing to fix what they broke. I found out after research with my title company that 3 weeks after we signed closing papers, Tamika Williams on behalf of Mr Cooper sent an urgent request supposedly at my request to change the deed. I reported it to Mr Cooper who still has no answer why it happened. I have not sold my house this error would force me into probate and we did everything to never be in probate. They refuse to discuss it with me. I am a widow it is costing me 20k a year in payments. Despicable, Shady, Unethical like the collections agency they used to be. They have paid enormous fines for errors like this and they still will not fix the error they made. I am currently hiring an attorney to bring suit against them. They have caused incredible hardship and made me ill in the process. They prey on those like me stuck and it is Wrong. I had sold all my furniture and signed a long term lease. I had to back out of that costing me thousands more. Anyone else have issues like mine? If do how did you deal with it?

I have a mortgage with Mr. Cooper and a fixed interest rate the first year was fine and then the second year my payment went up not my interest-rate just my payment they said I had a shortage in my escrow which I gladly paid them while I was on the phone in fact with them but my mortgage payment still was $22 and change more a month I asked them about it and they said it was an escrow shortage which I said I just paid make a long story short they had no answer for me went back-and-forth with different representatives that was last year I am still paying the $22 so I decided to make a call just recently because they kept getting junk mail from them trying to refinance they have a better chance in hell please do not deal with this company they will put you on hold forever and when I did get a representative today in fact I explained the situation to her and after my conversation which I didn't really finish she hung up on me I was not rude I was professional and this is how they treat their customers I would love to know if anyone else out there has the same problem where issue maybe we can put in a class action suit against this company thank you

My loan was bought by Mr. Cooper from Cenlar. I was happy with the service and the website portal and decided to refinance my loan with Mr. Cooper. The process was disorganized and very slow. It took about three months to collect documents and get the loan ready. My processor was Seleta Jones with Mr. Cooper - disorganized and unresponsive. We were finally on track to close on Dec. 1st, 2021, when they called me in the morning of the closing to tell me that they had sold my loan to Rocket Mortgage on the day of my closing. Seleta had no idea this was going on. I had a choice at that point, to start the refinance all over again with the new company or choose to go back to Mr. Cooper and refinance. The only issue of going back to Mr. Copper, now I would have to come up with the tax payment of $15,000 in cash. So, I decided to refinance with the new company Rocket Mortgage. I am still trying to collect the fees I paid to Mr. Cooper even though they caused the loan refinance issues. I would definitely not recommend Mr. Cooper if possible to go with another company.

This is an absolutely crooked company. For one I don't even know how my mortgage was turned over to them. I left a review not too long ago explaining basically how they just ripped my home out from an underneath me.

I received a courtesy call today saying that they are going to review my application for the forbearance plan in which I was guaranteed to be able to keep my home in which they lied and made me short sell on May 31st. Do these people not understand what they already did they suggested I get a realtor and put my home up for sale before they short sell it and leave me hanging I did that I spent a couple weeks trying to get the home ready my stuff moved find me a little roach infested in apartment and put my forever home up for sale. Now they want to call me and say they're going to relook at my modification. Excuse me people Mr Cooper the damage has already been done... I have taken days off work literally almost lost my job because of the strain and stress you put on me to sell my home before you jerked it out from underneath me. Now you're calling me with a courtesy call!?!? You know why I don't even know what to say and there is no tellings how many lives and homes you have destroyed...

Apparently you don't have any choice if your mortgage is sold to Mr Cooper or whatever they do. Would suggest now that if you have any relation or mortgage with this company I would suggest you find something real quick to get out of that hole because they will bury you. Give you a courtesy call. Not know what you are thinking but the damage has been done. Azzholes..

Q&A (10)

Why do 39 of 41 reviews give your company one star?

Answer: BECAUSE 1 STAR IS THE LOWEST THEY CAN BE RATED-IT SHOULD BE -0- STARS. THEY ARE HORRIBLE.

How can they continue to do this to people?

Answer: They are the worst company that ever existed. Quickly refinance your mortgage elsewhere. I am. They conveniently lost my payment and damaged my credit as soon as I started the refinance process. Go figure. Make public complaints. CFPB, BBB, Yelp, Twitter, Facebook. Everywhere. They need to be shamed out of business for treating people the way they do.

I have made 7 calls, (about 9 hours involved), in trying to get resolution on my escrow account moving from Pacific Union to Mr. Cooper,

Answer: Good luck. Mr cooper will not help you. They are the worst

What made you choose Mr. Cooper over similar businesses?

Answer: And all of my 61 years I have never experienced such an unscrupulous company. They have ripped off so many customers I cannot believe that they are still in business. They can change their name but they have not changed their practices. I hope To be involved in a class action lawsuit against them. I will hire an attorney to fight them.

Can you share a success story using Mr. Cooper?

Answer: None None None None None None None None None None None None

I keep trying to call Mr. COOPER AND THE CALL KEEPS GETTING DROPPED! PLEASE CALL ME AT 210 362 0329

Moving home in foreclosure said they would fine 1000 a day if anything left behind. Can this happen?

Have a question?

Ask to get answers from the Mr. Cooper staff and other customers.

Overview

Mr. Cooper has a rating of 1.3 stars from 440 reviews, indicating that most customers are generally dissatisfied with their purchases. Mr. Cooper ranks 236th among Mortgages sites.

- Visit Website

- Coppell, Texas, United States

- Edit business info

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Similar businesses you may also like

See more Mortgages Businesses- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members