The Motley Fool Reviews Summary

The Motley Fool has a rating of 2 stars from 334 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with The Motley Fool most frequently mention customer service, stock recommendations and credit card. The Motley Fool ranks 2nd among Stock Research sites.

JAN 2022 The following recommendations were made:

SHOP at $1000+/sh; 4/21 its under $500

NFLX@ $400/sh; 4/21 under $220

CFLT@ $63; 4/21 at $36

Since January 2022 TWLO down 36%. UPST down 30%. DOCU down 28%. DOCN down 24%. ALGN down 22%. Five other recommendations down 10-16% during same time frame.

CRWD & NVCR are their winners during this time. All told, you would be down well over 20% in four months.

But if you buy 25 or more stocks and hang on to them for 5+ yrs, you'll allegedly beat the S&P 500. Given they recommend so many stocks, you better hope you pick winners and avoid their losses. I can get free picks from just about any financial publication for free and get the same returns. Given how far these stocks are down with absolutely no market guidance from "The Fools", I'm glad I took the time to monitor before jumping in with both feet. This is a well marketed operation with little to offer beyond what you will get for free from Bloomberg, Kiplingers or Money.

I spent over 1000 to get 10x stock picks and I am down 30% after following their recommendations exactly. I highly recommend you do not use this service!

Thank you for your feedback.

We're sorry to hear you've been disappointed in the performance of your service so far. It's important to keep in mind that no financial publisher, The Motley Fool included, can guarantee that a recommended stock will not fluctuate. Investments are inherently a risk, and the market will vary. We encourage our members to build a diverse portfolio of at least 25 stocks that they plan on holding for 5 years, minimum. We believe this pairing is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

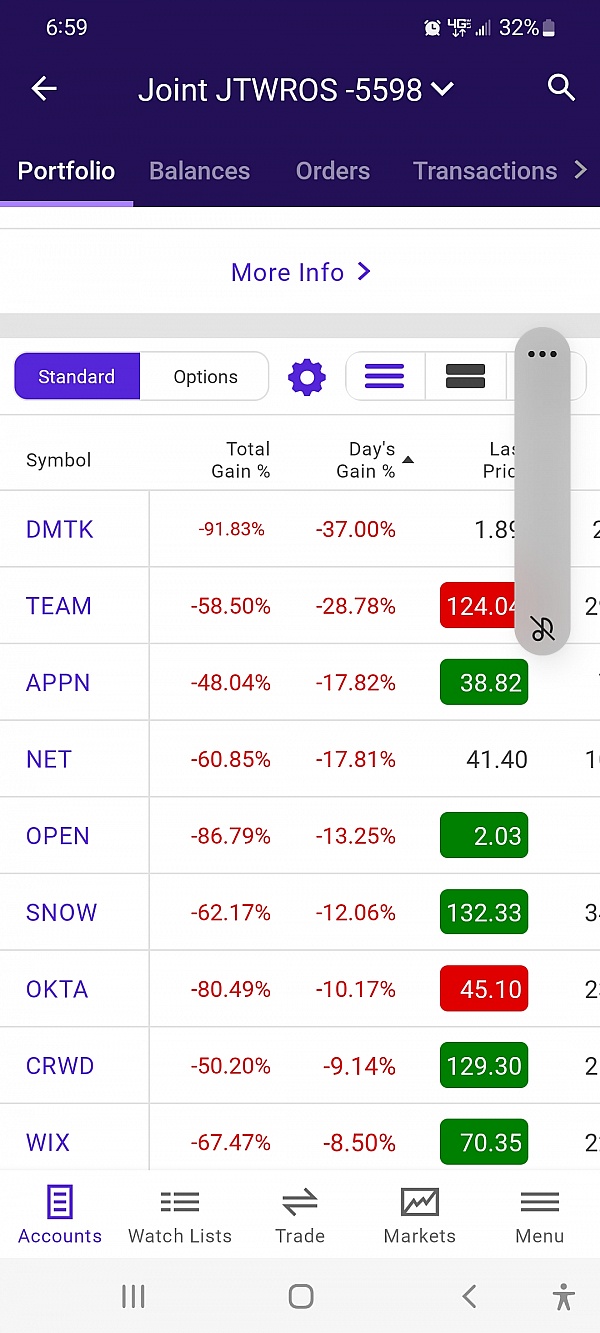

After taking my non refund subscription they sent me a list of stocks I should buy for the long-haul. Within three months every last one of them is down 50 to 60%. - four times as bad as the S&P performance over the same period. Bottom line they sent old outdated news that put me closer to the poorhouse.

