CareCredit Reviews Summary

The company has garnered a predominantly negative reputation, with numerous customers expressing dissatisfaction with high interest rates, unexpected fee structures, and poor communication regarding account management. Many reviews highlight frustrations related to customer service, citing unhelpful representatives and unresolved disputes. While some customers appreciate the convenience of financing options for healthcare expenses, these benefits are overshadowed by concerns over predatory practices and a lack of transparency. Overall, the sentiment reflects a significant need for improvements in customer support and clearer communication regarding terms and conditions to enhance customer trust and satisfaction.

This summary is generated by AI, based on text from customer reviews

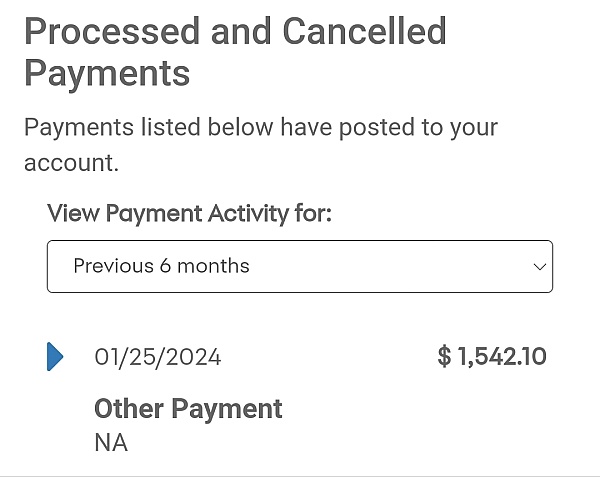

Zero stars. As much as I am thankful for the credit to get my gum suture done. It was an unnecessary treatment and CareCredit doesn't care about getting our refund back. Not to mention, called numerous times to change/update my due date because they charged me over $30 interest when I did in fact, call and change the date about FIVE times! The new date did not reflect on my new statements. They have charged me $304.44 in the past year for interest charges! And poor customer service! The last agent I talked to was yelling AT ME! I held it together and apologized was the stronger person by far. But that is NO WAY right treating the customer like that! He was saying that I NEVER CALLED when I did just a couple weeks before that and nothing was notated when I called the first time!

I got the card with one year no interest, sure enough they are chargng me something called, +/- credit, fees, adjustment! Thieves!

People don't speak English. Purchases need to be paid by their "promotional period. If not, the interest accrued is approx $300.00 more. If purchase is under $200.00

$26.69 interest is accrued. So if purchase from 2016 of $58.00 is now $150.00! When call to explain why, you get different answers. Stay away from this credit card if you can.

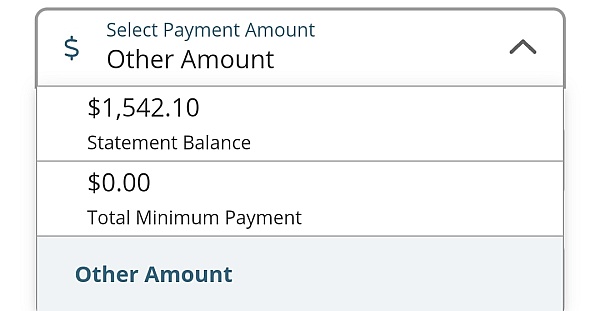

I am appalled at the rudeness of the customer service agents. Two of the people I spoke with yesterday, asking for help regarding my account, were not only less than helpful but were actually very mean. This is not the first time the customer service reps have been rude. After being kept on hold for 32 minutes, one of them--a manager, no less--told me she could not wait longer than two minutes for me to get my husband on the phone to confirm that I was allowed to access our account. When I refuted this, she said, "Actually, I am under no obligation to wait at all for you" and then hung up on me! WHAATT? This same person also argued for a good 5 minutes that the customer service phone line is available 24/7 but on the Synchrony site it says M-F 9-5. More than just the way they treat their customers on the phone, the company is sneaky in their practices. Some providers will offer promotional purchases--like 6 months no interest. However, some don't or will only offer it for purchases over a certain amount. If you have both promos and regular charges on your account, Care Credit will apply your payment to the promo (no interest) first unless you call and tell them to apply it to the high interest (23.9%) purchases first. So it is VERY easy to get huge interest charges building up very quickly, without being aware. It is a deceptive, awful company. I do not recommend them at all.

Every month i go in to pay care credit my login info is not valid, nor is my personal information. Not sure why this happens, this is getting old, not sure if if company has the security to protect our information requiring their customers constantly change login info. This is highly annoying and will no longer be using this card. Not sure if this is set up to receive late fees, not sure what is going on here?

