Tilly from customer service was not understanding the issue and refused to transfer me to the supervisor. I had my agent add a car to the policy in addition to the other 2 cars that I had there. When I got my bill a month later, I noticed I was being charged for miles driven during a turo trip, so I called. Tilly stated that even though my turo account was already linked, the last car wasn't showing as a turo vehicle and refused to give me a credit for a turo trip miles. I am switching from this company based on this experience. Tilly had a major attitude and refused to help and understand the situation from the customer point of view.

As an infrequent driver, I paid FAR less than I would have through a more conventional insurance policy.

More importantly, I couldn't be more pleased with the service I have received after my car was totaled by an uninsured driver.

The pay-out on my car was quick, and honestly more than I expected. They have also been very responsive regarding medical claims. My two adjusters have both been a joy to work with.

I couldn't have asked for better service!

Stay away from this insurance co. In older cars, the device they send you will drain your battery. This "parasitic" drain will lead to the shorting of your electrical system. It has happened to me 4x across 3 cars that never had electrical issues. Metromile is well aware of this issue. They pretend only you are having this problem and will not reimburse you to fix the electrical gremlin problems you'll get. Parasitic drains and electrical gremilins are hard and expensive to diagnose and repair - assume the minimum diagnosis bill you'll get is $500+. You'll probably pay $1,500 to have an electrical problem repaired. Not to mention you'll never feel confident driving the car as you'll never know for sure if its going to start.

I had metromile for almost a year and a half. If you have a car that you do not use that much, they will try to charge you the max for inactivity and send you another device. Paying bills on the website does not always work properly for reasons their customer support was unable to tell me; except that they were willing to double bill me. Compared to Farmers and Allstate I saved about 10% based on about 10k mileage for the year; but my coverage limits were lower and my deductibles were higher. I switched to Geico and will save about 25% with better coverage than I had with metromile. If you are retired and drive under 7K per year you may be able to save a small amount compared to competitors but be prepared to be the metromile lab rat as they continue to work out all the bugs in their system if you decide to experiment with this company.

My car was in an accident within the first month of owning. I made 1 insurance payment before then. I canceled the the premium after the accident and they took my car as a total loss. They charged 100$ for their device when they have it in the totaled car at their lot... Months later... And I have yet to receive my 1000$ deductable when the other party claimed fault... this company is a joke and everyone should stay away! I wouldn't suggest to my enemies...

Only sign up with MetroMile is you need a bare minimum premium. They underwrite their policies through National General, which is one of the worse providers out there.

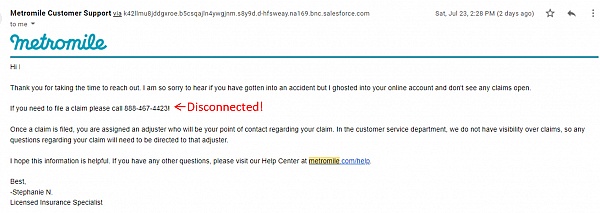

Horrific customer service. My car was broken into and the ignition was broken two weeks ago and I still haven't spoken to someone. This is a criminal company that should be shut down.do not use them.

All the other reviews are planted reviews supressing negative reviews. It is low cost insurance. But the Metromile OBD II device has caused a number of different electrical issues across several of my cars. To diagnose and repair these electrical issues is more expensive than the savings on the insurance. When you complain Metromile offers to send you a new device and a car lighter adapter. But i've had to have a number of my cars that wouldnt start towed where all the different dealerships electrical diagnostic computers all said the Metromile OBD II device fried something in my electrical system. Also, their road side assistance program is horrible. Its an outsource service provider called Agero Road Side Assistance.

I would give zero stars if possible. Their claims team ignores emails and phone calls and is generally unreachable.

I am out of the USA most of the time and keep getting "No pulse" when in fact I am not driving my truck at all. I have told them MANY times that the car is not being driven, so now they charged a flat rate of 150 miles when I am not driving the truck AT ALL.

I just emailed a request to cancel their insurance. I bet I will get no response. TERRIBLE insurance company.