Thank you for your feedback.

Unfortunately, we're unable to find any accounts with the information you've provided. Most yearly promotions of Stock Advisor offer a 30-day, money-back guarantee.

We're sorry to hear you've been disappointed in the performance of your service so far. It's important to keep in mind that no financial publisher, The Motley Fool included, can guarantee that a recommended stock will not fluctuate. Investments are inherently a risk, and the market will vary. We encourage our members to build a diverse portfolio of at least 25 stocks that they plan on holding for 5 years, minimum. We believe this pairing is the best way to counteract the whims of the market.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

While packages that require mininum maintenance are good; premium packages are not. The cost is $2000 per premium package and there is about a 25% overlap being stocks in premium packages and stock advisor/other premium packages. Moreover, custommer service dwindles exponentially after the first 30 days (in which you can get a refund). For example, the package I had they ranked all 40 stocks for the first four months, now after 11 months they only rank 10. Moreover, rankings, which are supposed to be monthly, are really every 6-8 weeks. There are supposed to be MFool people answering members' questions - but questions all go unanswered. The commentary on the stocks is kidish and less than someone would get going to the internet and search on one's own. Numerous errors are made by MFool people, for example, stocks that members were told to sell show up on rankings two months later. Members are told to buy stocks that aren't even in the portfolio. In short, the management of the premium packages is terrible. I know, for example, the members in the premium package I belong to - are not renewing and many have went to other services like Seeking Alpha - it is better and much more accurate.

Thank you for your feedback.

Unfortunately, we're unable to find an account with the information you've provided. We'd love to reach out to you to assist you further with your account and subscription, but we are unable to do so at this time. Please contact our Member Services team for assistance - Help@Fool.com

The Motley Fool

Of course Motley Fool has responded by stating they cannot find my account, this is "text book" marketing actions of a business trying to discredit a disgruntled and unhappy customer and not taking responsibility for the business poor performance. Well here is the respond they sent me.

Please note the standard words in their response, but more importantly the time frame has extended to 10-20 years and the last paragraph expressing there legal position.

We are now 16 months in and the portfolio performance has just got worse! Some stock are down 40%+

Christine (The Motley Fool)

Apr 2,2021, 5:10 PM EDT

Hello Lindsay,

Thank you for contacting The Motley Fool.

There isn't a financial publisher, The Motley Fool included, that can promise that a recommended stock will not encounter market fluctuations. Investments are inherently a risk, and the market will fluctuate. We invest in companies in which we have long-term confidence, and encourage our members to do the same.

The market has its ups and downs, but over time, it goes back up. In the short term, anything can happen — including market corrections and even crashes. One of your holdings could fall by 20% tomorrow but if you're holding for the long term, you can ride out the downturns. While it might seem devastating today, that drop won't matter in 10 or 20 years. If you ride out the dips, you'll likely benefit from the long-term wealth-building magic of the market, which is why we are long-term investors at The Motley Fool.

One of the principal tenets here at the Fool is that the best person to handle your finances is you. By your use of our Services, you're agreeing that you bear responsibility for your own investment research and investment decisions. You also agree that The Motley Fool, its directors, its employees, and its agents will not be liable for any investment decision made or action was taken by you and others based on news, information, opinion, or any other material published through our Services.

Thank you for your feedback.

