The Motley Fool Reviews Summary

The Motley Fool has a rating of 2 stars from 334 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with The Motley Fool most frequently mention customer service, stock recommendations and credit card. The Motley Fool ranks 7th among Stock Research sites.

I've been with Motley Fool for 10 years or so. In that time they have recomended a number of stocks that have tremendously added to my retirement nest egg! Most of the picks recomended did very well. Although their 3D (DDD) recommendation I've been sitting on for 3 years waiting for it to break even. Hopfully it will before I retire. Even if it dosent I've made way more returns on their other picks than I've lost on this one. I highly recommend Motley Fool.

I think Mootley Fool advisor gives too much recommandations.

Of course with a lot of stocks, you have any chance to pick a big winner as Amazon, shopify or Netflix

Sadly i have a value investor profil and i had no chance with the selected stocks i pick up from your recommandations (teradata, calamp, liquidity services and other).

But i have to admit that if you buy each recommanded stock in little quantity on a year, you are a winner.

So, perhaps MFA is not the best formula for me because my stock analysis is too much fondamental.

Thank you for your feedback.

Although we encourage our members to build a diverse portfolio of at least 10-15 stocks, it is still ultimately up to our members to select an array of stocks that make the most sense for their individual portfolios.

If you have any questions regarding your service(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help!

Foolishly,

Ashley

I bought into the Marijuana portfolio for $500 and put $7500 into seven stocks I could buy on the American Stock Exchange. Luckily I didn't buy into the Canadian ones. Since then they have all dropped considerably! I am down almost $13,000 from my original $49,000. Since then I have dropped out of the stock advisor and adjusted my email to send the excessive offers to buy other Marijuana stocks to my SPAM folder!

Thank you for your feedback.

Here at the Motley Fool, we stand by a long-term buy and hold strategy of 3-5 years minimum for any recommended stock. It can be helpful to bear this time frame in mind when weathering market volatility. We’ve found the best results are obtained by holding onto companies we feel confident about in the long term - but we will issue sell and hold notices when necessary.

If you’d ever like to learn more about a particular stock, you can do so by logging into fool.com and using the “Search Ticker or Keyword” box in the upper left-hand corner. Simply type in the name of the company or ticker symbol and select it from the drop-down menu that will appear. This will take you to the stock’s “Snapshot page” – here, you will find a graph of the trends, articles, reports, etc.

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

I would prefer succinct and focused messages. Advice and success gets dumbed down with verbose sales pitch. Let your product sell itself.

Thank you for your feedback.

I'll pass along your input to the appropriate team. We appreciate you sharing your thoughts with us.

If you're unhappy with the amount of marketing emails you receive, we'd like to help you fix that. At the bottom of our emails, there is a link to unsubscribe to that marketing email. Additionally, you can log into fool.com, click on "My Fool" in the upper right-hand corner of the screen, and then click on "Email Settings." This will allow you to adjust your email settings on your account. You can also reach out to our Member Services Department and we can update your email settings for you.

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

I often kick myself when I see they recommend a stock that I tell myself "no way: and then the stock takes off Witness SHOP which rose 250 points since I did not buy it (tears)

Thank you for the positive feedback!

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

There is so much valuable information on the website and the email newsletters are great too. It's not just bloated information sent to your inbox, it's carefully curated so it's easy to digest or delete if it doesn't fit your interest. Great group of people and valuable service.

Thank you for the positive feedback!

It's great to hear that you're enjoying our website and emails! We're always working to provide information in the best way possible - after all, our purpose is to make the world smarter, happier, and richer! We also offer a variety of ways for members to update their email settings at any time.

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

Great service with easy to understand analysis of their recommendations. I have been using Stock adviser for years, and have great returns to show for it. I don't have the time to find great stocks like these on my own, but SA makes it easy with plenty of recommendations each month. My only wish is that I could go back in time and follow their advice more often - I would have done even better.

Thank you for the positive feedback!

We're glad to hear that you're enjoying our services, and that you find the information easy to understand. We aim to provide information that will help everyone - from the novice to the more experienced investor.

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

I think that there is not much value associated with a lot of the other services/options to invest in that are sideshows of the Motley Fool. You get very tired of repeated e-mails for "secret" offers where you can make Millions $$$.

Thank you for your feedback.

There is no singular investing strategy which fits the needs and preferences of all investors. Our services follow different strategies and have different resulting risk profiles. We offer these various services to all members who have subscribed in case there is a better fit for that particular member.

If you're unhappy with the amount of marketing emails you receive, we'd like to help you fix that. At the bottom of our emails, there is a link to unsubscribe to that marketing email. Additionally, you can log into fool.com, click on "My Fool" in the upper right-hand corner of the screen, and then click on "Email Settings." This will allow you to adjust your email settings on your account. You can also reach out to our Member Services Department and we can update your email settings for you.

