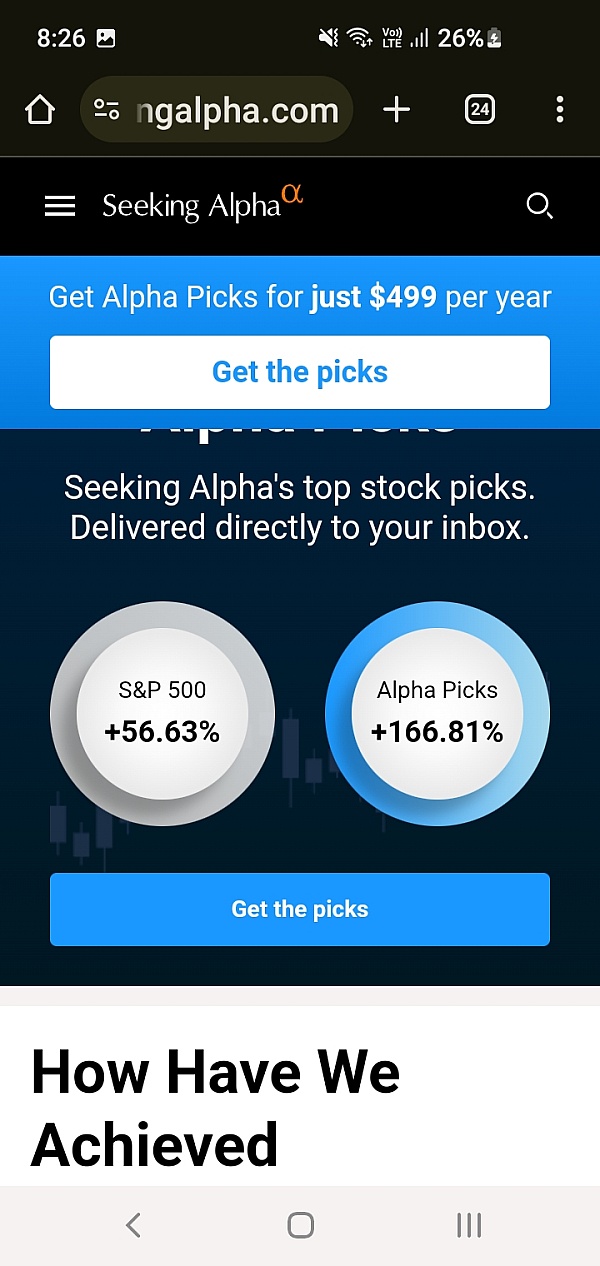

Seeking Alpha is one of the only informational investment sites that I base actual investing decisions on. I highly recommend them as an essential resource.

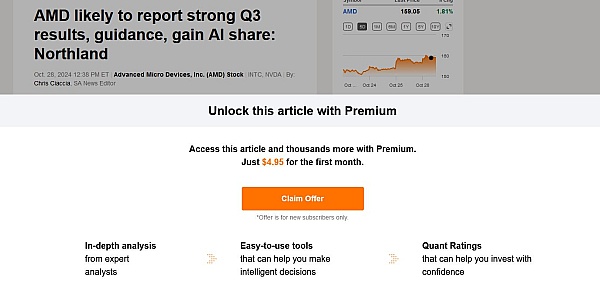

I used to be a fan of SA but the push to make money has made it useless. Even basic news on portfolio holdings requires premium cost. They really screwed up a good thing!

Hi Steven,

Please be informed that it is our endeavor to make the site as user-friendly and beneficial as possible, and we will ensure that the feedback reaches our Product team for further analysis and improvements.

We recently made some changes to our paywall policy, in order to continue providing our users with outstanding financial analysis and news.

The good news is that you can still access any article on any stock, even without a paid subscription.

You can read more about this recent change here: https://seekingalpha.com/article/4396836-important-update-for-seeking-alpha-users

The monthly article limit is dynamic to the individual member, based on the device they use, the traffic source, and a number of other parameters. We do notify the member of when they are close to reaching their limit and when they have reached their limit with the following banners:

If you have any additional questions, please feel free to write to us at subscriptions@seekingalpha.com

Best,

The Seeking Alpha Team

BEWARE! DO NOT USE THIS SITE!

