The Motley Fool Reviews Summary

The Motley Fool has a rating of 2 stars from 334 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with The Motley Fool most frequently mention customer service, stock recommendations and credit card. The Motley Fool ranks 7th among Stock Research sites.

I have contacted Motley Fool support people on a number of occasions telling them that signing on to the paid site is painful & usually takes at least 20 minutes of concerted effort. I am so frustrated with these people that I would never use them again or recommend them to anyone else.

I've been a member of The Motley Fool for 22 years and the returns I have earned have put two kids through college, paid for three Teslas and given me a very comfortable retirement. Their investment advice is second to none, the discussion boards are excellent if a bit archaic, and the various meetings and Motley Fool Live are worth the subscription price alone.

Thank you for the positive feedback!

We're glad to hear you've been happy with your services, and that you're enjoying so many other features that we offer.

It sounds like you’re following our Foolish investing philosophy! We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I have had nice returns just by using the heads up info i have received so far! Keep up the good job.

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy. We believe the best way to counteract the whims of the market is to build a diverse portfolio of at least 10-15 stocks that you plan on holding for a minimum of 3-5 years.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I've read and subscribed to a number of stock picking services and motley Fool is the only one I've renewed year after year for over 7 years.

Thank you for the positive feedback!

It sounds like you’re probably following our Foolish investing philosophy! We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I re-enrolled in the MF SA this year after several years away. I came into some money and was looking to put it to work. Using the MF advice, and my own experience, I selected a basket of stocks and waited for a dip in the market before purchasing shares in about 10 companies. One year later my portfolio is up 94%. I just took profits yesterday to lock in these gains, but retained ownership in the same ten companies with the same dollar value as when I started, but now I have thousands more in cash in my account (which I am now looking to invest!)

Thank you Motley Fool!

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy. We believe the best way to counteract the whims of the market is to build a diverse portfolio of at least 10-15 stocks that you plan on holding for a minimum of 3-5 years.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Has been the best financial information when it comes to investing I have ever had. This service has put me far ahead of where I would have been without it

Thank you for the positive feedback!

It sounds like you’re building a diverse portfolio, which is great to hear! We encourage our members to build a diverse portfolio that they plan on holding for the long term – a minimum of 3-5 years. We believe pairing a portfolio of at least 10-15 stocks with a long-term investing outlook is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I'm that guy. You know, the one who over analyzes and hesitates to make a move. I sat on the subscription and did not invest but watched the performance. Only after about a year did I jump in. My story is like so many others who wish they had started over. After initially investing my returns have been great. My sons have even come on board in their early 20s and have a bright future as Fools. This journey so far has been a Foolish blessing.

Thank you for the positive feedback!

It sounds like you’re following our Foolish investing philosophy! We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Buying a subscription to the Motley Fool Stock Advisor was the best investment I ever made. The low cost yearly subscription has paid huge dividends to my portfolio. I would highly recommend this service to beginner or seasoned investors who believe in stock holdings as a means of building wealth.

Thank you for the positive feedback!

It sounds like you’re building a diverse portfolio, which is great! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

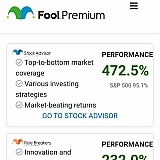

I have been a Motley Fool member for about 5 years and I wish I had started with them sooner! My portfolio that I started 5 years ago is up over 100% at this point and a separate portfolio that I started on March 10,2020 with completely different stocks is up 96% as of July 7,2020. About 90% of the companies I own are Fool recommendations. Photos are of Motley Fool account home page, my Folio First account, the graph of my Folio First 3 year earnings relative to the S&P, and the performance of my Schwab account that is less than 4 months old.

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy! It’s our belief that a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of at least 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Been trying to contact custometr sevice for 15 days. Tried different emails, different phone numbers... Impossible to speak to someone. Can't even cancel my subscription via their website!

Thank you for your feedback.

We’re sorry to hear you were unhappy with your experience. We’re very proud of our Member Services department – we feature a great team of Foolish representatives who handle thousands of emails and hundreds of calls every week. They help guide our members through their services, reset passwords, adjust email settings, answer a multitude of questions, and so much more.

