03/15/2020 at 08:44:04 PM I finished filling out my small business return on TaxAct Online for Federal, and North Carolina Returns. They charged me $159.90. I followed their step by step directions, answered their step by step questions and they totally misled me to fill out the wrong forms. I e-filed using TaxAct thinking it was complete and correct because I am paying them to do this. However Federal rejected my return and state rejected my return because Federal did.

TaxAct does not have the proper forms, did not provide me the correct help and now I have to manually fill out the correct forms to mail in to amend my return. The proper form I was supposed to use was 1120S which TaxAct never provided or could be found when I tried to amend my return using TaxAct.

I did send an email to customer support on 3/15/20 and they never replied back. I also called on 3/16/20 at 7:30 pm and the customer service rep could not help me saying she had to transfer me to technical support, however I was THEN put on hold for another 15 minutes!

They did call me back and say that they are providing me a full refund. I won't know for sure until another 10 days when it is processed.

Have use tax act every year and never had a problem with the software I've never had a problem with paying their fees or fees are minimal. This year it wasn't TaxACT its Republic Bank & Trust that screwed me that's who handles Tax Act direct deposits. First they screwed up my direct deposit then they mailed my check to the wrong address then they made me wait 6 business days while I had to stop payment on the check then they tried to direct deposit my check again into a different account which was wrong now my check is lost in the mail. It's been 22 days and I still haven't received my refund. When you call Republic Bank and Trust their phone system gives you the run-around so long you could you get fed up and want to hang out but you just have to hang in there. However when you do get someone on the phone they're rude and unwilling to help. Late trying to blame all of the problems with the bad deposits and lost check on me when it was clearly their fault they mailed it to an address that I haven't had in 20 years. I never used Tax Act again simply because they use Republic Bank and Trust I used TurboTax next year. Tax Act software did a good job Republic Bank & Trust is the one that really screwed me no refund today day 23

Unaware, TaxAct Online had downgraded me from Premium filing (1040 with capital gains) to a simpler Plus filing (1040 with Schedule A and associated forms) for tax year 2016. I had been using TaxAct Online for at least 10 years. However, this year, TaxAct Online deleted my repeat-customer-guaranteed and locked-in $26.95 filing fee for Premium filing and charged me $40 for a simpler Plus filing. I had previously paid $16.95 or less for its Plus filing before using only once its Premium filing. I immediately telephoned TaxAct Online and reported the pricing discrepancy; the customer service representative lowered the Plus filing fee to $35, still above $16.95. After a day, I received a customer service representative emailed response; she lowered the Plus filing fee to $26.95, the previously guaranteed and lock-in Premium filing fee though I was using a simpler and less expensive Plus filing service. Since the higher pricing snafu is TaxAct Online mistake, "No, Thank you, TaxAct". Via an online search, I found many inexpensive filing services or free filing services with ads. One online filing service have no ads and offered everything that I needed at $0 cost. The only disadvantage at this competitor's filing service is that this year's tax data and info is not transferable to next year's filing. However, after completing TaxAct Online data input this year but surprised by TaxAct high regular pricing for a simple product, re-entering data on a competitor's online filing service is no biggie. Until TaxAct Online gets its act together, I would, and recommend that you, avoid TaxAct Online.

For several years I used TaxAct. With the exception of one year, when the IRS got paid but TaxAct failed to actually file my return (fortunately I wasn't penalized since they already had the money!) there weren't any real problems with filing except that my once-free Federal return was no longer free because I am self employed and filing a 1040 with Schedule C.

In the beginning it WAS free for the Federal (I only paid for my state tax return) and then in 2015 I was charged for the Federal as well. Seems unless you have the easiest of tax returns it isn't "free" anymore. Unfortunately it wasn't until after I filled everything out that they decided to tell me this! I paid it because it was easier to do so and still pretty reasonably priced.

