The Motley Fool Reviews Summary

The Motley Fool has a rating of 2 stars from 334 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with The Motley Fool most frequently mention customer service, stock recommendations and credit card. The Motley Fool ranks 7th among Stock Research sites.

I love seeing the two monthly picks. I also like the starter stock picks and The Motley Fool's individual analysis.

A little less verbage on your accomplishments, and more to the point. We are well aware of your value, I or others I presume don't need to be convinced again and again.

Thank you for your feedback.

We appreciate you taking the time to share this suggestion with us. If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I have followed several of the recommendations and have not been disappointed. Shopify was one that really came through for me.

Thank you for the positive feedback!

It sounds like you’re building a diverse portfolio, which is great! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I've been a member for a couple of years and have been very happy on my ROI on my membership fee. Great investment!

Thank you for the positive feedback!

It sounds like you’re following our Foolish investing philosophy! We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

For many years I have relied on the information from The Motley Fool to guide my investment decisions. I like the way they present the data and how easy it is to understand it. Keep it up!

Thank you for the positive feedback!

We're glad to hear you find our information helpful and easy to understand. After all, our purpose is to make the world smarter, happier, and richer! If you'd like to read more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Being a sissy, so far as investing in any stocks, I renewed just because Motley Fool is a long standing name, that as I recall, I must have become aware of them some 20 to 30 years ago. I'll have to research that for myself now, so I can feel even better about "pulling the trigger" using their information..

Thank you for the positive feedback!

Although we provide research along with our stock recommendations, we certainly encourage our members to do their own additional research. One of the principal tenets here at The Motley Fool is that the best person to handle your finances is you. It is our firm belief that it serves every investor’s best interest to encounter and consider opposing viewpoints.

One thing to keep in mind is that we believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I have been using the Motley Fool for a few years now. I am not the smartest investor but try and do my best with the guidance that is provided by the team. They always advise DO NOT PUT ALL YOUR EGGS IN ONE BASKET and I am a firm believer of that.

Thank you for the positive feedback!

You're absolutely right - we encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Have been using motley for a couple of years now, so far I am happy with the $ outcome, in my portfolio I hold a spider index for benchmark comparison and motley picks outperform it by few dozens percent.

Keep on doing what u r doing

Thank you for the positive feedback!

It sounds like you’re following our Foolish investing philosophy! We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Very good stocks pick. During Covid-19 pandemic, this is the only investment portfolio, among others, came back from the bottom and in positive territory in a short time. Fool did it.

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy. We believe the best way to counteract the whims of the market is to build a diverse portfolio of at least 10-15 stocks that you plan on holding for a minimum of 3-5 years.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I had signed up and been with the Motley Fool for almost a year and a half. The only stocks they ever

Touted were ones selling for 100s of dollars per share. I couldn't afford those kinds of stocks. I finally realized

That they only cared about signing people up. They expected people to hang on to those stocks in the

Hopes that they would increase. I made more money taking my own insight into the market and buying

Those stocks I could afford. Those companies not only increased in value but they also paid and increased their

Dividends over time. Of course the Motley Fool never touted any of those stocks. I always wondered why.

Dividends over time

Thank you for your feedback.

Although we recommend a range of stocks, The Motley Fool's analysts do not focus on share price alone when deciding on recommendations. As long-term investors, we recognize that when we make a stock recommendation with a time horizon of three to five years, stock prices will fluctuate. However, we won’t always recommend a sell just because the stock price drops. We prefer to hold stocks in companies that we are confident in for the long term.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I have been investing using Motley Fool's stock recommendations for several years now and I've have watched my investment portfolio do nothing but grow consistently, as a result I've become a huge fan of their investing acumen and recommend them to family and friends. I'm sooo glad I found Motley Fool!

Thank you for the positive feedback!

It sounds like you’re building a diverse portfolio, which is great to hear! We encourage our members to build a diverse portfolio that they plan on holding for the long term – a minimum of 3-5 years. We believe pairing a portfolio of at least 10-15 stocks with a long-term investing outlook is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

The best advice will use daily please keep those ideas coming looking for coronavirus ideas there are great opportunities out there!

Thank you for the positive feedback!

It sounds like you’re following our Foolish investing philosophy! We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Excellent stock tips, well researched companies and I have grown my portfolio for retirement over 30%

Thank you for the positive feedback!

It’s great to hear you’re building a diverse portfolio! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for the long term – 3-5 years, minimum. We believe this pairing is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

The challenge of picking a good stock is no easy task and it comes with plenty of risk. I have been observing stock recommendations with high growth potential and some with very high price fluctuations. Therefore, it will be helpful for investors to get some of the specific risk information in advance.

Thank you for the positive feedback!

If you'd like to read more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

It sounds like you’re building a diverse portfolio, which is great! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I am new to investing and use various free websites for choosing stocks, I choose mostly companies that provide something i am interested in. However i joined Motley Fool back in April as it was reasonably priced and I have enjoyed using their Stock Adviser service to pad out my portfolio since. I haven't invested in every recommendation, just selected the ones i liked the sound of.