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

You want smart people on your team. They make it easy. Over time we have weeded out some stocks, true, but we always knew what stocks we could depend on and in some cases ones we could no longer depend on.

Thank you for your positive feedback!

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

The Fools information is accurate and timely. I don't have the time to do the research myself but have always been able to rely on them for great stock picks. The last two that I purchased, based on their timely information, have doubled in value. Thank you!

Thank you for your feedback!

We're glad to hear that you've made a return in your first year using our recommendations. It’s important to note, though, that the market has been near all-time highs recently and it’s impossible to predict how it will perform. That’s why we encourage Fools to buy and hold stocks for the long term -- most of our services recommend an outlook of 3-5 years -- we think it’s the best way to counteract the whims of the market. We also suggest that Fools diversify their portfolio by purchasing at least 10 to 15 stocks.

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

The Motley Fool is a wealth of easily digestible and useful knowledge. It will make anyone a better investor, from the greenest novice to the most seasoned expert.

Thank you for your positive feedback!

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley

Love Motley Fool and especially David' Best Buys. HATE, HATE, HATE constantly getting offers for new subscriptions and fund. Please stop. Thanks.

Thank you for the positive feedback!

We love to hear that you love The Motley Fool and David's Best Buys.

We offer various services to all members who have subscribed, because sometimes there is a better fit for that particular member. Our services have different strategies and different risk profiles. There is no singular investing strategy which fits the needs and preferences of all investors.

If you're unhappy with the amount of marketing emails you receive, we'd like to help you fix that. At the bottom of our emails, there is a link to unsubscribe to that marketing email. Additionally, you can log into fool.com, click on "My Fool" in the upper right-hand corner of the screen, and then click on "Email Settings." This will allow you to adjust your email settings on your account. You can also reach out to our Member Services Department and we can update your email settings for you.

Foolishly,

Ashley

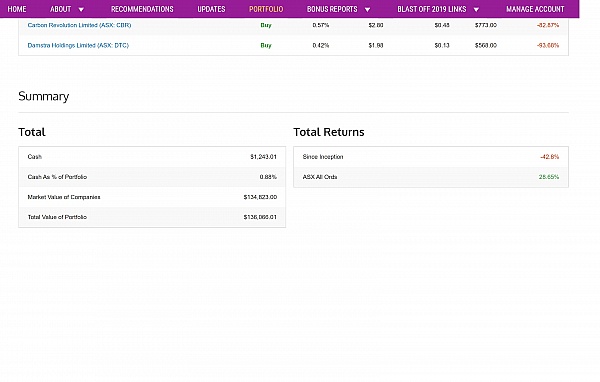

I have been a paying member of several Motley Fool services for several years, and I am very satisfied with the quality of the services. Big fan of Blast-off 2019 in particular!

I retired eight years ago with what I thought would be a reasonable amount of funds for the future. I had had three financial advisors before I retired, not particularly interested in dealing with investments myself, nor did they apparently. Motley Fool allowed me to invest for myself with timely information that I could assess based on my own values and interests... and decisions! Needless to say, the market has been robust these past years, but in any case, I have been able to increase that original fund substantially, and see my investments now not only for my own retirement needs but as the foundation for my daughter's investment future!

I think it gives good advice, but joining means that you get tons of spam advertising their expensive premium services. You wind up getting much more annoying spam than anything else.

If you're an investor and looking to accumulate wealth over the long haul this is for you. If you're just looking for quick wins take your money elsewhere. Over the course of membership across several services I've realized over 40% returns. They invest in solid companies, they measure themselves against the market, and investments are for greater than five years... ideally longer. Also realistic expectations are a portion of their picks will lose money, but their winners will eclipse those losers and carry the portfolio. I suggest starting with Stock Advisor and expand based on your risk and investment style.

The rule breakers service helps identifying long term winners and transformative companies to hold long term for amazing gains. Save investors a lot of time while keeping up to date and giving recommendations for actions. Great value for money, thanks for the great work!

Learned a lot from Motley fool first year of investing..., been buying recommended stocks and Ive been doing pretty good...

I am following TMF since 2005 and I believe David and Tom did an excellent job in guiding me through the bads and the goods of stock exchance recent history. As long term investor I am happy to still be with them. Not suitable for short term and speculative investors.

As a financial advisory tool, Motley Fool provides me with a lot of information and opinion that helps me make intelligent, well-researched and informed choices. I highly recommend it, as long as you use it as a tool to make your own choices.

Q&A (10)

Is The Motley Fool a scam or a legit company?

Answer: Kind of a scam: impossible to cancel auto-renew subscription from their website and impossible to contact member support, been trying HARD for 15 days...

Should I invest in Stock Advisor or Rule Breakers?

Answer: Absolutely not... pure waste of time and money...

Which one is worth it: the boss mode or extreme opportunities platinum.?