We apologize for any frustrations - because Sitejabber only requires a first name and last initial, we are unable to find your account, as there simply isn't enough information provided. If you have questions or concerns, we'd encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

The Motley Fool

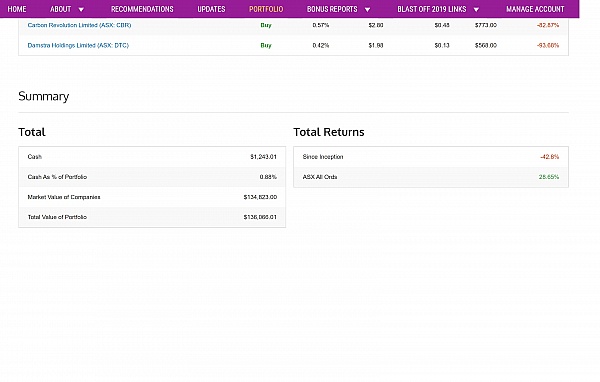

So I joined MF on a basic service, then was bombarded with offers of services that claim significantly better performance then the S&P500 ETC. After careful consideration and reading their growth statements I upgraded my service to Blast off 21, at nearly $2000AUD, and invested a significant amount of money!

After nearly 6 months the portfolio is over 20% down, whilst the S&P is 15% up. They state to hold for 3 years for returns, that said the current losses will most likely take at least a year to recover, if they do.

When I wrote to them asking what, or if there is a strategy to help improve the performance of the portfolio. I receive an unbelievable response stating "they take no responsibility for the performance of the recommendations", and I am "responsible for the investments", even though the whole intention of the service is to recommend stocks and follow their recommendations to the letter, which I initially did. Along with some statements clearly expressing their legal responsibility.

So you will only hear about the wins and the outstanding performance of some of their stocks, but not the losses, and don't expect MF to offer any useful responses to when they don't perform.

Of course all companies will state their wins, I completely understand this, but its when things go wrong that the true measure of a company and its customer service will be evident.

I also understand that stocks can go down significantly with market swings. But when a service is openly and clearly marketed, and sold on its performance to against another and then fails miserably one has the right to be upset.

The most disappointing part was their response to my question.

This clearly showed them to be a marketing company and not a true investment advisory company

Reckless stock advise. Been with them for 12 months and already my portfolio is down $*******. Don't be their Fool!

Thank you for your feedback.

One of our representatives has reached out to assist with any questions or concerns. You may want to remove the screenshot from your review, as you are sharing your full name, email address, and mailing address on a public review site.

When we recommend a stock in any subscription or strategy, we are doing so with the intention of holding that stock for 5 years, minimum. As long-term investors, we recognize that stock prices will fluctuate. That being said, we won’t always recommend a sell just because the stock price drops. We prefer to hold stocks in companies that we are confident in for the long term. If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

... and they seam to have been roughly 75% right.

But not recently.

Especially when they recommend and dont recommend the same stock at the same time as in this:

On Nov 3,2021 at 9:08AM,

You get this:

Motley Fool Issues Rare "All In" Buy Alert

Key Points

• Supply chain disruptions this year have been a bane but could be a potential boon for Coupa Software.

• Pager Duty stands to benefit significantly from the rapid increase in spending on corporate digital transformation.

Then on Mar 14,2022, you get this:

Eric Volkman

(TMFVolkman)

Should you invest $1,000 in Coupa Software Incorporated right now?

Before you consider Coupa Software Incorporated, you'll want to hear this.

Our award-winning analyst team just revealed what they believe are the 10 best stocks for investors to buy right now... and Coupa Software Incorporated wasn't one of them.

WTF!?

Thank you for your feedback.

One of our representatives has reached out to assist with any questions or concerns. You may want to remove the screenshot from your review, as you are sharing your full name, email address, and mailing address on a public review site.