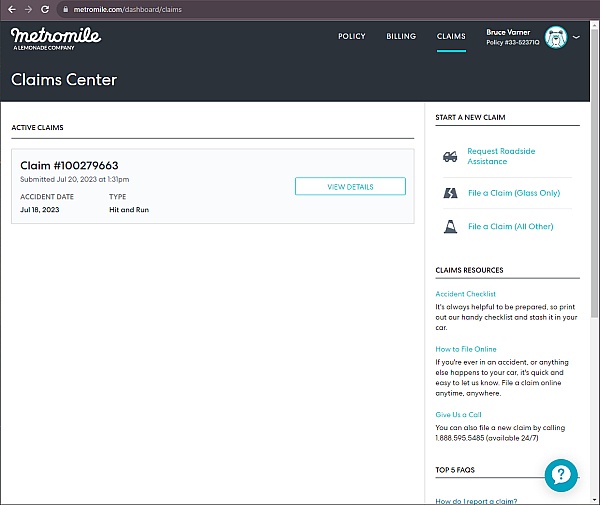

I've used Metromile for 3-4 years now. I haven't had to file any claims until one month ago. My car was hit while parked, and needed body shop repair.

1. The reaction time from the claims department was slow. I had to work with my claims adjuster over email (no direct phone line).

2. I spent 2 weeks trying to set up an appointment to get my car repaired. The body shop recommended by Metromile was either not given the claim information correctly, or screwed up on their end... between multiple phone calls and emails I made, a 3 way meeting Metromile setup, and that leading to nothing, and finally another support person filing a brand new claim, I finally got my appointment setup. No idea who screwed up here.

3. This is the real reason for the 1 star. I was told I had car rental coverage. When buying insurance, I was told I can opt in for car rental coverage. I don't remember if I was ever asked for a per-day limit, but here's the thing -- I would expect that the lowest per-day limit COVERS rentals in California for the cheapest cars. But no, the coverage was for $30 a day, and Enterprise charged me $34 a day (+$7 a day, thanks to "additional fees", so $41 a day really). So now if I want a rental car I need to pay $11 out of pocket every day. The salesperson at Enterprise let me know that another insurance company had a deal with them for $29 a day.

It's ridiculous, given Metromile is partnered with Enterprise. I think it's deceptive advertising to say you cover a car rental and then your max amount happens to be less than ANY available car rental in the market.

I tried checking into new quotes, and realized that in California they expect me to email salespeople individually to get a quote. Are they not serious about being in California?

At any rate, I won't be keeping this insurance anymore. Very disappointed.

Not even a customer yet. According to customer sales you can't have a prepaid debit card to pay for insurance with these people. THEY WANT TO CONTRIL HOW YOU MAKE A PAYMENT. That explains why this company isn't growing. Well you don't want me as a customer I'll go else where as you sink into bankruptcy. They will for sure want my business. Not smart business practices from the get go, kinda makes me wonder how everything else would have went. I'm sure not good.

I received a couple of fliers in the mail from MetroMile and decided to compare it to what I am paying. Turns out their price was pretty much what I am paying now with Pemco. I DO recommend Pemco!

I WAS VERY UPSET to see a hit on my credit score. MetroMile did a hard inquiry on my credit when all I was asking for was a quote. Should have known better than to give them enough info to do that.

BEWARE!

I don't want to spend too much time ranting, but simply put: they lost my business because they told me to jump through a bunch of hoops that their website made LITERALLY IMPOSSIBLE, and then nobody from customer service wanted to get off their rear to help me resolve the issue after repeated emails and phone calls. So, good riddance, I'm a loyal GIECO customer from now on.

Like many of you, I was a loyal customer for years, paying $40-70 per month while driving only about 100-150 miles per Month. Then I bought a newer car, going from a 20 yr old Chrysler to a 10 yr old Cadillac. My insurance doubled immediately, but that isn't the worst. Every few months it has gone up and up and up for absolutely no reason at all. Today I went to their site and pretended to need insurance. Put in all the same info they already have on my car, but used a different email address. I was quoted a new customer price half of what I am currently being charged as a loyal customer. I have sent them so much business over the years, but never again. Their computer program is set up to gauge you for unknown reasons. Some reasons could be, they look and see they aren't getting much from you each month cause you hardly drive your car, so they double the per mile charge. Or maybe it is the model/make of car you have, such as a Cadillac, BMW, Lexus, etc, even if 10 yes old, is recognized as a big spender and thus can raise your rate at will without complaints from you. I can't say what it is, but their system is definitely playing 'the game' with you. Their sales reps and customer support have no clue either. They just go along with whatever their system does, and has a few standard lines they use to explain why a rate would normally go up, even if it doesn't apply to you. I am done with them. Sorry too, for they once had the right idea to help those who hardly ever drive their car. Hopefully, another company will take over the mantle and stay loyal to their customers.