Doesn't deserve even a 1 star! Liars, cons that ONLY care about making themselves a profit! Slandering company/stocks without solid evidence, just BS! Which proves they are nothing but PAID tyrants that do NOTHING but print what their TOLD to by crooked traders!

Hi there,

Thanks for your note and we apologize for it took us longer than usual to reach back to you.

Please be informed that it is our endeavor to offer you a hassle-free experience and help you make better investment decisions, we are here to gain a better understanding of what may have transpired and provide an amicable solution, in case of any concerns please feel free to reach out to us at subscriptions@seekingalpha.com

Best,

The Seeking Alpha Team

Top value for the subscription cost. SA blows Dividend.com, of which I'm a paid subscriber, out of the water. I like SA better than Yahoo Finance Plus, as well.

Thanks for your wonderful feedback, Robert!

It is always our endeavor to provide you with the best user experience, and we're delighted to hear that Seeking Alpha is hitting the mark for you:)

Best,

The Seeking Alpha Team

Overall SA is great for US equities. I wish it covered all equities in the world and gave more insight into why the quant system is rating a particular stock well or not.

Hi Arnav,

Thanks for your wonderful feedback - we're really happy to hear Seeking Alpha is able to help you make more informed investing decisions!

We've shared your suggestions with our product team for their review and consideration.

Best,

The Seeking Alpha Team

Articles are always well written and thought provoking. The Q & A portion is most helpful since it portrays differing views that are very helpful in forming an opinion on the subject covered.

Hi Donald,

Thank you so much for taking a moment to review us!

Our teams work hard to meet expectations like yours, and we’re happy to hear we are hitting the mark for you.

Best,

The Seeking Alpha Team

Please find hereunder my multi year experience as a very satisfied Seeking Alpha user since many years

Seeking Alpha offers a great variety of investment info on all types of investments, written by competent authors whose positions are cleverly completed by recommendations of others articles on related subjects and reader's comments generally as interesting as the authors' articles

Excellent courteous and friendly customer service, always ready to help and answer quickly to any question or problem...

All that for free ( SA Standard) or at a very affordable price {Premium).

Seeking alpha {free and Premium) have become my main source of information for my investment decisions. So many authors, tools and sources to choose from, displayed in an easy to use and easy to understand way.

I use it profitably since many years, first using the Free standard service which is very complete by itself

This service has been so helpful and informative that it took me my several years before considering that I would need the Premium service but a great promotion price helped me to take the decision.

Now, after two year using the Premium service the facts are that it paid easily by itself so that I do not consider it anymore as an expense but rather as an irreplaceable knowledge and decision asset to investing.

A. L Premium

Now Retired individual investor from BC Canada

Hi Annie,

Thank you so much for this wonderful feedback!

We're delighted to hear that Seeking Alpha is hitting the mark for you:)

Best,

The Seeking Alpha Team

Most of the authors have an agenda, the site is completley biased against Technical Analysis, even though many of the authors have good track records. I remember following Sol Palha and Arvy, and suddeny Sol Palha stopped publishing. I asked him why, he responded that they would not publish any article unless he included fundamental analysi and kept the TA to a minimum. The ironic part is that this author proved himself over and over again through the articles he had published on other sites but they would not have it. So he Sol left and then Arvy also left.

Their premium service now that is a joke, who would pay $200 for such a service. I asked someone that used it for two months, they said got nothing out of it.

Hi Vlad,

Thanks for your note and we apologize for any misunderstanding.

We strive to ensure all our articles are factually correct but we do not keep any biases towards anybody's opinion. Authors are allowed to publish bullish/bearish articles on stocks that are long/short (respectively), providing they disclose their bias. Active investors with "skin in the game" often have some of the most articulate opinions on a stock, and we encourage them to publish their opinions on Seeking Alpha.