When we recommend a stock in any subscription or strategy, we are doing so with the intention of holding that stock for 5 years, minimum. As long-term investors, we recognize that stock prices will fluctuate. That being said, we won’t always recommend a sell just because the stock price drops. We prefer to hold stocks in companies that we are confident in for the long term. If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

I used the service for 2 years. Their picks (other than the already know Apples and Facebooks, etc) are horrible. The thing is: they never go back and say how their other picks are doing. For example, they picked autodesk and I went with it. Stock stunk and the fools never mentioned it again. Never said sell it or boy did we do bad with this one. It wasn't just one stock, it was quite a few. They were still recommending Zoom until the day it took a dive. Not sure how they calculate their returns, but they should be looking at the 75% loss on that one. But they don't. Blindfold yourself and use a dartboard. Fool is aptly named.

Thank you for your feedback.

Unfortunately, we're unable to find any accounts with the information you've provided. It sounds like you may need assistance navigating your subscription - I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

Please let us know if there's anything else we can do.

The Motley Fool

As a beginner stock trader I put my trust into Motley Fool, they had a free year via Amex which I jumped at the opportunity. They would send me emails telling me to buy this now, or these are the best buys which comes out on Thursdays. However, EACH and EVERY one of their stocks I've bought have gone down after buying. I shouldn't have listened to them as I'm thousands in the red right now. Some of the examples they've blasted everyone to buy and have since tanked include "GDRX", "ETSY", "DOCU", "BYND"," RBLX", "CHWY", PTON", PINS" and "ROKU" just to give a few examples. These are all stocks in their BEST BUY NOW column that has come out each Thursday the past year. Keep in mind these are not stocks that go down a little bit, but have since tanked and lost 20-50% of its value. I wish I never saw the AMEX offer in the first place as they have cost me thousands.

Thank you for your feedback.

We're sorry to hear you've been disappointed in the performance of your service so far. It's important to keep in mind that no financial publisher, The Motley Fool included, can guarantee that a recommended stock will not fluctuate. Investments are inherently a risk, and the market will vary.

We encourage our members to build a diverse portfolio of at least 25 stocks that they plan on holding for 5 years, minimum. We believe this pairing is the best way to counteract the whims of the market.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

I subscribed thinking they had done extensive due diligence on their pics and during a bull market should expect moderate gains and not loses. Well guess what, FIVRR and OGI are dogs that they promoted and touted. Don't buy in to their sales pitch, it is not real. You are better off going it alone.

Thank you for your feedback.

Unfortunately, we're unable to find any accounts with the information you've provided. It sounds like you may be new to our services and our investing philosophy - we encourage our members to build a diverse portfolio of at least 25 stocks that they plan on holding for 5 years, minimum. We believe this pairing is the best way to counteract the whims of the market.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

The Motley Fool produces content like a spammy ad blog site, pushing out content that is favorable to the institutions and individuals that pay them to write biased "articles". None of what they write is credible or unbiased. For the first several years, they were a great resource but over the years, they've really gone down the gutter. A site full of misinformation and biased rhetoric. Avoid anything they say or sell.

Thank you for your feedback.

We're sorry to hear our services weren't the right fit for your needs, and wish you the best on your investing journey. If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

Motley's very top picks: Shopify, Digital Ocean, Upstart and others are down up to 60 - 73% the last 6 months, NASDAQ about 20% down. Digital Ocean is down 19% today and Shopify is down 17.5% today. NASDAQ is down 2.5% today. Their top picks are down 700% as much as NASDAQ!

But instead of owning up to how atrociously their very top picks have done the Motley company statement is: "It's hard across the board since the NASDAQ and thus our recommendations are not doing well at this time"! Their picks are doing 300 - 400% worse than NASDAQ. Motley needs to own up to that. When they talk about how good their stocks have done they compare their stock gains against Nasdaq. So when your stocks do horribly badly do the same: compare them to NASDAQ.

Thank you for your feedback.

We're sorry to hear of your frustrations over the recent performance. There isn't a financial publisher, The Motley Fool included, that can promise that a recommended stock will not encounter market fluctuations. Investments are inherently a risk, and the market will fluctuate. When we recommend a stock in any subscription or strategy, we are doing so with the intention of holding that stock for 5 years, minimum. As long-term investors, we recognize that stock prices will fluctuate. That being said, we won’t always recommend a sell just because the stock price drops. We prefer to hold stocks in companies that we are confident in for the long term.