Care Credit is easy to use but you better pay it off fast! Great for very temporary financing only. My credit got tanked cuz once the interest payments start I could not keep up. Find another way to get financial help but don't use this service.

Be wary if you have an FSA account that could cover some of your medical expenses. They won't let you make payments with your FSA account. They tell you to contact your FSA account to get an "account number", which my FSA said didn't exist. Then, when you offer to pay with a non-FSA debit account (to seek reimbursement for the medical expense) they tell you their policy is to only provide a written confirmation. What legitimate company refuses to provide a written receipt? In fairness, I am paying the bill on behalf of my husband. They tell me that if he called in, he could ask them to send him a "letter," which they wouldn't represent was actually a receipt for payment. But how does it make sense that I can call in to make his payment but I can't request that you send him (to the address he has on file) a receipt? Clearly, they whole system is set up to be sketchy. The weirdest part was that the person I first spoke to would answer questions that I had with a contradicting answer. For example, I asked "can I pay the amount due with a flex savings account card?" and her response would be "Absolutely! You cannot pay with a credit card." It was extremely confusing talking to her.

They lure you in with money to pay for emergency medical bills knowing people are desperate and might not be paying attention to fine print. You make all your minimum payments and then they suddenly slap you with 1300 in interest reporting you're over the limit to the credit bureaus. Asked for increase to cover over the limit amount only to be denied. Supervisor contacted giving less than a month to pay 1500 to avoid fees. Going to have to get another card or dip into retirement to cover this. They are crooks, do NOT get this service!

Care Credit (aka Synchrony Bank formally GE bank) takes your personal information from your provider to try and get you to sign up for one of their high interest credit cards. Stay Away

If you are thinking about using CareCredit for dental work, explore every other possible option in the world first. Including a loan shark- they would be easier to work with. CareCredit has absolutely no idea how to accurately deduct payments, or ever, ever, ever let you talk to a human. I was actually hung up on 2x by a automated message. For the 3rd month in a row, I recieved a message that my payment had posted, only to get an automated call the next day saying I was late. You cannot get by the automated message with asking to speak to a representative- the machine must know why, and if it does not like your answer, it hangs up. Completely frustrating!@!@!

I first got care credit when I was new to the credit card world to use toward my dog's emergency vet bill. I racked up almost $2,000 on it and qualified for the no interest if paid in full promo they had. So I made payments as much as I could. I almost had it paid off when I got a statement in the mail showing $200 in interest had been added on. I freaked out and called customer service who said it was deferred interest. I had no idea what that was. I know now. And now I make sure I have everything paid off within the promo period. I don't care much for care credit. The monthly payments also kept going up too. Your better off just using a regular credit card.

Sent in 6 months of payments at the start, thinking I was off to a good start. Got a notice the next day my next payment was expected in about three weeks! Called them to ask why they were billing me when they already had 6 months of payments in hand and got an indefensible explanation regarding "policy" and "billing cycles." No reputable credit company operates this way. WARNING: Paying early will not ease the burden of minimum monthly payments with this bunch of predators.

This company is skilled at collecting interest on "no interest promotional periods". I have several "promotional interest free charges" due to my fur babies getting sick so often and so expensively. Although I have outstanding credit with this company, I have to carefully watch EACH AND EVERY MONTH how they are applying payments. Even in the face of an expiring term, they will NOT pay on that charge, UNLESS you call in and insturct them like a parent to a child. They REFUSE to confirm anything with you. When I ask they confirm the amount I want allocated to a certain charge, their response is, I cannot tell you anything. Ummm, excuse me, but that is code for I will allocate your payment after you bother us enough in a given month. Oh, by the way, you are required to wait AFTER payment is made, then call them and instruct how the payment should be applied. That is, Dear Company, I have a promotional interest free charge expiring this month could you kindly apply the payment that I emptied my bank account to make to that charge? Oh and thank you Dear Company for taking up 2 billing cycles to complete that transaction so that you can collect your interest. Stay far from this company, they very unethical to say the very least about them.

Was not told about Promo period. Left with high balance that I could have paid off if I realized the interest rate was deferred to higher rate. Only good if you pay off in Promo period. Had been making payments for 8 months on a 12 month. When I figured out about the "Promo" period... pleaded with 3 representatives to apply all 8 payments to account. They each time considered it, then shot me down. Phones manned by overseas reps that are frustrating to say nicely! No matter how good you handle account, you never have a chance to reduce interest rate. When I make payments and choose to take survey, always hangs up before being switched. Ruthless plan. Sure, if it was explained in detail, maybe it works. But to say your helping and catch a few that don't understand, take advantage? Kinda like "pay day" loans.