If you find a Seeking Alpha article containing a material factual inaccuracy, you can dispute it using the following steps:

Submit a dispute by emailing disputes@seekingalpha.com. Please be sure to include a link to the article under dispute in addition to the above information.

Identify precisely which section of the article you dispute (quoting the text), and provide supporting evidence of your claim that the article is materially wrong.

(Please do not use the dispute process to disagree with the author. Everyone is entitled to his or her opinion about a stock; that's what makes a market.)

In any case, please always feel free to write to us at subscriptions@seekingalpha.com

Best,

The Seeking Alpha Team

The tools that write here take sound bites and public info and make rash, ill informed and wildly inaccurate predictions with garbage analyses. Serious idiots.

Hi Joseph,

Thanks for your note and we apologize for it took us this long to reach back.

Every contributor on our website goes through a rigorous screening process. Every article posted on our website goes through a rigorous editing process to ensure quality and accuracy.

If you feel the need to dispute an article, or any of the facts in it, please do it from the article page itself. You will find a link to do so in the 'About us' section at the bottom of the article.

You may also contact our editorial team directly by writing to editorial-issues@seekingalpha.com. One of our product managers will read your email promptly, and address any issue.

Best,

The Seeking Alpha Team

Good reading for analysis and most of them are timely and in plain English. There are wide range of opinion provided so it is up to each individual to take the ones that suits oneself.

Hi Grace,

Thank you so much for taking a moment to review us!

We work hard to meet expectations like yours, and we’re so happy to hear we are hitting the mark for you.

We've shared your suggestions with our product team for their review and consideration.

Best,

The Seeking Alpha Team

Most of the authors has their own agenda, working for some one else beside you.

If you do any decision on their research it could be disaster for your finance.

Hi Matan,

Thanks for your note and we apologize for any misunderstanding, and that it took this long to get back to you.

Every contributor on our website goes through a rigorous screening process. Every article posted on our website goes through a rigorous editing process to ensure quality and accuracy.

If you feel the need to dispute an article, or any of the facts in it, please do it from the article page itself. You will find a link to do so in the 'About us' section at the bottom of the article.

You may also contact our editorial team directly by writing to editorial-issues@seekingalpha.com. One of our product managers will read your email promptly, and address any issue.

Best,

The Seeking Alpha Team

I like Seeking Alpha, they have great customer service on the rare occasion that there is a query. I have found for me as a private investor, Premium is the best choice, allows access to articles and content. The Free part is okay but to be fair limited.

Over the years I have on and off subscribed to various paid subscriptions and some have been okay but none that tempted me to stay indefinitely. I did ok in 2021 by following a few Tech based ideas but be careful as ultimately it is a subscribers own call as to how to play things, there are a few "model portfolio" subs but actually the SA picks is just as good. I imagine there are some very good paid sub providers but I have enough with Premium and SA picks.

Clearly there are competing websites but to date I haven't felt the need to move even after having a look. There are active contributors on articles and often more is got from that then the article itself.

Overall it's the only sub I consistently stick with allowing for the fact I may sign up to other paid services on SA now and again.

Thanks for your wonderful feedback, Paul!

It is always our endeavor to provide you with the best user experience, and we're delighted to hear that Seeking Alpha is hitting the mark for you:)

Best,

The Seeking Alpha Team

Articles for every point of view on a stock. Never fact based and often use misleading stats. The web would be better without it.

Hi Nigel,

Thanks for your note and we apologize for any misunderstanding, and that it took this long to get back to you.

Every contributor on our website goes through a rigorous screening process. Every article posted on our website goes through a rigorous editing process to ensure quality and accuracy.

If you feel the need to dispute an article, or any of the facts in it, please do it from the article page itself. You will find a link to do so in the 'About us' section at the bottom of the article.

You may also contact our editorial team directly by writing to editorial-issues@seekingalpha.com. One of our product managers will read your email promptly, and address any issue.