Answer: If you'd like to learn about the differences between Boss Mode and Platinum, I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

Why is the name of your company so Stupid?

Answer: If you'd like to know the reason behind our name, visit this site or read below: https://www.fool.com/about/ The Motley Fool's name comes from William Shakespeare's play "As You Like It". The court jester, known as the Fool, could speak the truth to the king and queen without having his head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom. In the same way, we aim to speak the truth about money and investing...and to make financial guidance accessible to people of all backgrounds and experience levels.

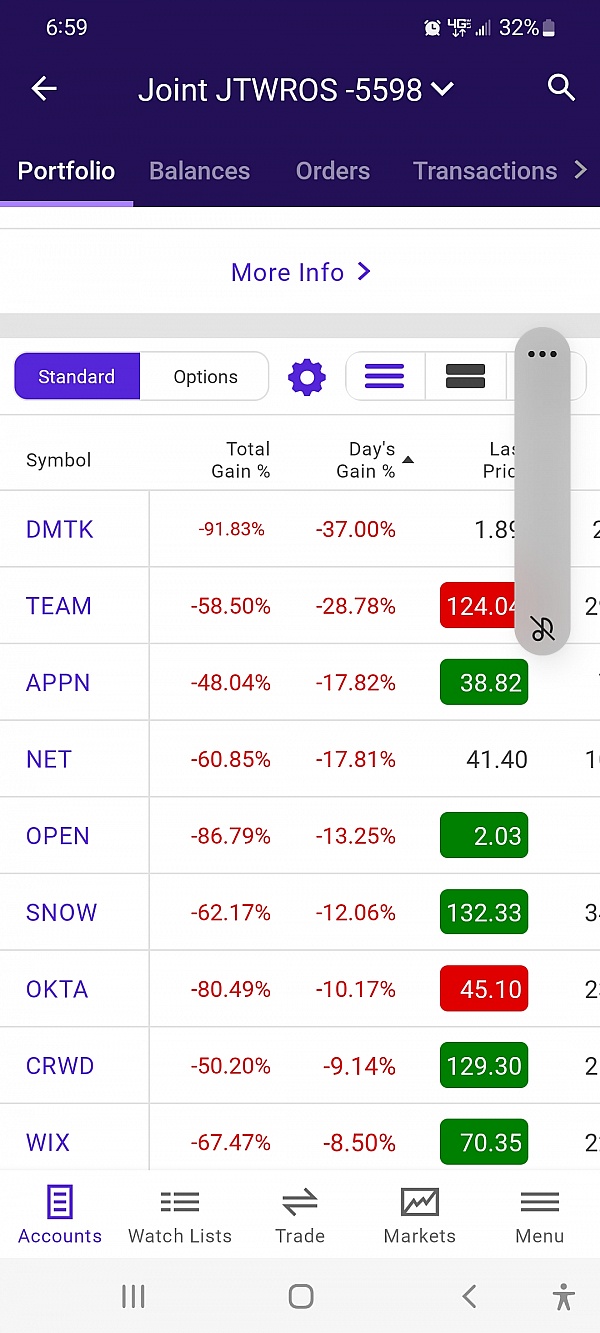

Are you guys really this incompetent? I mean really justlook at upstart, path, wkhs, payc, shop, Sq, dis, mtch, team, adsk, nflx, lulu, ttd, coup, pin

Answer: Yes, they are that incompetent. I also own all those junk stocks after listening to these thieves advice

What is new about Amazon? Somebody told me there is a golden opportunity to buy their stocks. Is there anything true to that?

Answer: For questions regarding our services or our marketing, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Hi, I am thinking of subscribing to your services, but would like to see your platform first before subscribing. Are there any free trials?

Answer: For questions regarding our services, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Where and how do I make an investment

Answer: To start with, you stay as fat away from motley fools picks as you can. They are a huge pump and dump scam, nothing more. Anyone tellimg you different has skin in the game at motley fool headquarters. If a revolution breaks put, these scum bags are first on the list to be hung

Why do you keep hawking for more money by promissing more opportunity? Just have one fee for ALL.

Answer: They cater to different requirements. The motley Fool One combines them all but I am not sure is open to new members. I just renewed my three year membership that has yielded many times over its cost.

Have a question?

Ask to get answers from the The Motley Fool staff and other customers.

About the Business

The Motley Fool provides leading insight and analysis about stocks, helping investors stay informed.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Thank you for the positive feedback, and for being such a dedicated Fool!

It sounds like you've created a diverse portfolio - that's great to hear! We recommend that Fools have a diverse portfolio of at least 10 to 15 stocks, and that they hold those stocks for a minimum of 3 to 5 years. We believe it's the best way to counteract the whims of the market.

If there's anything we can do to improve our services, please reach out and let us know.

Foolishly,

Ashley