The Motley Fool Reviews Summary

The Motley Fool has a rating of 2 stars from 334 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with The Motley Fool most frequently mention customer service, stock recommendations and credit card. The Motley Fool ranks 7th among Stock Research sites.

Worse than seeking alpha and they are pretty bad so this gives you an idea of how good this place. Its on massive clickbait mine. None of the free info is usefull

Click bait that's all. They provide no value. I wish I could give them negative stars. No wonder millennial are avoiding the stock market. Having to put up with charlatans like this simply too much

Great investment advice. I would highly recommend it if you enjoy investing on your own. Stock Advisor has a great track record.

The free information is literally useless and every article is nothing but a trap to try to lure to pay for something equally meaningless. If you buy one product they keep pushing you to buy more. I tried their service and cancelled during the grace period and believe it took several attempts to get that so-called risk free trial cancelled. The paid information was worthless, you could do as well by going to yahoofinance and we all know that place is a swamp

They try to sell you everything under the sun. Every article is basically a gimmick to try to get you to buy something. And if you buy something it does not stop there, they plague you with more emails trying to get you to buy even more.

Will go there only when forced to

The ads so intrusive and pushy that if you are naive you could easily be tricked into paying for something that is one order short of being crap. For basic data this site is okay but be ready to put up with a lot intrusive and sneaky look ads.

You are better of by going to contrarian sites such as

Goldseek.com

Tacticalinvestor.com

Safehaven.com

Marketoracle

Too many click-bait articles, the title has nothing to with the subject matter. Its really annoying when the title says A but the subject discusses B and they have nothing in common. Yahoo finance is a better source as is talkmarkets.com

For those looking for something contrarian then tacticalinvestor.com is quite a good source for financial insights but as they dont follow the conventional line of thinking.

A good place for finding stock data as in a screener is finviz.com

There are so many gimmicky ads that are sent to entice you to become a member, but, looking at the past stock recommendations and the timelines, it's not very good at valuing stock at all.

Site is okay for investors who want to do some very basic diligence on companies, but content is very shallow and sometimes nonfactual

I do not like the lost leader factor they use. Click on for three free tips! You listen for 30 minutes to balony and then they say we can not give you the tips but if you buy our product we will tell you. I would probably buy it if you gave me a winner instead of trying to "FOOL ME".

Motley Fool doles out stock trading wisdom but it's very unclear if anyone benefits outside the owners of Motley Fool. A smart investor might buy an index fund and waste their time somewhere else.

These "fools" should more closely monitor and approve their content. I hate nothing more than seeing these articles populate on Yahoo finance and it's by someone who doesn't have a clue about how markets work.

Q&A (10)

Is The Motley Fool a scam or a legit company?

Answer: Kind of a scam: impossible to cancel auto-renew subscription from their website and impossible to contact member support, been trying HARD for 15 days...

Should I invest in Stock Advisor or Rule Breakers?

Answer: Absolutely not... pure waste of time and money...

Which one is worth it: the boss mode or extreme opportunities platinum.?

Answer: If you'd like to learn about the differences between Boss Mode and Platinum, I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

Why is the name of your company so Stupid?

Answer: If you'd like to know the reason behind our name, visit this site or read below: https://www.fool.com/about/ The Motley Fool's name comes from William Shakespeare's play "As You Like It". The court jester, known as the Fool, could speak the truth to the king and queen without having his head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom. In the same way, we aim to speak the truth about money and investing...and to make financial guidance accessible to people of all backgrounds and experience levels.