I believe I found your account with the information you've provided in this review, and it looks like our Member Services team has been in contact with you. In the future, please make sure you're contacting our representatives through the correct channels:

-via the Help tab on Fool.com

-via email - MemberSupport@Fool.com (use the email address associated with your account)

-via phone - There may be longer wait times during popular times such as lunch, but our phones are usually open 9:30 am until 4 pm, Monday through Friday.

Foolishly,

Ashley

I believe the Fool is unique in the services they offer. However, as a passive investor, I found the email traffic to be a bit much, and difficult to distinguish the signal from the noise. The marketing folks have taken over the firm. Consequently, I have not been able to take full advantage of my subscription, but will try to do so this year.

Thank you for your feedback.

It sounds as though you’re subscribed to receive marketing for additional Motley Fool services. Since publishers like The Motley Fool are prohibited from personalized recommendations, we offer all of our expanding and various services to members who have subscribed to receive promotions, in the hope of finding a better fit for some. Our many services are not upgrades of each other -- they simply follow different strategies, and have different resulting risk profiles.

At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I found the sheer amount of hype and daily load of emails overwhelming and hard to understand. The headline might say, "Four Stocks To Buy Today." But you'd have to click here and open and sign up for another thing... I felt like they were always trying to sell me on how great they were and to buy up the next level of information. Perhaps for the big investor, this information is good. For someone looking for invest a smaller amount - too confusing. Honestly, I could never find the section that laid out in a clear format about what to buy and why.

Thank you for your feedback.

We're sorry to hear you're having trouble navigating our website. I encourage you to reach out to our Member Services department - we feature a great team of Foolish representatives ready and able to help answer questions about your subscriptions. You can reach our representatives via the help tab on Fool.com or by phone.

If the amount of emails you're receiving are proving troublesome, we'd like to help you fix that! At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

Foolishly,

Ashley

Have attempted to cancel my Everlasting Portfolio membership several times but am still being charged for this. My most recent attempt to cancel my membership was on 18 June 2020 and I am still waiting for them to address this; it's now 24th; 48 hour response, ya right. At this point, I'm going to address this through my bank. Maybe if they don't receive another payment from me, they'll actually take my request seriously. Bottom line, don't ever give them your money. They'll set you up in a recurring payment plan that you can never get out of.

Thank you for your feedback.

I was able to find your account and your request. You will not be charged again for that service. On the order page, it stated that you would have a recurring monthly charge. We apologize for the delay in disabling the automatic renewal.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

I've been a long time subscriber to several Fool newsletters - all are very well done - timely and have excellent support for their recommendations. Further - their track record is, overall, very impressive!

Thank you for the positive feedback!

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I started listening and reading to motley fool info years ago when it was a paper publication! I have been helped tremendously financially!

Barbara

Thank you for the positive feedback!

It sounds like you’re probably following our Foolish investing philosophy! We believe a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of a minimum of 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I'm new to investing and I look forward to every Thursday to see what's new on the recommendation list! Having fun investing.

Thank you for the positive feedback!

We're glad to hear you're enjoying our research and recommendations. It sounds like you’re building a diverse portfolio, which is great! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I followed the fool newsletter back in the late 90s/early 2000s but with no real ability to invest but lost track. I started following them again in 2016 and got a subscription. I invested a little with good results. A couple years ago, I thought that these good markets couldn't last and was curious how they did through the 2007 and beyond downturn. I looked at their results vs the S&P500 and saw pretty astounding returns. Starting in late 2018, I've been moving much of our retirement to fool recommended stocks and incredible results so far. As of 6/15/20, I'm up 38.3% OVER the S&P on an annualized basis! While I don't expect that enormous difference to always continue, it certainly is a great start.

Its aggressive, and you'll need to be able to tolerate some swings. During the Covid-19 crash in March, I lost about 34% from our peak in mid/last Feb2020 but have gone up 61% since for a net 7% gain while the S&P is still down a fair bit. Its still early days of COVID as it relates to investments, but so far so good in a big way.

Nuts and bolts: they give their new recommendations (2/month) but keep updating 10-12 Best Buy Now (their term) each month. As some others have mentioned, they keep a list of Starter Stocks (some/many companies you'll likely have heard of) as well.

Fool on!

Thank you for the positive feedback!

