CareCredit Reviews Summary

The company has garnered a predominantly negative reputation, with numerous customers expressing dissatisfaction with high interest rates, unexpected fee structures, and poor communication regarding account management. Many reviews highlight frustrations related to customer service, citing unhelpful representatives and unresolved disputes. While some customers appreciate the convenience of financing options for healthcare expenses, these benefits are overshadowed by concerns over predatory practices and a lack of transparency. Overall, the sentiment reflects a significant need for improvements in customer support and clearer communication regarding terms and conditions to enhance customer trust and satisfaction.

This summary is generated by AI, based on text from customer reviews

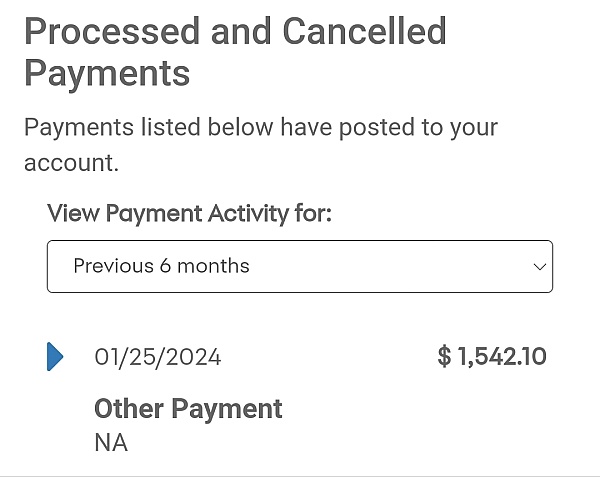

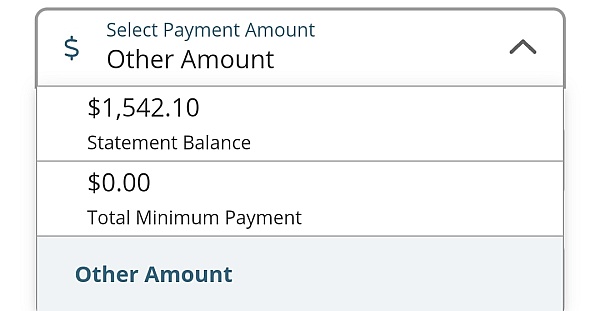

We were told we had 15 months at 0% to pay a $1439 service so we set up automatic payments and paid it off in 14 months (a month early for safety). We then found out it had to be paid in 12 months and we now owed $365 in retroactive interest. I called sustomer service and although they clearly saw that there was a misunderstanding and we had paid every month on time, and in good faith, they were unable to do ANYTHING to help. I would have been okay with spitting the difference. Wish I had read their terrible reviews before trusting them! Never again

I had some dental work done and charged the almost $900 on my CareCredit card and paid it off in the 24 months As outlined when I charged the $900 ( for it to be interest-free). As soon as I paid it off I received a letter stating they closed my account. They then said it was something on my credit report that made the decision for them to close my account. The kicker to this whole lie is my credit report was better after I paid it off then it was before they approved me so if that's the case why did I even get approved? I called them and customer service is extremely rude! They talk to you like you're nobody and as if they did you any favors but yet you gave them your business. The representative then told me three different reasons why it was closed and when I confronted her about each issue she gave me and asked why did she keep changing the reason she became more rude. So look somewhere else if you need credit for medical or veterinarian or Optical expenses. This is definitely not the company to deal with.

The company it self is ok. Every singe damn time I need to log into my account I either get locked out or I have to reset my freaking password. Your log in system is a joke. I even wrote down my log in name and password last time so I wouldn't have to go through that again, did that work HECK NO. Somehow you STILL have to reset the password and it takes over 30 minutes sometimes just to log in and pay my bill!

Here's how these companies (and other similar companies) operate: They rope you in, usually while you are under duress e.g. to save a loved one, with an unusually high interest rate if you miss ONE payment. So, for a few months, they send out monthly reminders that your payment is due. Here's the kicker, they then 'miss' sending a reminder. I know this because I have saved every communication from them and it was obvious where they skipped a reminder (I still have the audit trail). Same thing happened to my wife.