Used care card twice for my dog being to the vet first time had problems but paid off card second time I used was for a vet bill $560 they did not send me any paperwork or due date for 3 months then when I did get it from a phone call they tacked on late fees for 3 months in a total of over $110 when I told them that it was their fault that I never received any notice of when the payment was due and the actual due amount I made them a payment then I made another payment a month later after making 3 payments and over $300 paid on a $560 bill they still said that I owed $427 when I explained the first time I made my payment that they didn't send me anything they said there was a 10-day grace. Over the due date that you would not get charged when I just talked to a manager he said there is no grace period and he couldnt explain why my first bill was not sent to me until three months later but couldn't take of the fees because it automatically charges on the due date when i asked him where the other $350 i had already paid went he also couldn't tell me! When i made my last payment the bank said my account was paid but it would take 48hrs to post on my account. I asked if that 48hrs would cause a late fee on my account when i paid it on the due date he said yes it would! So when you make a payment on your due date the bank takes 48 hours to put it on to your account in that 48 hours they will charge a late fee so another words you pay for their 48 hour post when you actually paid the payment on time! This is the worst bank I have ever dealt with I will never use them again!

Like one other reviewer said, the complaints about these financial dirt bags is that people don't understand what a "promotion period" is. I got my card a few years back and charged it up to $10K limit with a 12 month promotional period. Paid minimum balance every month. On the 11th month, my calendar popped up with a reminder (the reminder that I set when I made my first charges) telling me to pay the card off that day. I did. Result: I borrowed 10K from these horrible people interest-free for 11 1/2 months! They soon called back and wanted me to get their regular card for 26.99%. I said "thanks, but no thanks." They then agreed to give me ANOTHER promotional card - this time for $7,500. Wonder, wonderful idiots! I will use this card in the exact same manner as the first. People: Learn how to scam the scammers. It makes life a truly beautiful and wonderful experience.

Read these words: DONT. USE. THIS. CARD. UNLESS YOU 1) PLAN ON PAYING THE MINIMUM PAYMENT EVERY MONTH AND 2) PAY THE *ENTIRE AMOUNT* OFF ONE MONTH BEFORE THE TOTAL IS DUE. PERIOD!

I agree with the negative reviews here. Will never use this card again. Interest is outrageous once the promo period is over.

CC is easy to apply for and obtain, making it an attractive option for financing needed medical/dental procedures. The interest rate skyrockets after the promotional period is over, however. I suggest having a plan in place ( e.g., debt consolidation loan) to pay off the debt before interest kicks in, saving you thousands in interest.

Wow, I have never had an experience as bad as this. To save my pet's life, my vet referred me to CareCredit with zero % interest for 18 months. I set it up for auto payment from my account and didn't look online at the account for 4 months! Every month had interest and when I called they wouldn't take off the interest. Horrible customer service, I immediately paid the balance with a balance transfer from CapitalOne with no interest payment for 18month. I KNOW they wouldn't rip me off like CareCredit. Please stay away from these liers. Bad, bad, bad...

This is not a scam. Like most banks who lend money, you have to pay loan off by end date, or there is usually a stiff penalty. That's one of ways banks make money, and they generally are not happy if you don't pay it off on time, honoring your agreement with them. This is one way you get good credit and are deemed responsible. Most all credit cards are backed by banks and you have to stick with your agreement with them, or you are penalized; by late payment fees, for example.

With no interest promotion credit cards there are strict rules about how card is no longer interest free if you don't pay in full by promotion end date and they tell you clearly that this is the deal, All your accrued interest will be added to your principal if not paid off by promo end. I always pay in full a few weeks before promo ends and send the last payment with a return receipt so i have evidence that i paid it off on time.

Unfortunately these promotional cards work better for people who don't really need the loan, but want to leverage their money with a no interest loan. If you are sometimes short on funds you would do better paying monthly interest on a card where the minimum payment will be less and so will the interest if you can't make a payment on time. But for cards that have no interest promotions, the rules are the same for all of them. It's not a scam, it's just the way business works.

Q&A (102)

Have a question?

Ask to get answers from the CareCredit staff and other customers.

About the Business

Discover the healthcare financing credit card from CareCredit. Learn about financing for procedures like LASIK, cosmetic surgery, dental, & more.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Similar businesses you may also like

See more Credit Cards Businesses- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members