It sounds as though you’re subscribed to receive marketing for additional Motley Fool services. Since publishers like The Motley Fool are prohibited from personalized recommendations, we offer all of our expanding and various services to members who have subscribed to receive promotions, in the hope of finding a better fit for some. Our many services simply follow different strategies and have different resulting risk profiles. At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

I enthusiastically signed up for Stock Advisor and then 2-3 other services. They're always marketing to you the next great service and the next and the next, etc. Problem is none did well over the last 14 months or so. I concede it was a tough year for the NASDAQ but they have to be accountable. Their pitch is they beat the S&P 500. They didn't come anywhere close. Yes, there were some really good winners but plenty of bad losers (like 60-70% decline losers). Their various services can never succeed when there are a bunch of those that they identify through their much hyped "research" and recommend. They'll say you have to wait it out five years. Not realistic unless someone can sit on a loser that long while your money could have had those same five years of compounding in a good index. They're good promoters. Not so good stock advisors

Thank you for your feedback.

Unfortunately, we're unable to find any accounts with the information you've provided. There isn't a financial publisher, The Motley Fool included, that can promise that a recommended stock will not encounter market fluctuations. Investments are inherently a risk, and the market will fluctuate. When we recommend a stock in any subscription or strategy, we are doing so with the intention of holding that stock for 5 years, minimum. As long-term investors, we recognize that stock prices will fluctuate. That being said, we won’t always recommend a sell just because the stock price drops. We prefer to hold stocks in companies that we are confident in for the long term.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

Everything costs. Appears every piece of financial insight requires added deposits. Over promises, under delivers.

Thank you for your feedback.

The Motley Fool is a business and cannot offer paid information outside of our subscriptions as a matter of fairness to our paying members. That said, we also offer a host of free information at fool.com - you may peruse that at your leisure and needn’t purchase any Motley Fool products to do so.

It sounds as though you’re subscribed to receive marketing for additional Motley Fool services. Since publishers like The Motley Fool are prohibited from personalized recommendations, we offer all of our expanding and various services to members who have subscribed to receive promotions, in the hope of finding a better fit for some. Our many services simply follow different strategies and have different resulting risk profiles.

At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

I suppose these guys rise with the other boats on rising tides but their recommendations that I took in a late bull market tanked. Premium membership promotions that seemed to come with every email too. Motley Fool is a herendous waste of time and money in my opinion.

Thank you for your feedback.

Unfortunately, we're unable to find any accounts with the information you've provided. We’re sorry that your experience with our marketing has been frustrating. There is no singular investing strategy which fits the needs, preferences, and a reasonable fee ratio of all investors. Our many services simply follow different strategies and have different resulting risk profiles. Since publishers like The Motley Fool are prohibited from personalized recommendations, we offer all of our services to members who have subscribed to receive promotions in the hope of finding a better fit for some. The fact that we offer other strategies to allow for different interests and investment styles does not diminish the quality of your service and its affiliated information. At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

It's important to keep in mind that no financial publisher, The Motley Fool included, can guarantee that a recommended stock will not fluctuate. Investments are inherently a risk, and the market will vary. We believe pairing a portfolio of at least 25 stocks with a long-term investing outlook is the best way to counteract a fluctuating market.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

Motley fool is for fools. They recommend the same picks and they give a buy recommendation when the stocks are highly over priced. I honestly believe Motley fool is a pump and dump scheme. I am down anywhere from 50 to 95% on every stock I bought on their recommendations. Buyers beware is the best advice I can give you. My previous reviews of motley called them out and they responded to those reviews exactly how I predicted. Anyone considering subscribing to them, you will be a fool to do so. Seeking alpha or Kramer will give you much better advice. I can't stress enough what terrible forecasts Motley fool predicts. Investing isn't rocket science, your not going to get rich quick. But if you listen to the Motley fools you can go broke quick, that's a promise. NOT only are they taking you to the bank with subscription fees, they recommend a stock, you, and all the other fools buy it which pumps the price up, and the swindlers at Motley fool cash out, dumping their shares and leave you holding a bag of trash stocks. Unless you have way too much money amd are looking for a way to lose a bunch, don't take their advice

Thank you for your feedback.