CareCredit simply SUCKS, run away as fast as you can!

I had to get a Care Credit card because i couldnt affod the test needed to check to see if hi had cancer I was told that i could get a care credit card and it would cover the cost and i could pay it off over time After a year of being in and out of the hospital and having surgery to have organs removed i get a notification that all the money i had payed off to synchrony financial care credit was being added back onto my debt because of some interest promotion i was not informed of Long story short no matter how ill you are and no matter how much you feel like your going to die take your time with companies like this and read all the fine print because even if they act like they want to help you they only want your money and will do anythign they can to make sure they get as much of it as possible.

Card statement and advertising is false, you can not pay all providers online using your card online. Do not use unless you wade through the site to see if your provider is listed. Emergency appendectomy at 2am, customer service told me nothing we can do i should of gone onto site. RIPOFF can't pay provider using useless card.

We applied for and received a large line of credit, but did not charge anything with them. We applied simply because they advertised "No Interest If Paid In Full" over a period of time ranging from 6-18 month, so we applied and received enough to cover braces for 2 kids. When we presented the card at the orthodontist, they laughed and said, "you know it will still be 17% interest, right?" And they gave us 14 mos at zero percent on their own! I called to cancel the CareCredit account, at which point I was told they won't cancel accounts withing 72 hours of opening them. So, they ran our credit and I now have another open account on my credit report, both of which lower my credit rating, all because of deceptive marketing practices.

If you are thinking of getting CareCredit, check with your Dr first before you apply. It's likely not as good of a deal as they purport it to be. It also appears to me that they are trying to get lower income folks signed up so they can hit them with high interest rates over the duration of the promotional period and then slam them with higher rates when the period ends and they haven't been able to pay. Reminds me of the credit card companies camped out at college campuses. As an aside, their customer service reps treat you like collection folks do - mine were rude and were talking to me like dirt before they even looked up my account. Really unfortunate.

You all really should be called "NO CARE CREDIT" since you charge 26.99% finance charge if POOR PEOPLE cannot make the promotional deadline... JUST SAYING. You should all be ashamed. I had to pay off someones debt to you all because if they did not make the PROMOTIONAL DEADLINE you wonderful people were going to charge and extra $700.00 plus finance charge. Something to be proud of... yeah.

Care Credit sucks, Period! They are scam artists and their reps lie or just completely uniformed, low paid drones who don't CARE.

I used $2926. 00 for my dental work in March 2017 and had 12 months to pay it off before getting hit with $800.00 in interest. No big deal since I had so much time, a payflex spending account and an open credit card. By January 2018, my balance owed was 2223. 00. No big deal, I still had 673.00 in payflex plus another $900.00 in payflex for 2018. 00. I was going to put $1573. 00 towards care credit... No bueno! They do not accept credit card payments of any kind. Checking account only! I paid the $1573. 00 cash and payflex reimbursed me. I paid another $500.00 This morning. Slide on over Bandit cause the Snowman is coming through. HOT DAMN WE'RE GONNA MAKE IT! Having care credit paid in full is going to look woohoo good on my credit. They are little snakes so be aware of your payment options ahead of time.

I wrote a review in 2016 complaining about them charging me a 250 dollar late fee. I just came across the review and thought i would revise it for anyone who has read it. I did not have a 250 dollar late fee but it appeared that way online and when i called to try to understand why my payment was 250 dollars more than it was supposed to be i was told by several representatives that it was because of my late fee so naturally thats what I thought it was.

Turns out 2 months ot payments were combined into one plus a 60 dollar late fee and that is why the bill was so high. I would have been more understanding of that but they have the worst customer service on the planet and i think it took a week and like 10 different customer service representatives to finally get one that was able to explain that to me clearly.

I am still paying off my bill with this company and after almost 2 years i still do not like them.

Ive ran into so many hidden fees & customer service has continued to be very unhelpful!

I signed up for Carecredit when I needed $4500 for some dental implants. They gave me an option of 12 months same as cash and then 26% interest if not paid in 12 months or a 60 month payment plan at 16% interest. Well obviously I went for the 60 months because I knew I wouldn't be able to pay the whole thing off in less than 12 months. I needed an additional $1700 of credit to get the crowns and they gave me an additional $3000 in credit no problem.