It sounds like you’re building a diverse portfolio, which is great to hear! We encourage our members to build a diverse portfolio that they plan on holding for the long term – a minimum of 3-5 years. We believe pairing a portfolio of at least 10-15 stocks with a long-term investing outlook is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I had mutual funds for decades that seemed to retreat as much as grow. I am a self-employed artist/crafts person and have never been rich. Every year I added money, but the total value inched up so slowly. I decided to try a self-directed IRA in 2011. My random investments based on friends' advice lost more than it gained, bringing 12,000 to about $9500 by 2014. Then I got the Fool's Stock Advisor. The results were so much better! I started with 10 stocks and now have over 100. From 2017 to 2019 I moved all my mutual funds into stocks. The growth has been so good that I invested in the Cloud Disruptor 2020 service, and that has gained 30%, even though I started in Feb 2020, just before the COVID crash. Thank you, Motley Fool!

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy. We believe the best way to counteract the whims of the market is to build a diverse portfolio of at least 10-15 stocks that you plan on holding for a minimum of 3-5 years.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

Overall I've enjoyed the subscription but the recommendations have definitely not lived up to the hype. It's a risky business, I get it, that's why I'm paying for the advice. I'm giving it one more year.

Thank you for your feedback.

We're sorry to hear your returns haven't been as large as you expected. It's important to keep our Foolish investing philosophy in mind. We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

This company lies and twists truths to get people confused! They are terrible people! I dont understand how they can legally and blatantly lie in order to trick people out of hard earned cash!

Thank you for your feedback.

Without further context, it's difficult to provide feedback or help resolve your frustration. Could you elaborate on what it is that is upsetting you?

Unfortunately, I'm not able to find an account with the information you've provided. I encourage you to reach out to our Member Services team if there are problems with your account that we can help clarify or fix. You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Q&A (10)

Is The Motley Fool a scam or a legit company?

Answer: Kind of a scam: impossible to cancel auto-renew subscription from their website and impossible to contact member support, been trying HARD for 15 days...

Should I invest in Stock Advisor or Rule Breakers?

Answer: Absolutely not... pure waste of time and money...

Which one is worth it: the boss mode or extreme opportunities platinum.?

Answer: If you'd like to learn about the differences between Boss Mode and Platinum, I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

Why is the name of your company so Stupid?

Answer: If you'd like to know the reason behind our name, visit this site or read below: https://www.fool.com/about/ The Motley Fool's name comes from William Shakespeare's play "As You Like It". The court jester, known as the Fool, could speak the truth to the king and queen without having his head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom. In the same way, we aim to speak the truth about money and investing...and to make financial guidance accessible to people of all backgrounds and experience levels.

Are you guys really this incompetent? I mean really justlook at upstart, path, wkhs, payc, shop, Sq, dis, mtch, team, adsk, nflx, lulu, ttd, coup, pin

Answer: Yes, they are that incompetent. I also own all those junk stocks after listening to these thieves advice

What is new about Amazon? Somebody told me there is a golden opportunity to buy their stocks. Is there anything true to that?

Answer: For questions regarding our services or our marketing, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Hi, I am thinking of subscribing to your services, but would like to see your platform first before subscribing. Are there any free trials?

Answer: For questions regarding our services, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Where and how do I make an investment

Answer: To start with, you stay as fat away from motley fools picks as you can. They are a huge pump and dump scam, nothing more. Anyone tellimg you different has skin in the game at motley fool headquarters. If a revolution breaks put, these scum bags are first on the list to be hung

Why do you keep hawking for more money by promissing more opportunity? Just have one fee for ALL.

Answer: They cater to different requirements. The motley Fool One combines them all but I am not sure is open to new members. I just renewed my three year membership that has yielded many times over its cost.

Have a question?

Ask to get answers from the The Motley Fool staff and other customers.

About the Business

The Motley Fool provides leading insight and analysis about stocks, helping investors stay informed.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Thank you for your feedback.

We're sorry to hear you've been having trouble logging into Fool.com - some browsers will remember your username and password for you. This may be something to consider if you're experiencing difficulties logging in.

Please reach out to our Member Services team - we'll be happy to look into your account further. You may have multiple emails registered with us, which can cause confusion. When typing in your password, remember to follow the 'rules' - at least one capital letter, at least one lowercase letter, etc.

You can reach our representatives via the Help button on Fool.com, as well as by email - MemberSupport@Fool.com

Foolishly,

Ashley