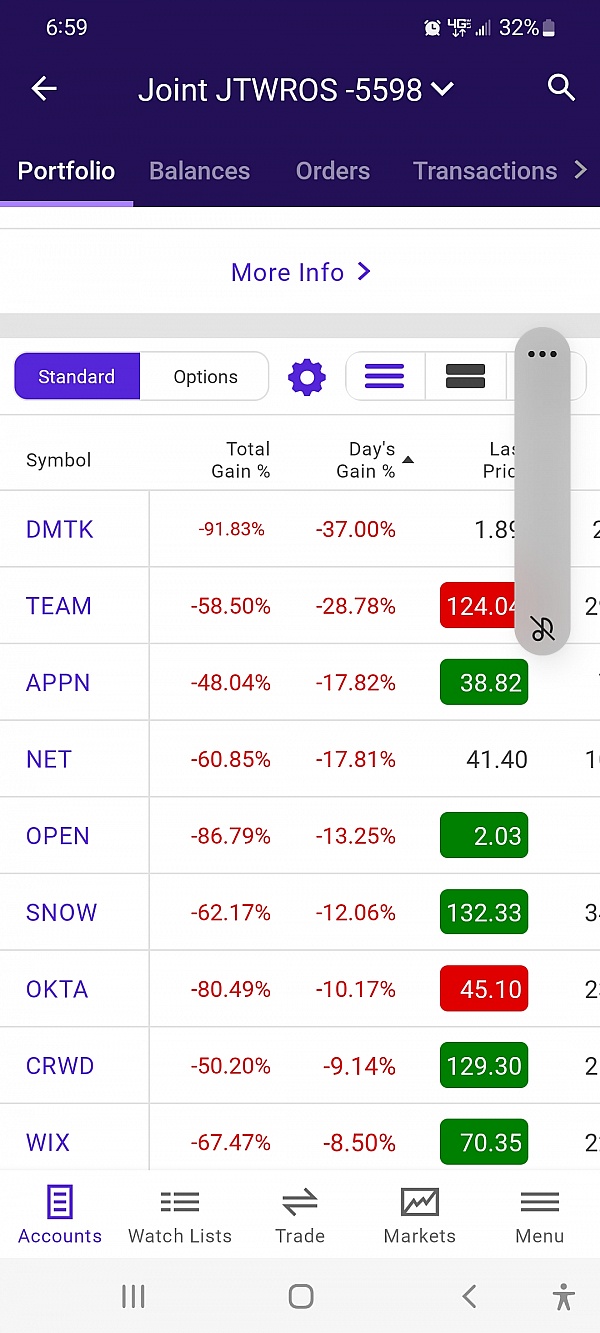

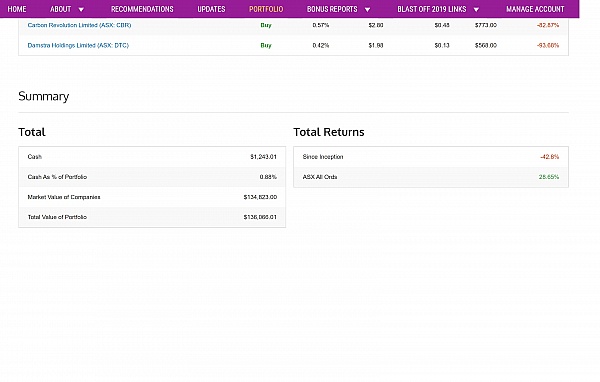

Are you guys really this incompetent? I mean really justlook at upstart, path, wkhs, payc, shop, Sq, dis, mtch, team, adsk, nflx, lulu, ttd, coup, pin

Answer: Yes, they are that incompetent. I also own all those junk stocks after listening to these thieves advice

What is new about Amazon? Somebody told me there is a golden opportunity to buy their stocks. Is there anything true to that?

Answer: For questions regarding our services or our marketing, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Hi, I am thinking of subscribing to your services, but would like to see your platform first before subscribing. Are there any free trials?

Answer: For questions regarding our services, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Where and how do I make an investment

Answer: To start with, you stay as fat away from motley fools picks as you can. They are a huge pump and dump scam, nothing more. Anyone tellimg you different has skin in the game at motley fool headquarters. If a revolution breaks put, these scum bags are first on the list to be hung

Why do you keep hawking for more money by promissing more opportunity? Just have one fee for ALL.

Answer: They cater to different requirements. The motley Fool One combines them all but I am not sure is open to new members. I just renewed my three year membership that has yielded many times over its cost.

Have a question?

Ask to get answers from the The Motley Fool staff and other customers.

About the Business

The Motley Fool provides leading insight and analysis about stocks, helping investors stay informed.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members