Read review too late. The FREE is not true. The deceptive wording leads to getting all your personal info and banking info before they nail you with "IT'S NOT FREE".

Don't believe any state is free. So because there are free sites, this one makes me wonder. All that information could be their game. Don't do it.

I have used other software programs to do taxes without a problem. I made the mistake of using this program. On State taxes it was especially awful. It didn't ask for much key information, which resulted in my owing over $600 instead of getting over $800 for a refund. When I contacted them about the problem, they gave a 1 line canned answer with no intention of fixing the problem. Federal also was wrong by over $1000. I ended up canceling my return and chose never to go with them... ever! Never seen anything this bad in my decades of doing taxes.

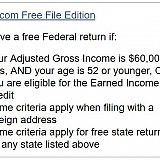

They are listed under the IRS website as not state restricted for free filing. They let you get all the way through the filing process and then tell you that you do not qualify for free filing.

It's an attempt to get you to go ahead and pay because you already spent time filling out the information.

I wish I would have seen the reviews for this platform before I wasted time trying to use it. If I trusted this system, I would have paid taxes instead of getting a $750 refund. Buyer beware! Use Turbo Tax and delete any info you put in their system.

I don't know why everybody claims about worst customer services and so on. My experience with em was favorable back when I was living in the US. I had to apply to them just because I didn't understand tax laws in this country and I needed a full-fledged guidance.

They helped me to get a reutnr rom paid taxes legally and this is really admirable of them.

Idk guys, of course these services can't be free, it's silly to complain about that, actually.

Half the time you can't sign on. There are no warnings that the taxes can't be filed after 10/15 and there is no way to print the documents to mail. It was a total rip off. I paid them, then had to go to another tax service and input my information all over again and pay them, just to file my taxes. I can't get signed on to freetax1040 to request a refund either. Very convenient for them! DO NOT USE THEM!

I was able to file my federal return, but while it said I could file my state return on this site, when I elected to not file online to avoid paying the fee, it disappeared and I was unable to access anything having to do with my state returns. I now have to apply for an extension for my state returns and go through the process of filling everything out all over again. I still have access to my federal return through the website, but anything having to do with my previous return is inaccessible. The IRS should remove this terrible service from their website.

Used this service and then was told they might not be very good. Checked it against TaxSlayer and they were off by over a $1000. Had me owing money that i should not have owed. I spoke with customer service and they basically told me it wasn't their problem, STAY AWAY!

I tried to login & view the status of a return, by going directly to their website. The site wouldn't recognize my username/password. It was ONLY, when I went back to IRS.GOV, and used their link to FREE1040TaxReturn.com - that my username/password actually worked.

Also, your Federal Tax Return is FREE, when you go to their site via the IRS.GOV link. If you go directly to their site, you will have to pay. So, make sure that you use the link.

I sent their Customer Service a note about this, asking if they could place some message on their website login area, to reflect this possible login issue. Hopefully, they will fix the issue, so that other people can quickly access what they need.

They didn't ask enough information about my health care for 2016 and submitted the WRONG address to the IRS so I never received a very important letter from the IRS about amending the information. I'm now looking at about 2 months from the filling date before I can even get any information on my return, which I'm going to assume isn't going to be the amount the site counted.

Seriously. Don't use this sketchy site. If I could request the IRS remove it from their page I would, but we all know how helpful the IRS is.

SAme as everyone else. It's the worst site you could possibly use. This was my first year to use it, what a mistake. Everyone should call IRS or write to them and get it off their website for free tax returns...

How sad that complaints about this company go back to 2009? And they are still in business and a recommended e-file site from the IRS?

I too filed with them but was lucky I did not give my credit card info, because filing online should be free if you make under $50,000 per year, according to the freaking IRS.

Anyway, I filed a complaint with the Better Business Bureau.

I'll be filing my taxes through the mail for back up.

I used this program for my 2018 tax return which could have been easily filed as a short form. The Federal section is easy to use (as it should be for short returns) and computed correctly. I asked that my refund be applied to next year's taxes and herein lies a software glitch. The State section (AZ) automatically applied my state refund to next year's taxes rather than giving me the option of receiving a refund - SERIOUS FLAW that the company will not acknowledge. USE THIS PROGRAM AT YOUR OWN RISK!

I filed my brother's tax return in January since it was a simple return. The IRS did not receive it. You cannot call them and even though it says free customer service, there is a section that states you have to pay to speak to someone. Maybe they never filed it because I did not pay to file the state return with them. He received his refund from the State already. They will not respond to emails either. Will never use them again.

This site will give you nightmares. It WAS NOT free. I had a very simple return to file as we are retired. I had to use the 1040 form to claim a slot win in CT where they took out taxes. On this form, we had Social Security income, the slot income and two weeks worth of unemployment pay. For this, they charged us $40.00. I have tried to get back on the site to get a copy of our return, but can not log in. They have no phone number to call, yet they claim 24 hour service. This site is a rip-off that is a link provided by our government. More of the "change" we were expecting?

I filed 2020 taxes with this site, logged back in and it states I have a message and to click the help and support tab. I did so and NOTHING... Just a blank screen I also cannot get back to the completed taxes either... again... blank screen. ******DO NOT USE THIS PROGRAM**** I am truly disgusted with this service and it's a disgrace the way this service is set up. You cannot reach anyone by email or phone supposedly to protect the consumer, but who is the consumer to contact when the support and help tab doesn't work. If I cannot access my information, and I cannot get ANY support or help what am I the consumer to do. I repeat ****DO NOT USE THIS SERVICE**** IRS needs to remove them from their site as a service to use.

Their software screwed up my return and I didn't catch it. Their customer service is non existant. I personally believe they are a hack site to steal personal information.

This is the worst site I have ever used. Every comment I have read so far on this site is true! I filed my sons federal tax return and I can't get back in it to see where his state refund is at. No one is responding to my messages that I have sent and no phone # listed to call anyone. When I tried calling the IRS they were no help either.

I got $85 more Federal refund and $68 more state refund using TaxAct due to Free1040TaxReturn not correctly including my HSA contribution on form 8889 and myhealth insurance premiums on the state tax form, respectively. I pointed this out to them and their canned response was "Your return is accurately calculated based on your input and current tax law. Please review your entries carefully." In many cases, they simply didn't ask enough questions to accurately calculate my taxes correctly. Their software needs to fix its many gaps!

Theee worst! I am furious with the irs for making me use them! Rip off! Charges a fee which changes if you refresh the page! Some paid as little as 15$ and others paid more! They claimed my fee was returned but my bank said it was reversed on their behalf! I am just disgusted with their lack of customer service!

Q&A (17)

Why can't I log into the where's my refund tool but I got congratulation I was accepted by the IRS

Have a question?

Ask to get answers from the Free1040TaxReturn staff and other customers.

Overview

Free1040TaxReturn has a rating of 3.1 stars from 75 reviews, indicating that most customers are generally satisfied with their purchases. Free1040TaxReturn ranks 66th among Tax Preparation sites.

- Visit Website

- Reno, NV, United States

- Edit business info

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members