It sounds as though you’re subscribed to receive marketing for additional Motley Fool services. Since publishers like The Motley Fool are prohibited from personalized recommendations, we offer all of our expanding and various services to members who have subscribed to receive promotions, in the hope of finding a better fit for some. Our many services simply follow different strategies and have different resulting risk profiles. At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

When we recommend a stock in any subscription or strategy, we are doing so with the intention of holding that stock for 5 years, minimum. We believe pairing a portfolio of at least 25 stocks with a long-term investing outlook is the best way to counteract the whims of the market. That being said, it is ultimately up to our members to build a portfolio that works best for their investing journey.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

Motley Fool's slogan should be "buy high, sell low". Their picks usually crash shortly after they recommend the stock. I'm not sure where their return info on their website come from; it certainly hasn't been my experience.

Thank you for your feedback.

Unfortunately, we're unable to find any accounts with the information you've provided. Our Member Services team would be happy to answer any questions you may have about our services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

We're sorry to hear you've been disappointed in the performance of your service so far. It's important to keep in mind that no financial publisher, The Motley Fool included, can guarantee that a recommended stock will not fluctuate. Investments are inherently a risk, and the market will vary.

We encourage our members to build a diverse portfolio of at least 25 stocks that they plan on holding for 5 years, minimum. We believe this pairing is the best way to counteract the whims of the market.

Please let us know if you have any additional questions or concerns.

The Motley Fool

I'm a subscriber to Stock Advisor and echo the complaints about the never ending sales pitches. I could put up with that if, and a big if, their stock picks were worth it. If you're able to figure out how to get to their scoreboard, they do a nice comparison against the performance of the S&P. Let's see how they're doing: as of 2/3/22,18 of their last 19 picks underperformed the S&P. 33 of the last 36 are underperforming. It's not even close. A lot of these are underperforming by 20-60%! They even report some are underperforming by worse than 100% (that takes a near complete collapse while the market is up.) Why is this? They're a one trick pony relying on a single style (think Cathie Wood) of picks. They found something that worked well in 2020, but it gets blown up when the market rotates. Will they come back? Maybe, but they're getting destroyed in 2022.

Thank you for your feedback.

Unfortunately, we're unable to find any accounts with the information you've provided. It sounds like you may need assistance navigating your subscription - I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

There is no singular investing strategy which fits the needs, preferences, and a reasonable fee ratio of all investors. Our many services simply follow different strategies and have different resulting risk profiles. Since publishers like The Motley Fool are prohibited from personalized recommendations, we offer all of our services to members who have subscribed to receive promotions in the hope of finding a better fit for some. The fact that we offer other strategies to allow for different interests and investment styles does not diminish the quality of your service and its affiliated information.

At the bottom of every marketing email, there is a link to unsubscribe. Additionally, you can log into Fool.com, click on "My Fool" in the upper right-hand corner, and then click on "Email Settings." This will allow you to adjust your email settings to your preferences.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

Would have done much better without their recommendations.

For example, they recommend Skillz Inc around Feb/Mars 2021 when it's all time high. Today, it's down from $40 to $4.

Thank you for your feedback.

There isn't a financial publisher, The Motley Fool included, that can promise that a recommended stock will not encounter market fluctuations. Investments are inherently a risk, and the market will fluctuate. When we recommend a stock in any subscription or strategy, we are doing so with the intention of holding that stock for 5 years, minimum. As long-term investors, we recognize that stock prices will fluctuate. That being said, we won’t always recommend a sell just because the stock price drops. We prefer to hold stocks in companies that we are confident in for the long term. We believe pairing a portfolio of at least 25 stocks with a long-term investing outlook is the best way to counteract the whims of the market.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

So many of their recommendations are down MORE than 50%. E.g. Early 2021 they recommended LMND when it was well above 100, look where it is now. Same goes for most of their recommendations from 2021. LMND would need to go up 400% to get to where it came from. Even more conservative recommendations like NYT are down. UPST, yeah, first a success but it gave back all its profits, big loss now.

