The Motley Fool Reviews Summary

The Motley Fool has a rating of 2 stars from 334 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with The Motley Fool most frequently mention customer service, stock recommendations and credit card. The Motley Fool ranks 7th among Stock Research sites.

I would love to use more of your products but they are well above my price point. I would love a product that helps me build a balanced portfolio.

The Motley Fool writers help their customers understand the vast world of stock investing. They also show how to apply that understanding to investing in the stock market in a way that is fun and profitable. They hold their investment newsletters to the highest standards by keeping track of all their recommendations, profits, losses, buys, and sells. No hidden gimmicks with the historic results of their recommendations. The knowledge you can from reading articles at their site in invaluable and will help you become a better investor. Whether you invest on your own or use an advisor. Customer since 2004.

Motley Fool is an honest and well respected advisory service with a variety of investment platforms. It focuses on long-term investing and lets clients know what to buy and when to sell. It provides monthly recommendations and displays the purchase date and cost of all current recommendations and the current date and value on its web site. This provides transparency to investors. I know of no better advisory service.

Being a long term investor in the Buffet style, I find the timely info from the Motley Fool to be well researched and helpful. I also use my common sense, the Wall Street Journal and other analysis, but the folksy, friendly, recommendations from Tom and David have alerted me to companies and trends I might not have noticed otherwise. I started slowly, subscribing at the $49 level, just to see what I thought. I'm now receiving the weekly newsletter and have broader site access. This subscription is as valuable as some of the more costly publications, less expensive than my stock broker and also grants access to site tools that help me determine whether to invest or not and how much risk is involved. Over all a very cool tool. Thanks, Tom and David.

Always a part of my research. Great analysis of possible purchases. My go to reference material. Great service.

Love the info. Saves time, distilled insight into the next new thing. Worth the money for what you get, which is presented in clear language that cuts through the bs.

Motley Fools suggestions have worked out very well for me this past year! They are very thorough, thoughtful! Highly recommend them!

Been member for 10 plus yrs, done very well with the stock advisor picks, my own not as well! Great advice for small fee. Join in, you be foolish not to..

I've been a subscriber/reader since 1999. I trust most of my investment decisions to the community of the Motley Fool. I appreciate everything they offer and do for the individual investor.

Over the years I've received some great stock pick recommendations and I use this service to direct my 401k. I've beat the S&P500 every year over a 10 year time. However, I've also had a number of losing picks from the Fool. When they give a recommendation, do your own diligence and make sure you are comfortable with it. Spread your $$ over a number of different picks and try to just ignore the market and let the stock grow. This is not a day-trading service. Its a buy and hold service.

I like reading the articles and overall is a good service. I miss being able to compare P/E's, Yields and other data in my scorecard. Stock metric comparisons are important to me. Going to different pages could be improved as it is not always easy to navigate to. I really thought about making the rating a 3, but you do have the potential to be a 5 with improving your metrics and navigation. I know the old scorecard is coming down, what and will it be replaced with?

Chris Hayes

Have had both success and big failures = BIDU; TRUE; CLDX; SKX. I have found that investing, when Fool does a second or third recommendation, is foolish. Fool gives out %returns from the first date a stock was recommended by Fool. Fool should give out %returns for each time a stock is recommended.

Do not like the hawking of 'special offers'. Reminds me of the bars in Bangkok!

If you are willing to take risk, i. E. potentially lose some money short term, in order to obtain long-term gains, this service is for you. It's a great filter to help find the ripest cherries to pick.

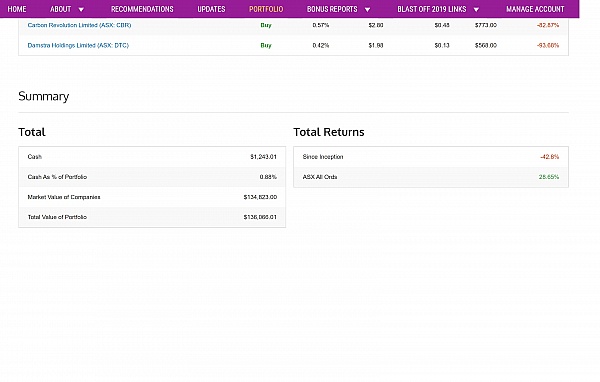

I just renewed my membership for the 2nd time. As a small business owner I don't have time to research stocks. Since I started investing in individual stocks all of the stocks I have purchased, with the exception of 1, have been Fool recommendations. Over any given period my portfolio is out performing the S&P 500 by about 11% points... if the S&P is up 4%, then over the same period my portfolio is up about 15%. One thing I did before ever becoming a member was listen to over a years worth of the Rule Breaker podcast by David Gardner. I learned a lot about the Fool philosophy before becoming a member. One of the most important things I learned was get to 12 to 15 stocks as quickly as you can. I did this over a period of about 6 months. In reading some negative reviews, it looks like a lot of negative experiences are the result of someone buying one or two stocks and seeing one or both immediately drop by a lot. I have a couple of those, but I also have 3 that are up between 100% and 300% in less than 2 years. My single biggest gainer is up by more than all of my losers combined. Here's my point, if you buy in and use the service like David Gardner teaches on the Rule breaker pod cast you will outperform the S&P 500. Also, I should point out I am a stock adviser subscriber rather than a rule breaker subscriber.

I appreciate the advice, and have bought a couple of stocks recommended that have appreciated nicely although many of the recommended stocks I bought have gone down or stayed flat. I don't like the constant pushing of special limited time offerings.

Beware that many of the Motley reviews are for pumping and dumping. For example, they pumped up Pot stocks way beyond a reasonable level. They didn't reveal the "good will" asset issues prior to this becoming common knowledge.

I have been a member of MF Rule Breakers for a few years now and have enjoyed the benefits of some outstanding recommendations, including Shopify, Mulesoft and MongoDB. These investments have made a huge impact to my families lifestyle and we look forward to enjoying the benefits of Rule Breaker membership for many years to come.

50%. I only a part of my portfolio, so my investing is limited now. I think Motely Fool is right half of the time in my short experience. I agree with Patrick B that the constant hyping of new investor openings/offering is very annoying. I like a lot of folks thought that Stock Advisor should cover most of the market.

I am giving motely fool another year also.

Downturn/Correction prediction? Timing?

The constant hyping of new investor openings/offerings is getting tiresome. The original buy in should cover most of these so called "new investor opportunities". I'm on the fence about any renewal after this coming year as I was close to not renewing this time around.

I have been a Stock Advisor for well over a decade and I have since joined other Motley Fool services. I rely on the Fool as a key source of info and my portfolio has done extraordinarily well with Foolish guidance. Joining the Fool family has quite simply been the best financial decision I have made - it has quite literally has changed my life.

Q&A (10)

Is The Motley Fool a scam or a legit company?

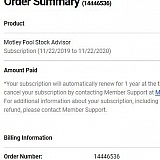

Answer: Kind of a scam: impossible to cancel auto-renew subscription from their website and impossible to contact member support, been trying HARD for 15 days...

Should I invest in Stock Advisor or Rule Breakers?

Answer: Absolutely not... pure waste of time and money...

Which one is worth it: the boss mode or extreme opportunities platinum.?

Answer: If you'd like to learn about the differences between Boss Mode and Platinum, I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

Why is the name of your company so Stupid?

Answer: If you'd like to know the reason behind our name, visit this site or read below: https://www.fool.com/about/ The Motley Fool's name comes from William Shakespeare's play "As You Like It". The court jester, known as the Fool, could speak the truth to the king and queen without having his head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom. In the same way, we aim to speak the truth about money and investing...and to make financial guidance accessible to people of all backgrounds and experience levels.

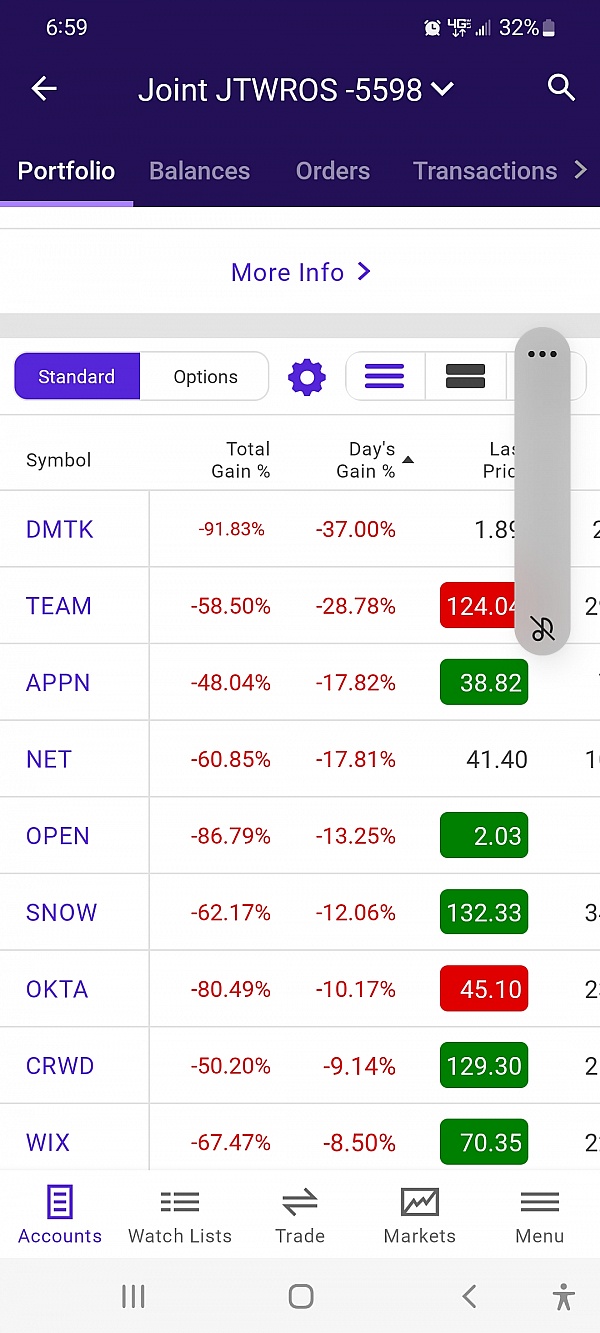

Are you guys really this incompetent? I mean really justlook at upstart, path, wkhs, payc, shop, Sq, dis, mtch, team, adsk, nflx, lulu, ttd, coup, pin

Answer: Yes, they are that incompetent. I also own all those junk stocks after listening to these thieves advice

What is new about Amazon? Somebody told me there is a golden opportunity to buy their stocks. Is there anything true to that?

Answer: For questions regarding our services or our marketing, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Hi, I am thinking of subscribing to your services, but would like to see your platform first before subscribing. Are there any free trials?

Answer: For questions regarding our services, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Where and how do I make an investment

Answer: To start with, you stay as fat away from motley fools picks as you can. They are a huge pump and dump scam, nothing more. Anyone tellimg you different has skin in the game at motley fool headquarters. If a revolution breaks put, these scum bags are first on the list to be hung

Why do you keep hawking for more money by promissing more opportunity? Just have one fee for ALL.

Answer: They cater to different requirements. The motley Fool One combines them all but I am not sure is open to new members. I just renewed my three year membership that has yielded many times over its cost.

Have a question?

Ask to get answers from the The Motley Fool staff and other customers.

About the Business

The Motley Fool provides leading insight and analysis about stocks, helping investors stay informed.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members