I have started following my stocks for an hour or so a day (because i have the spare time obviously at the moment (COVID19)), this is an eye opener and a good way to see how things work. I did panic a few times and sell unwisely, but i am now calmer with it and will hold for the Medium/Long term as the Fools recommend.

Yes you do get quite a few emails to start with about other services, which did make things a bit confusing and annoying to start with, but now i've sussed it and understand how they work (i'd rather have the emails and the opportunity they offer than not and go it alone). They are a business after all.

For me it works, i'm currently up on the stocks that they have recommended, i also understand that next week i could be down, but its 5 years down the line that counts.

I like the Motley Fools and would recommend them, I now subscribe to another of their services and may consider more in the future.

Hope all that made sense.

Peter Martin

Thank you for the positive feedback!

We’re glad to hear you’re trying to follow our Foolish investing philosophy. We believe the best way to counteract the whims of the market is to build a diverse portfolio of at least 10-15 stocks that you plan on holding for a minimum of 3-5 years.

If you'd like to adjust your email settings, we can certainly help you with that! At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

One of the major things I look for in any/all articles is the "justification" of why should I invest in this stock. They give an excellent approach to why we, as investors, should invest in their recommendation of a stock, sometimes when to invest and for how long. I always look to these two guys to see what I should invest in. You can trust them.

Thank you for the positive feedback!

We're glad to hear you're enjoying our research and recommendations. When our analysts recommend a stock, they provide an abundance of information as to why they consider that company a buy. This information includes but is not limited to; a short summary of the company and what it does, key data about the company, potential risks, and much more. You can read further into the latest guidance for a particular stock by logging into Fool.com and using the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

It sounds like you’re following our Foolish investing philosophy! We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

INVESTED IN RECOMMENDED STOCK LOST 50% IN MARCH ROLLED EVERYTHING TO SHOP NOW UP 100% FOR YEAR THANKS

Thank you for the positive feedback!

Although we're glad to hear your returns have turned around, I'd like to encourage you to follow our Foolish investing philosophy. We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I find many of the e-mails as adds, which I didn't' want. The stock advisor I liked and have invested approx. $30,000 since the C-19 BS. However the internet programs are a great disappointment. I cant' follow my stock or even get into the programs because the platform is to hard to access. My password never works etc. I'm not saying some access problems aren't my fault however it shouldn't be so hard to access my account to follow those stocks. I've tried to contact customer service for help via phone and computer with poor or no response. Based on my experience I won't renew. That said the stock advice is quite good, but I/you may have to use other solution not Motley to follow your money. If customer service dose monitor this THIS IS A CALL FOR HELP! Perhaps if its my understanding you could correct me and change my review. In the past I thought the fools advice as very good to compete with others and would like to continue but with an understandable and easy to use program. Larry McCroskey

Thank you for your feedback.

It looks like you exchanged a few emails with our representatives, where they helped you reset your password and navigate our website. Our phone hours are Monday through Friday, 9:30 am until 4 pm Eastern time. You can also reach our representatives via the Help tab on Fool.com

We're sorry to hear you've been having trouble logging into our website. Please make sure you're typing in your username and password correctly; using the proper 'rules' such as at least one capitalized letter, at least one lowercase letter, etc. If you're having trouble remembering your password, some browsers will let you save your username and password so you don't have to continually type them in - this might be a solution for you if you're using your personal computer to access our website.

If you'd like to adjust the amount of emails you're receiving, we can help you fix that! At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

Foolishly,

Ashley

I'm made significant profits on your recommendations of Dexcom, Shopify and, more recently, The Trade Desk and Zoom Video.

Additionally I really like the daily presentations on various topics through the use of Zoom. Only frustration I've had is I can't seem to get Zoom to work in the way it is designed so I connect through my browser for my viewing. This has been a minor restriction since my browser lets me watch and listen to the presentations.

Overall I've very happy with the service which I've demonstrated by my recent renewal fo Stock Advisor.

Thank you Motley Fool for giving me the information platform and service to improve my investment performance

Don S.

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy! It’s our belief that a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of at least 3-5 years, is the best way to counteract a fluctuating market.

Motley Fool Live has been a recent addition, and we're pleased to hear that so many of our members enjoy it! We're sorry to hear the Zoom app isn't working the way it's expected, but we're glad you're able to join us via browser.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Motley fool overall is a solid source of helpful information. I use it in selecting quality stocks, groth stocks mainly

Thank you for the positive feedback!

It sounds like you’re building a diverse portfolio, which is great! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Q&A (10)

Is The Motley Fool a scam or a legit company?

Answer: Kind of a scam: impossible to cancel auto-renew subscription from their website and impossible to contact member support, been trying HARD for 15 days...

Should I invest in Stock Advisor or Rule Breakers?

Answer: Absolutely not... pure waste of time and money...

Which one is worth it: the boss mode or extreme opportunities platinum.?

Answer: If you'd like to learn about the differences between Boss Mode and Platinum, I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

Why is the name of your company so Stupid?