The lesson is READ WHAT YOU ARE SIGNING UP FOR. If you can't make all of your payments within 12 months and you sign up for 12 months same as cash then expect at the end of that 12 months to be charged the 26% interest you agreed on, there is nothing dishonest about this. If you are illiterate then have someone else read the contract for you.

The safe option here is to sign up for 60 months at 16% interest. Yes it will take longer to pay and you will have to pay interest every month but your payments will be less and your interest will be less. 16% is the average interest you pay on a credit card we when you have okay credit.

My only complaint is that I have excellent credit and I usually only pay 11% - 12% interest but also Carecredit gives me a much larger credit line than the rest of my credit cards.

Read the contract you are agreeing to.

URGENT LOAN HELP@ 2% INTEREST RATE with *******@outlook.com

I was stuck in a financial situation and i needed to refinance and pay my bills for my son's medication and buy a home. I tried seeking for a loans from various loan firms both private and corporate but never with success, and most banks declined my credit. But as God would have it, i was introduced to VICTORIA LAWSON Trust Loan Firm (*******@outlook.com) with 2% interest by a friend, and i got a loan amount within few days because i was not always online to responds to her mails. Today am a business owner and my kids are doing well... so i want to advice any one in need of a loan to quickly contact her via email on *******@outlook.com. I own Victoria every day appreciation for all she has done in my life. Her service is strong, big and reliable.

Not only do they charge a high interest rate, but when our dog went into the hospital for 3 days it ended up costing us a whole boatload of money and they refused to give us a temporary credit increase. Terrible company, don't do business with them. They're terrible. And just for the record the call center is in India, and of course the people who run the phone banks have no real power. Terrible company.

Who is worse? McCollum Family Chiropractic who set this up or Synchrony Bank who offers it? My 88 year old dad was taken to a chiropractor by mu sister against my warnings. He has spinal stenosis - an INTERNAL nerve passageway issue. He was desperate and was denied surgery. He wanted to try this. Well, the efficient chiropractor's insurance gal set him up with a $3900. 00 CARE CREDIT that would go directly into the pockets of the chirpractor that day. The office visits were $45.00 each! Simple math says he would have 86 treatments at 3 x a week for 28 weeks. Over 6 months! Are you kidding me? Why couldn't he just pay $45/visit and see how it went? In the meantime nobody mentioned that the promotional offer had to be paid off within a year or else he'd be hid with a 27% interests rate for the entire amount. He'd been paying almost 4 times the minimum payment and with two payments left he considered just paying it all off at once, but decided to make the final payment the following month. Well, that bill came with a $1200. 00 interest fee. He called me and I tried to handle it over the phone, figuring if you get right on it 3 weeks after the promotion ended and only $210.00 left on the bill they'd just waive it. OH NO! NOT SYNCHRONY BANK! The gal in the account escalation department was such a $#*! refusing to discuss anything. I made an online payment that day and gave them $210 in interest, figuring that much was more than fair. I got power of attorney for my dad and am dealing with them on this issue now as he is in no shape mentally or emotionally to be hounded by bill collectors. He is living hand to mouth. Any money he has is going t living expenses or medical expensis. Screw Care Credit! That is completely unethical. Hes s90 years old. Let them wreck his credit. As for McCollum Family Chiropractic, they lied about his treatment helping him. Every time he got worse but they charted he felt better. He even quit going with a $500 credit they refused to return to him.

I had excellent credit, then they send me a new card and said it was for an upgrade, I was randomly selected cause I was a great paying customer, and my credit was above 768... Well I get the card and activate it, thinking my old card wouldn't be good... well 30 days later, I get a credit alert that something has change on my credit, I check credit karma, an sure enough, Care Credit closed my acct! And my score dropped 93 pts! I ws livid, tried calling transunion care credit, they were just like oh we didt close your acct, I'm like, I'm looking right at it... CLOSED OCT 10TH 2017! Long story short, all they said was we will submit a ticket and if we are at fault, they will reverse it with Transunion, after telling me I activated the card, and if I read the long attorney like letter, I would have known that acct would be closed. I said I thought u guys said it wasnt closed. She didn't know what to say. So basically, they upgraded me, closed my acct, screwed my credit from an A rating to a D rating, and that was my thank you for being a great loyal cst.,, F... ed right up the butt,,, So moral of the story is, never upgrade with Care credit they will close out your acct! Kicker part is, I never asked to upgrade or close out the acct. Everyone knows when u close out a 5 yr card, your credit takes a huge hit@!