I had a car accident on a Friday. I did receive a letter regarding the claim via email, but no one has called me (it's Sunday). This is different than previous insurers. I bought a new used car on Saturday, and since there is NO WAY TO REACH METROMILE CUSTOMER SERVICE ON A WEEKEND, I purchased new insurance with a different company to begin on Monday, when I hope to pick up my new car. Don't recommend.

My family relocated to California last summer, purchased a new car and new auto insurance from Metromile as I don't drive much. During recent policy auto renewal, I found the insurance rate increased due to "A previous drive license suspension on August 25,2018". The actual rate increase started long time ago but I just didn't realize. August 2018 is the time my family relocated from Massachusetts to California and I changed my DL from MA to CA. I'd never had DL suspended and believed this is just a mistake. I contacted Metromile and they asked to provide written proof from DMV. I contacted both MA and CA DMV, got required written proof indicating there is no DL suspension. Then I submitted the proofs to Metromile and their underwriter asked me to "provide documentation that specifically state that your license was never suspended in any state". This is ridiculous considering my 20 years driving history and lived in 6 different states. They refuse to correct the rate and process the refund. I cancelled my policy immediately and switched to another traditional auto insurance company. Don't want to any business with Metromile.

Not to mention they will bombarded you with messages/emails if the pulse device signal is un-detected for any reason, and threat huge penalty. Their rate is not cheap at all compared to other company even though I drive less than 5000 miles each year.

I used to brag endlessly about these guys. Them out of the blue, the underwriting team sends an email (ONLY) telling me they think someone is all of a sudden living with me and driving my car. The was NO reason for this. I thought the email was one of the many ad emails they send each month at first. So I overlooked it. When I got a letter stating my policy was scheduled to cancel because of it, I literally sent the 'no, no one had moved into my place or is driving my car' info back in, they still wouldn't call off the cancellation. So I asked to have that decision appealed. They still didn't care. Mind you, I've been a model customer for years. With no indication whatsoever anyone was moving in with me or even touching my car. Even wow the CEO to ask him to intervene for this nonsense. Nothing. They cancelled it anyway. And had the nerve to ask if I wanted one of their business partners to help me find new insurance. Help people that work with you? Absolutely not. Cancelled out of the blue for a questionnaire that appeared out of the blue? Ridiculous. I'll never recommend them again. All this probably because of the claims I filed from having been hit and run. Terrible business dealings.

Service is horrible! They leave you on hold for over a 1/2 hr. The place truly sucks if you want to talk to a live person.

Esurance looks like The best insurance on Earth compared to MetroMile.

Worst customer service ever!

Underwriter says car has to parked at your adress 10 month out of 12!

So beware if you take road trip!

Great insurance company if you never drive your car!

Q&A (12)

I want to know if its worth getting

Answer: If you pretty much never (and I mean almost never) drive your car, it's worth. If you actually need your car more than once/wk, don't bother.

Is there a age limit? I am 79.. Can I make my monthly payment by check?

Answer: No, they link it to a credit card.

are the staff trained to not pick up the phone and wait until the customer requests a callback?

Answer: Certainly seems that way!

Hello, I am shopping for an insurance company for my daughters car. She has a 2008 Hyundai Tucson. What would it cost for PL, PD, Collision, Uninsured driver protection, and towing service?

Answer: Metromile is for low mileage customers; check the department of insurance for a list of carriers and average premiums based on demographics.

can I see a printed/PDF version of your policy so I can better understand what is covered, included and excluded?

Answer: You make those decisions when you shop around; other people's insurance would not apply to you.

Have a question?

Ask to get answers from the MetroMile staff and other customers.

Overview

MetroMile has a rating of 1.3 stars from 109 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with MetroMile most frequently mention customer service, insurance company and base rate. MetroMile ranks 115th among Car Insurance sites.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members