Last year it was even more $$ but Turbo Tax was twice the amount so I went with TaxAct again. This year I got on and was informed that the price to file as self employed had doubled. It would've cost me almost $80 to file my taxes. That did it. I don't know why I didn't think to google "Free Tax" the past 2 years but this time "FreeTaxUSA" came up and it really IS free for Federal taxes and have a reasonable State tax filing fee (like TaxAct used to!) so it's "Goodbye TaxAct!".

Greed is bad. FreeTaxUSA actually has a better website and used the information FROM TaxAct from last year's return to make filing my return even easier. Why pay more when you don't have to?

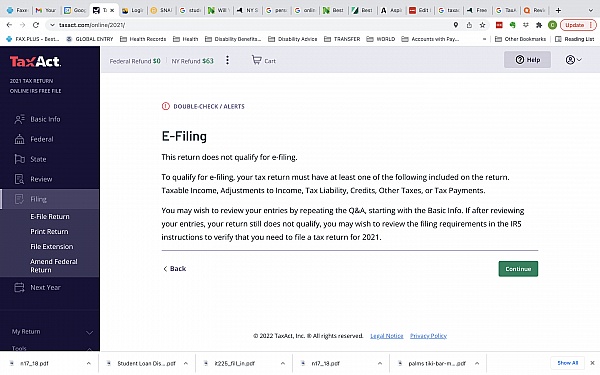

I have been using TaxAct for several years with no problems until trying to file a 2016 income tax return. I needed to claim a relatively obscure deduction and had to write something on the top of Schedule C. This meant I had to print off the forms which in itself wasn't a problem but resulting in meant being able to e-file the NY State tax return as I was manually filing the Federal. However TaxACT kept saying the NY return had to be e-filed, but wouldn't let me do it, as I wasn't e-filing the Federal tax return. When I did finally get a chance to print the NY return, which cost an extra

$ 25.00, it had written all over it, DO NOT FILE. Apparently the printed forms had not been approved by the NY Taxation Dept. I had paid $ 25 to print something that I could not use. This also stopped me e-filing the NJ Tax return.

They need to have a facility where words can be added to the top of schedule C, and also allow E-filing of State returns irrespective of whether the Federal return is filed manually.

I had to go and find printed forms on the internet that I could fill in and then post. What a nightmare. I will not be using TaxAct in future. I had pre-paid for the 2016 year, and also paid the $ 25 to print off something that was useless. What a big waste of money.

Wish I had seen this site before I purchased. I need to file an Initial/Final return for a Grantor Trust. I saw TA recommended on some other sites because they have a product specifically titled "Trust and Estate." I bought the Download version. I don't really have the energy to go into everything that was bad about it, but the interview process was not very intuitive, if I clicked for Help I got a very basic sentence or 2 and a link to the IRS Instructions. I input a 1099INT that was mostly IRD, I feel like there should be a related Statement to explain where the "missing" interest is being reported but I could never find one in the Forms and the Interview did not ask. Program shuts down at random, sometimes it comes back and offers to continue where you left, sometimes not. And, last straw, I got up this morning and opened the program to find that all the work I had done to that point was gone, tried a Restore from Backup option and it said backup was unreadable. So I'll be doing the return all over again, but not with this POS. Ordering TurboTax Business today.