Answer: If you'd like to know the reason behind our name, visit this site or read below: https://www.fool.com/about/ The Motley Fool's name comes from William Shakespeare's play "As You Like It". The court jester, known as the Fool, could speak the truth to the king and queen without having his head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom. In the same way, we aim to speak the truth about money and investing...and to make financial guidance accessible to people of all backgrounds and experience levels.

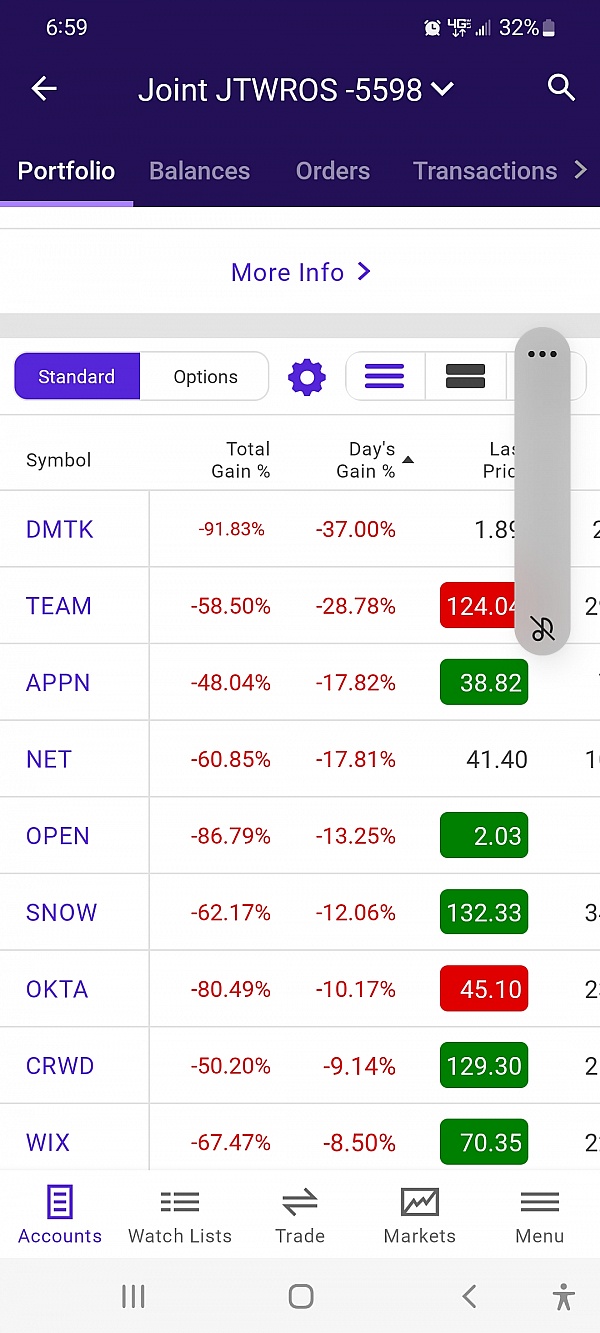

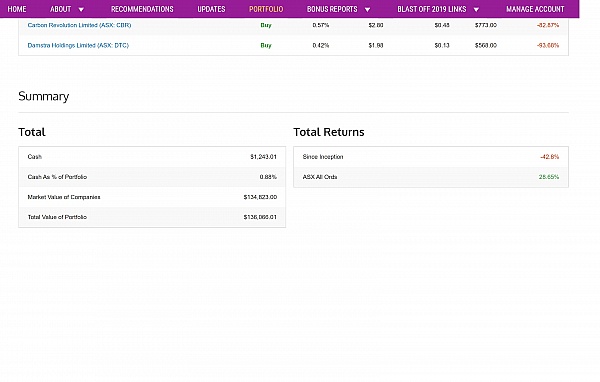

Are you guys really this incompetent? I mean really justlook at upstart, path, wkhs, payc, shop, Sq, dis, mtch, team, adsk, nflx, lulu, ttd, coup, pin

Answer: Yes, they are that incompetent. I also own all those junk stocks after listening to these thieves advice

What is new about Amazon? Somebody told me there is a golden opportunity to buy their stocks. Is there anything true to that?

Answer: For questions regarding our services or our marketing, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Hi, I am thinking of subscribing to your services, but would like to see your platform first before subscribing. Are there any free trials?

Answer: For questions regarding our services, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Where and how do I make an investment

Answer: To start with, you stay as fat away from motley fools picks as you can. They are a huge pump and dump scam, nothing more. Anyone tellimg you different has skin in the game at motley fool headquarters. If a revolution breaks put, these scum bags are first on the list to be hung

Why do you keep hawking for more money by promissing more opportunity? Just have one fee for ALL.

Answer: They cater to different requirements. The motley Fool One combines them all but I am not sure is open to new members. I just renewed my three year membership that has yielded many times over its cost.

Have a question?

Ask to get answers from the The Motley Fool staff and other customers.

About the Business

The Motley Fool provides leading insight and analysis about stocks, helping investors stay informed.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy! It’s our belief that a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of at least 3-5 years, is the best way to counteract a fluctuating market.

If you'd like to read more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley