The Motley Fool Reviews Summary

The Motley Fool has a rating of 2 stars from 334 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with The Motley Fool most frequently mention customer service, stock recommendations and credit card. The Motley Fool ranks 7th among Stock Research sites.

I've enjoyed learning more about stocks and businesses through the experience of Tom and David. I have purchased a couple of their recommendations that are doing well. But I would like to see some stocks that can be bought in at a lower price than the recommendations I've seen thus far. I'm not investing a lot, but steadily. Looking forward to the next year. But not interested in continuous up-selling.

I trust motley fool information. So many big companies are not trust worthy. I feel like motley fool does more research than most company's and it pays off.

Thank you for the positive feedback!

We're glad to hear you're enjoying the research behind our recommendations. If you'd like to learn more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I've been a Motely Fool customer since 2008 and believe Stock Advisor was my very first subscription. One of the stocks I hold was recommended and purchased in 2012. It has increased 2,204.83%! Of course, I picked some stinkers along the way. Looking back those poor choices resulted in not following their advice. I'm a fool for life.

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy! It’s our belief that a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of at least 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I have never visited the website. I don't have much money. But I really enjoy the emails that are sent to me, and I have bought a few shares of stock based on your email recommendations, and they are doing well so far, which I truly appreciate. I believe there will be a day when I might inherit a large amount of money, but I think it's necessary to learn what to do before it happens. I have an account with Ameritrade, and when you guys make a recommendation, I look them up and decide if I can afford them. I wish I had pots of money sitting around, because I could have made a lot more money with The Motley Fool's recommendations. For now, I'll learn and watch my little dollars grow. Thanks for your help.

Thank you for the positive feedback!

We're glad to hear you're enjoying our recommendations. It sounds like you’re building a diverse portfolio, which is great! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you'd like to explore our website, our Member Services department would be more than happy to help guide you there. We feature a great team of Foolish representatives ready and able to help answer questions about your services. You can reach our them via the help tab on Fool.com or by phone.

Foolishly,

Ashley

Your service is extremely informative and your stock picks speak for themselves. Your stock picks aim towards the future of the stock market and economy.

Thank you for the positive feedback!

We're glad to hear you're enjoying the research behind our recommendations. If you'd like to learn more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I very much like the idea to invest in a lot of stocks. On the long term 5-10 good stocks will easily erase the negative side of 50-60 bad stocks.

Thank you for the positive feedback!

We’re glad to hear you enjoy our Foolish investing philosophy! It’s our belief that a diverse portfolio of at least 10-15 stocks, paired with a long-term investing outlook of at least 3-5 years, is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I just subscribed a couple of weeks ago so I haven't had enough time to comment on their stock picks.

I am disappointed that my yearly membership fee only covers a small portion of their stock recommendations. To gain access to "everything" members need to pay large fees in addition to the yearly subscription. I receive up-selling emails daily from Motley Fool that contain headlines that seem beneath the professional standard I expected. "Did you see our last email?" "I hope you read this before the market opens tomorrow!" "In case you missed it." "Don't miss out". Again, daily up-selling emails and very little in the way of actual stock analysis. Finally, I'm getting tired of reading, almost daily, about how they picked Amazon and Netflix when their stock prices were lower... Ancient history. I hope they come up with new content and add more stock recommendations for their "basic" members.

Thank you for your feedback.

We're sorry that your experience with our marketing has been a frustrating one. There is no singular investing strategy which fits the needs, preferences, and a reasonable fee ratio of all investors. Our many services are not upgrades of each other – they simply following different strategies and have different resulting risk profiles.

Since publishers like The Motley Fool are prohibited from personalized recommendations, we offer all of our various services to all members who have subscribed to receive promotions in the hope of finding a better fit for some. The fact that we offer other strategies to allow for different interests and investment styles does not diminish the quality of your service and its affiliated information.

At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences. It sounds like you also have the "reminder" emails turned on, and those can easily be disabled.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I'm just getting started and learning so much about the stock market from Motley Fool. They've taken the fear away and given me confidence to invest.

Thank you for the positive feedback!

We're glad to hear that our services have given you the confidence to invest. After all, our purpose is to make the world smarter, happier, and richer! If you'd like to learn more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I have been a member for five years and I love their stock picks. I don't have a lot to invest so I pick a stock in the $20 -$50 range. I wish I had more money to invest. I cant buy them all

Thank you for the positive feedback!

It sounds like you’re building a diverse portfolio, which is great! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

Pretty good stock picker for amateurs. Nothing special or technical.

Investors Business Daily or Zack's probably gives better picks.

Thank you for your feedback.

We're sorry to hear you aren't particularly pleased with our stock recommendations. If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

All but 3 of my 51 stocks are Motley Fool picks. And most are "up", in spite of the Corona virus "sell-off".

Doing better than my Fisher account.

Thank you for the positive feedback!

It sounds like you’re building a diverse portfolio, which is great to hear! We encourage our members to build a diverse portfolio that they plan on holding for the long term – a minimum of 3-5 years. We believe pairing a portfolio of at least 10-15 stocks with a long-term investing outlook is the best way to counteract a fluctuating market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

Motley Fool gives no guidence

Buy a stock and hold 3-5 Years?

Just go ahead, and buy a etf / mutual fund. They have recommended two really bad stocks. A pot business, and coffee business. Notifications are long and boring. Over and over the wonderfulness of MF.

Useless. Their quoted returns are impossible. Skewed a certain time. Did not renew subscription.

Think MF stands for something other than Motley Fool.

Thank you for your feedback.

As long-term investors, we recognize that when we make a stock recommendation with a time horizon of three to five years, stock prices will fluctuate. However, we won’t always recommend a sell just because the stock price drops.

We prefer to hold stocks in companies that we are confident in for the long term, because because good businesses tend to remain good businesses, or as David Gardner says, “Winners keep winning.” We realize, however, that significant price changes are worrisome to our members. Because of this, we try to post additional articles and research on stocks that have seen a downturn. For any recommended stock that changes in price by 10% in a single day, our analysts will write special reports as to why this occurred, and we refer to these as the “10% Promise.”

We're sorry to hear you were unhappy with our promotional emails. At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

Respectfully, within our services we clearly show the performance of all of our recommendations - whether it was a winner or not. It sounds like you previously had a subscription to Stock Advisor - that service has far more than 2 stock recommendations, and you only list two 'losers.' It's also had some exceptional 'winners.'

If you have any further questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley

Very informative to investors. Has been profitable! Your stock data gives the investors the time to make decisions to stay the long haul. Thanks

Thank you for the positive feedback!

We’re glad to hear you’re following our Foolish investing philosophy. We believe the best way to counteract the whims of the market is to build a diverse portfolio of at least 10-15 stocks that you plan on holding for a minimum of 3-5 years. If you'd like to learn more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I always tell everyone about The Motley Fool. They give the best stock advice. I wouldn't use anything else.

Thank you for the positive feedback!

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I'VE TRIED SEVERAL OTHER STOCK ADVISERS. NONE AS GOOD AS THE FOOLS FOR ME. I'VE BEEN WITH YOU FOR 5 YEARS. THE STOCKS YOU'VE RECOMMENDED THAT I HAVE PURCHSED HAVE MADE ME VERY GOOD MONEY. I LOVE THE YOU TUBE VIDEOS AND THE COMMENTARY FROM EVERYONE. I DO NOT HAVE A BUSINESS BACKGROUND, BUT I'VE NEVER HAD TROUBLE LEARNING FROM YOUR GROUP. THANK YOU.

Thank you for the positive feedback!

We're glad to hear you're enjoying our research and recommendations, as well as our YouTube channel! We also have podcasts available if you'd like to explore them: https://www.Fool.com/podcasts/

It sounds like you’re building a diverse portfolio, which is great! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. It’s our belief that this combination is the best way to counteract the whims of the market. If you'd like to learn more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

Since joining, I've had some hits and misses on some recommendations, but over all I managed to be ahead.

However, some of the up-sells were very annoying. The videos were mostly irritating designed to sell you more products or stocks that may or may not work. In the end, it's up to the individual investor to sort through the information being fed to you. Still, The Motley Fool is worth it, So, Fool on!

Thank you for your feedback!

We’re sorry your experience with our marketing has been a frustrating one. Their job is to entice members to join our subscription services as they launch and promote their respective approach to investing. There is no singular investing strategy which fits the needs, preferences, and a reasonable fee ratio of all investors. In that vein, I want to reiterate that our many services are not upgrades of each other – they simply following different strategies and have different resulting risk profiles.

Since publishers like The Motley Fool are prohibited from personalized recommendations, we offer all of our various services to all members who have subscribed to receive promotions in the hope of finding a better fit for some. The fact that we offer other strategies to allow for different interests and investment styles does not diminish the quality of your service and its affiliated information.

At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

It sounds like you're following our Foolish philosophy of building a diverse portfolio! We encourage our members to build a diverse portfolio of at least 10-15 stocks that they plan on holding for a minimum of 3-5 years. We believe this combination is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

The Motley Fool has been a great help for guiding me in investing into equities. Being an engineer, my knowledge regarding investing in shares was not existing. At retirement, I needed help in investing my money. Thanks to Motley Fool, I managed to do good investments in shares.

My only complaint is that they are not equally pront to advise me when is time to sell. Once, I had to decide myself to sell some shares to contain the loss. Anyway, the beauty in this organisation is that they explain clearly what are the pros and cons for each share without the jargon usually used by other advisers.

Well done guys, carry on with the good work that you are doing.

Thank you for the positive feedback!

At The Motley Fool, when we recommend a stock in any subscription or strategy, we are doing so with the intention of holding that stock for 3-5 years, minimum.

As long-term investors, we recognize that when we make a stock recommendation with a time horizon of three to five years, stock prices will fluctuate. However, we won’t always recommend a sell just because the stock price drops. We prefer to hold stocks in companies that we are confident in for the long term. We realize that significant price changes are worrisome to our members. Because of this, we try to post additional articles and research on stocks that have seen a downturn.

For any recommended stock that changes in price by 10% in a single day, our analysts will write special reports as to why this occurred, and we refer to these as the “10% Promise.”

If you'd like to learn more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

For years, I had a big-name broker whose recommendations, in the end, lost a lot of money for me. I then tried to play the market by myself, until I realized (after losing lots of money) that I did not have the time, or the ability, to do proper research. I became wiser, though still poorer, when I took a chance with the Motley Fool. The name had turned me off for a long time, but its record of giving winning advice convinced me. Twelve years later, I rest easy knowing they my wife and children are secure through their old age (provided Trump does not get us into WW III.)

Thank you for the positive feedback!

We're sorry to hear you were turned off by our name at first - on our "About Us" page we explain why it was chosen. "Our name is in homage to the one character in Shakespearean literature — the court jester — who could speak the truth to the king and queen without having his or her head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom."

We're pleased to hear you're enjoying the research behind our recommendations. If you'd like to learn more about the latest guidance for a stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

The fool gives great advice that leads to pure joy. Their insight into the markets seem

To be in touch with the day.

Thanks

Thank you for the positive feedback!

We're glad to hear you're enjoying the research behind our recommendations! If you'd like to learn more about a stock we're recommending (or other stocks you may have discovered on your own), you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

I bought their service, first stock I noticed was an otc stock call CHAR. WEB bought over 500 shares, go for one of their morning online chat show a and first thing I see is this company is in huge trouble WOW strike one, then watch a presentation called for a stock I though he said was ceam could not find it anywhere strike two. On the up side I bought other recommendations and they put me ahead so far, I buy a little at a time as I don't know much about the market and don't have a lot to invest, realize this they are selling their knowledge for the research they have done and nobody bats a thousand on the other hand if they were auto mech. Would they work on your car for free, it's business. Just my two cents worth.

Thank you for your feedback.

We're sorry to hear your experience has been rocky at times, although we appreciate your input. If you aren't sure what stock was being discussed in a presentation, I encourage you to reach out to our Member Services department - we feature a great team of Foolish representatives ready and able to help guide you through your subscription.

It's great to hear you're building a diverse portfolio, and you've given an explanation as to why we think it's a good idea. We encourage our members to build a diverse portfolio of at least 10-15 stocks, and to hold those stocks for a minimum of 3-5 years. We believe this pairing is the best way to counteract a fluctuating market.

If you'd like to read more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the help tab on Fool.com or by phone.

Foolishly,

Ashley

Q&A (10)

Is The Motley Fool a scam or a legit company?

Answer: Kind of a scam: impossible to cancel auto-renew subscription from their website and impossible to contact member support, been trying HARD for 15 days...

Should I invest in Stock Advisor or Rule Breakers?

Answer: Absolutely not... pure waste of time and money...

Which one is worth it: the boss mode or extreme opportunities platinum.?

Answer: If you'd like to learn about the differences between Boss Mode and Platinum, I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

Why is the name of your company so Stupid?

Answer: If you'd like to know the reason behind our name, visit this site or read below: https://www.fool.com/about/ The Motley Fool's name comes from William Shakespeare's play "As You Like It". The court jester, known as the Fool, could speak the truth to the king and queen without having his head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom. In the same way, we aim to speak the truth about money and investing...and to make financial guidance accessible to people of all backgrounds and experience levels.

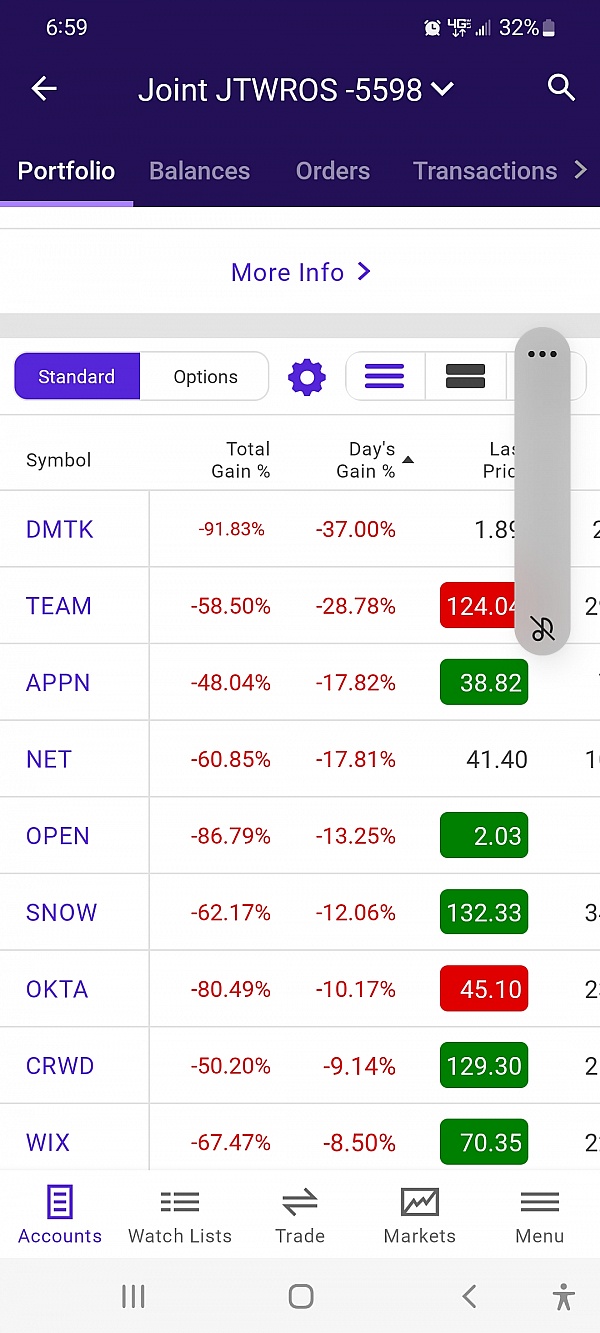

Are you guys really this incompetent? I mean really justlook at upstart, path, wkhs, payc, shop, Sq, dis, mtch, team, adsk, nflx, lulu, ttd, coup, pin

Answer: Yes, they are that incompetent. I also own all those junk stocks after listening to these thieves advice

What is new about Amazon? Somebody told me there is a golden opportunity to buy their stocks. Is there anything true to that?

Answer: For questions regarding our services or our marketing, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Hi, I am thinking of subscribing to your services, but would like to see your platform first before subscribing. Are there any free trials?

Answer: For questions regarding our services, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Where and how do I make an investment

Answer: To start with, you stay as fat away from motley fools picks as you can. They are a huge pump and dump scam, nothing more. Anyone tellimg you different has skin in the game at motley fool headquarters. If a revolution breaks put, these scum bags are first on the list to be hung

Why do you keep hawking for more money by promissing more opportunity? Just have one fee for ALL.

Answer: They cater to different requirements. The motley Fool One combines them all but I am not sure is open to new members. I just renewed my three year membership that has yielded many times over its cost.

Have a question?

Ask to get answers from the The Motley Fool staff and other customers.

About the Business

The Motley Fool provides leading insight and analysis about stocks, helping investors stay informed.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Thank you for the positive feedback!

We appreciate hearing that you're enjoying our research and recommendations. If you'd like to learn more about the latest guidance for a particular stock, you can log into Fool.com and use the "Search Ticker or Keyword" box in the upper left-hand corner. Simply type in a company name or ticker symbol and select it from the drop-down menu that appears. This will take you to the stock's Snapshot page, which includes a graph of the trends, reports, articles, and the latest guidance for your service(s).

We’re glad to hear you’re following our Foolish investing philosophy. We believe the best way to counteract the whims of the market is to build a diverse portfolio of at least 10-15 stocks that you plan on holding for a minimum of 3-5 years.

If you're unhappy with the amount of emails you're receiving, we'd like to help you fix that! At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by phone.

Foolishly,

Ashley