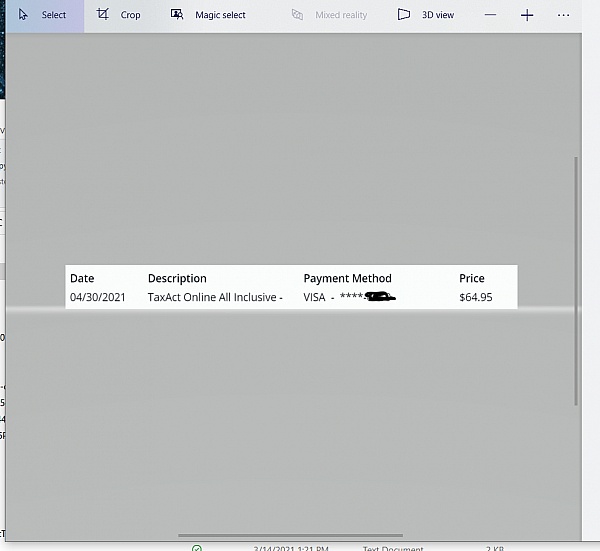

DO NOT use tax act they charged me $54.95 to pay for my $24.95 fee for TaxACT

Software if I did agree to it it was by mistake however if I understood clearly I would have never agreed to pay $54.95 for a $24.95 fee because it was to be taken out of my return this is totally ridiculous and dishonest and not right. I've been using text act for years and I've never experienced this because of this experience I will no longer use them just beware! FYI I contacted tax act twiceon January 30th 2022 at approximately 7 p.m. Eastern Standard Time and neither representative good help me this was within 2 hours of me doing my return again if I would have known they were going to charge me $54.95 for the tax act fee $ I would have paid the $24.95 old to TaxACT out of my own pocket with a credit card I would have give them a zero rating but the rating review would not offer me that option it's hardly worth my time to do this for you cuz I don't believe anything is going to be done again do not use tax act I work too hard for my money to be getting ripped off by these people

TaxAct is very confusing now and will only offer help if you pay more money. They have gone downhill fast. I am going with H&R Block from now on.

Wanted insurance information? Must be selling that and they bumped me to 47 dollars to file a schedule c on my return am going to call the IRS

It repeatedly gives many unnecessary Alerts, such as for 1099-B forms when you correctly enter VARIOUS in the date acquired field for funds acquired through several different purchases as is stated on the IRS INSTRUCTIONS. If your 1099-R form is blank for the (Illinois) State Distribution, the unhelpful Alert FAILS to notify you that you only need to enter your Gross Distribution amount to correct the input. Most frustrating is that now it seems to be almost IMPOSSIBLE TO TALK TO ANY OF THEIR PROMISED TAX EXPERTS: telephoning their Contact Support at *******600 gives a recorded Menu of number to press (I pressed 2 for assistance with filing the 2022 taxes, and then another 2 for their next selection, never getting a number for talking with a human tax expert), invariably, even with any other number selections, each time ending with the repeated statement that I should talk to someone on their Xpert Assist. BUT SELECTING IT ON THE TaxAct computer display screen repeatedly gives a popup that states: Our experts are currently assisting other callers (in bold fonts)... Please try back later, or on our next business day. You can visit the Help Center in the top-right corner for further assistance,...

And below this displaying their regular hours, a Try Again Latter button, and a Go to Help Center button.

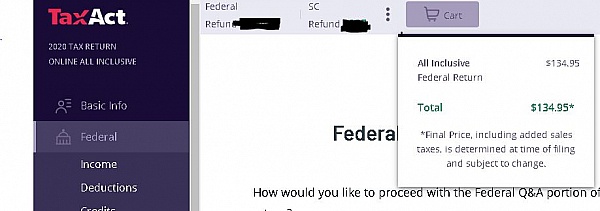

Pushing the Try Again button puts you into a ridiculous infinite loop that I wasted several hours in without any possibility that that TaxAct would care enough about their paying customers to even ask me if they could at least put me on a call back list and CALL ME BACK LATER, INSTEAD OF FORCING ME TO STAY IN A REPEATED LOOP FOR MANY HOURS, DAYS, AND WEEKS! Their so-called Help Center is much WOST than a Google search, only giving a several irrelevant links without any human experts help around. Does TaxAct even care about all the hours that their customers cannot reach ANY OF THEIR EXPERTS ON THEIR INACCESSIBLE XPERT ASSIST? DO NOT USE TAXACT UNLESS THEY MAKE SUBSTANTIAL IMPROVEMENTS AND START PROVING THE ASSISTANCE THEY PROMISED WITH THIER ALL-INCLUSIVE $133.95 bundle.

I have always done my taxes by hand. At first with pencil, then pen. Then came the computer. Tax software was easy for me to justify spending money on. Perhaps a hidden deduction could be found to justify the expense.