Other tickers are FVRR, OKTA, COUP, CPNG. Always use stop losses and much more important, your brain. Sell short whatever they recommend:-)

Thank you for your feedback.

It looks like you've let your subscriptions expire - we're sorry to hear our services weren't the best fit for your investing journey. It's important to keep in mind that no financial publisher, The Motley Fool included, can guarantee that a recommended stock will not fluctuate. Investments are inherently a risk, and the market will vary.

We encourage our members to build a diverse portfolio of at least 25 stocks that they plan on holding for 5 years, minimum. We believe this pairing is the best way to counteract the whims of the market.

If you have any other questions, need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool

Q&A (10)

Is The Motley Fool a scam or a legit company?

Answer: Kind of a scam: impossible to cancel auto-renew subscription from their website and impossible to contact member support, been trying HARD for 15 days...

Should I invest in Stock Advisor or Rule Breakers?

Answer: Absolutely not... pure waste of time and money...

Which one is worth it: the boss mode or extreme opportunities platinum.?

Answer: If you'd like to learn about the differences between Boss Mode and Platinum, I encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions and guide you through your services. You can reach our representatives via the Help tab on Fool.com or by email – Help@Fool.com

Why is the name of your company so Stupid?

Answer: If you'd like to know the reason behind our name, visit this site or read below: https://www.fool.com/about/ The Motley Fool's name comes from William Shakespeare's play "As You Like It". The court jester, known as the Fool, could speak the truth to the king and queen without having his head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom. In the same way, we aim to speak the truth about money and investing...and to make financial guidance accessible to people of all backgrounds and experience levels.

Are you guys really this incompetent? I mean really justlook at upstart, path, wkhs, payc, shop, Sq, dis, mtch, team, adsk, nflx, lulu, ttd, coup, pin

Answer: Yes, they are that incompetent. I also own all those junk stocks after listening to these thieves advice

What is new about Amazon? Somebody told me there is a golden opportunity to buy their stocks. Is there anything true to that?

Answer: For questions regarding our services or our marketing, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Hi, I am thinking of subscribing to your services, but would like to see your platform first before subscribing. Are there any free trials?

Answer: For questions regarding our services, we encourage you to reach out to our Member Services department. We feature a great team of Foolish representatives ready and able to help answer your questions. You can reach them via the Help tab on Fool.com or by email – Help@Fool.com

Where and how do I make an investment

Answer: To start with, you stay as fat away from motley fools picks as you can. They are a huge pump and dump scam, nothing more. Anyone tellimg you different has skin in the game at motley fool headquarters. If a revolution breaks put, these scum bags are first on the list to be hung

Why do you keep hawking for more money by promissing more opportunity? Just have one fee for ALL.

Answer: They cater to different requirements. The motley Fool One combines them all but I am not sure is open to new members. I just renewed my three year membership that has yielded many times over its cost.

Have a question?

Ask to get answers from the The Motley Fool staff and other customers.

About the Business

The Motley Fool provides leading insight and analysis about stocks, helping investors stay informed.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Thank you for your feedback.

We're sorry to hear you've been disappointed in the performance of your service so far. It's important to keep in mind that no financial publisher, The Motley Fool included, can guarantee that a recommended stock will not fluctuate. Investments are inherently a risk, and the market will vary. We encourage our members to build a diverse portfolio of at least 25 stocks that they plan on holding for 5 years, minimum. We believe this pairing is the best way to counteract the whims of the market.

If you have any questions regarding your subscription(s), need assistance navigating our website, or would like to share additional feedback, please reach out to our Member Services department - we're happy to help! You can reach our representatives via the Help tab on Fool.com or by email - Help@Fool.com

The Motley Fool