So thanks Credit Care for taking care of your great credit csts. What a bunch of unethical morons... Lets ruin someones credit cause they have great credit and close out their acct... Who does that? Baffled in Florida

I have no sympathy for people who "didn't know" they would be charged interest on charges if not paid within the promotional period. What they heck did you think you were signing up for? I have had an excellent experience with Care Credit for various dental and vet bills, in total amounts of approximately $3500 100% INTEREST FREE! I have been able to spread my payments out over a 6-12 month period (I schedule them in equal installments as soon as the charge hits my online account) Again, 100% interest free! What's not to love?

I used Synchrony Bank with my T. J. Maxx card years ago and it was a terrible experience. When I hit a $20,000 medical procedure done my doctor talked me into using Care Credit with no interest for 12 months. I can tell you I wish I could just use my Chase credit card or talk to my bank about a medical loan. Care Credit is a nightmare. I paid on time and in advance and I finally ran into a huge problem when I had a bogus contract with a chiropractor's office. Care Credit and Synchrony Bank did not represent me at all. I had to dispute because the chiropractor it told me I could cancel it with a full refund if I was unable to get a doctor's clearance to use his services. I was unable to use the services and wanted a full refund and his office gave me the run-around and when I filed a dispute with CareCredit they never represented me. His office sent in some partial records and they went along with them leaving me a balance for services not rendered of $590. I was Furious. Synchrony Bank and Care Credit was not in unity and it was a mess. Yesterday I went to the chiropractor's office and saw him directly and he told me his staff had never told him the circumstances and he apologized profusely and wrote me a check for the balance of $590 for the refund. When I called CareCredit to let them know I had resolved the issue myself in my favor their representative was rude and uninterested other than curtailing the call as quickly as possible. I only wish the promise survey had come on after I completed my call with her but instead I got to dial tone when she hung up on me. In 20 years I never had a problem with Capital One or my Chase credit card when I've had the rare dispute. I have clipped my CareCredit card and half and we'll pay it off at the end of the month and be done with it. Be careful of the free months of interest-free used with Care Credit because when that. Is over your interest rate will be anywhere from 24% to 36% and that is no deal my friend. Use your credit card, get a medical loan and if you can't do that don't get the procedure. Run from Care Credit Synchrony Bank less

I charged 250 on the card at the vets office cause our dog was really sick, i have paid over 436 dollars now and still somehow owe 213... talked to customer service and was informed that since i made my payments after 5pm on the due date they were considered to be late and had over 300 dollars in late fees. I wanted to jump through the phone and scream at this person cause that is outrages. She said she was sorry there was nothing i could do... So i have Cancelled this card and will never be applying for another one and letting my friends and family know to never get one of these. This company is just trying to rip people off and steal their hard earned money. But that is 90% of companies now a days anyway!

I am on social security because of all the cancer I've had. Got a card to get the care. Every month, I made my payments and the balance was coming down. It's a few days after the promotion ended, they added $700 interest. No one could help me, or were willing to help me. I told them I was going to die in the next few years, so credit doesn't really matter anymore. I said if they take that off, I will continue making payments. Otherwise, I won't make any payments. I called 3 times, and all of them said, if I can pay the balance off in a few days, they would take the charge off. Of course I can't. Each of them said there is NOTHING that can be done/worked out. They feel they are being fair. I feel they are whores for money, who take advantage of the poor. All the payments I have made didn't take the balance down at all.

Q&A (102)

Have a question?

Ask to get answers from the CareCredit staff and other customers.

About the Business

Discover the healthcare financing credit card from CareCredit. Learn about financing for procedures like LASIK, cosmetic surgery, dental, & more.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Similar businesses you may also like

See more Credit Cards Businesses- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members