I used Turbo Tax. It didn't find me that elusive deduction, but I enjoyed using it. It asked me an endless amount of questions and I think it even took longer than to do them by hand. I was nice having a soft copy and everything well organized. I was hooked.

This year I decided to try TaxAct. TaxAct is much cheaper than its rival TurboTax. I found a site that reviewed Tax software and ranked TaxAct a close second to Turbo Tax.

Using my Staples gift card that I won from QuiBids (TMI, I know), I bought TaxAct Deluxe Federal and State. Now, the store had a more expensive version. I thought it was "Premium" but looking at their website, I see they offer FREE, Deluxe, and Small Business.

This was my first problem with the software. Should I spend the extra $10 or not. Or not, according to the box. So, I didn't.

Well the darn thing kept asking me if I wanted to upgrade. And every-time I clicked on more-info or help, I got the cheesy nag screen demanding more money for the information that should be included. To do my taxes, I had to search IRS website for the answers and enter the information into TaxAct.

I needed to search for a form, but couldn't find it. It was a common form, so I had to go, Form by Form through the included forms to find it. Apparently TaxAct doesn't use the Form number as a search-able key.

I also found it a little confusing to get back to where you were when you leave interview session to jump to another location - or - when you exit the program and re-enter and don't select "Start Where You Left Off" (say if you wanted to make changes first).

The interface was nice and filing was pretty straight forward. I recommend the software for someone who knows a lot about taxes. For novices like me (if there are any) I would pass.

Never again will I use Taxact to do my taxes again nor any other taxes on the internet for that matter

TaxAct threw on 2 last minute cost

Online 2022 Deluxe Edition Federal Return $46.95

Refund Transfer Fee (pay fee from refund) $54.95

I gave up on questions. I will never use TaxACT again in this lifetime [because it will require a lifetime for them to respond to any questions].

Was not intuitive, was not helpful, just frustrating and overpriced. I will be using a different site next year. Next!

Crazy long hold times, the phone system will have you wait forever and they often don't return calls or mail at all

I had been using TaxAct for more than 6 years. I always have had good experiences until this year. I had 2 problems, neither has been resolved. The first is more of an IRS issue where I had to file an amended return and the IRS has yet to even acknowledge it so what they think I owe is very different than what I really owe. However, TaxAct's "expert" Audit Protection Service didn't even understand the IRS rules around one of the line items (I actually educated them on the topic by pointing them to an IRS publication!). They (or I should say, we) crafted a letter to the IRS for follow-up; I'm not sure when it will be acknowledged. The second is a true bait-n-switch on their Refer-A-Friend program. The terms that are currently stated on their website are very clear: "A 'new' TaxAct customer refers to anyone who did not file with TaxAct in the previous tax year." With that being said, the PREVIOUS year refers to 2019. I referred my son this year to file his 2020 taxes; he did file with TaxAct in 2018 and previous years but filed them himself in 2019. After following up with TaxAct since they never sent the referral bonus, I received an email from Amanda in their Support Department and I quote, "Unfortunately the referral reward was declined as it was determined the referred friend has already been a TaxAct customer in 2018, 2017 and prior years. The purpose of the Refer-A-Friend program is to recruit new customers who have never heard of TaxAct or who have never used our services, that includes last year, but not limited to the year prior. I will put in a request to review the language used on our help pages to indicate a more accurate description of eligibility for the new customers recruited with the Refer-A-Friend program." Regardless of what they think is the Refer-A-Friend "purpose", the terms that are CURRENTLY stated on their website are very clear and should be honored. Amanda chose not to honor them and ignored further follow-up attempts; classic bait-switch. I am definitely done with TaxAct.

Q&A (11)

Have a question?

Ask to get answers from the TaxAct staff and other customers.

Overview

TaxAct has a rating of 1.5 stars from 139 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with TaxAct most frequently mention customer service, last year and federal return. TaxAct ranks 62nd among Tax Preparation sites.

- Visit Website

- Cedar Rapids, IA, United States

- Edit business info

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members