Best,

The Seeking Alpha Team

"HUSK OF A COMPANY. CLEARLY, A STEAMING PILE OF DOG EXCREMENT" Is what they published about a tech company I am invested in. They obviously did NO research and support false narratives. An author of theirs was recently sued for libel, falsely stating info while shorting a company they wrote about. FRAUD IN ACTION. I used to think they wrote about stocks. They are CLEARLY manipulating, gouging, and denying affiliation. These are the criminals who make their money by trying to tank small businesses by shorting and writing false narratives. Talk about a husk of a company...

https://www.reuters.com/world/us/i-regret-any-harm-short-seller-compensates-target-rare-move-2021-06-21/

Hi Joshua,

Thanks for your note and we apologize for any misunderstanding.

Every contributor on our website goes through a rigorous screening process. Every article posted on our website goes through a rigorous editing process to ensure quality and accuracy.

If you feel the need to dispute an article, or any of the facts in it, please do it from the article page itself. You will find a link to do so in the 'About us' section at the bottom of the article.

You may also contact our editorial team directly by writing to editorial-issues@seekingalpha.com. One of our product managers will read your email promptly, and address any issue.

Best,

The Seeking Alpha Team

My main complaint is that customer service does not email you to advise that your free 2 week subscription is up and that your credit card will be charged if you do not cancel. I complained about the fact that a charge was made for a servce I did not want and didn't even know I had subcribed to. I was told that they do not issue refunds afer the charge was made. I rang them on the 26th. Customer service said they would issue a refund provided I took a two year subscription at their special rate. This I did and my credit card was charged on the 26th. There was a refund issued on the 6th of December but since I did not call them until the 26th to complain I did not know how the refund could be issued dated the 3rd when I did not ring them until the 26th. I needed a clarification and the agent said I did not ring on the 26th about the matter of the refund and that he would deny that any such conversation happened. He would not answer my question and hung up on me. I have completely lost trust in Seeking Alpha and can only advise that you be vigilant with subscriptions and do not allow automatic renewal in your paypal account.

Thank you so much for taking the time to leave us a review, Shirley.

We maintained complete transparency with the users and the question of any confusion should not arise. We send a Purchase confirmation email with all the product details immediately as soon as the user subscribes to any service on the Seeking Alpha website.

Yes, Our Terms of Use specify that our subscriptions are non-refundable once billed. And canceling a subscription does not trigger an automatic refund.

However, your opinion matters to us. So, I have noted this feedback and will make sure to pass it along to our feedback and improvement team for further review and consideration.

If you have any further questions, feel free to write to subscriptions@seekingalpha.com

-The Seeking Alpha Team

I started a 14-day free trial of premium service on seekingalpha.com (SA for abbreviation). According to their promotion, there should be no charge on me if I cancel it on time. I canceled the subscription precisely the same day I subscribe. However, my credit card has been charged $ 320.80 for an annual fee. The fee was not charged for the premium service but for an unknown service called 'The data driven investor' (DDI for abbreviation).

From the very beginning, I did subscribe to only one service that is a 14-day premium free trial. I did not click on any button by myself to subscribe to and did not agree to use the DDI service, not to say an annual subscription. Only SA did send me a separate email about DDI, which was automatically assigned to me, and the trial period is also 14 days. However, SA sent me too many emails a day that this email did not get my notice. As a result, I did cancel the premium service on time, but I did not cancel the DDI service. That's why I got a charge on my credit card.

It really takes some effort to get my refund. (I here give one more star because they finally refund.) Take caution; when you subscribe to one service, they may assign additional services behind you. It's their tricks. Read every email in every detail to avoid being charged, not of your own will.

Hi Moonie,

Thanks for your note. We are happy to hear your refund request was positively resolved.

To provide context to what happened:

You had opted to start a free trial to DDI immediately upon starting a free trial to Seeking Alpha Premium. Based on invaluable feedback such as yours, we came to understand that some members had difficulty understanding they were opting in to a free trial to a separate service.

We sincerely apologize to all members for any confusion or misunderstanding, and have since revised how DDI is offered within the Premium onboarding flow to make it more clear to members that they are undertaking an additional free trial that is separate from Seeking Alpha Premium.

If you have any further questions regarding DDI or Premium, feel free to share your thoughts with us directly - contactus@seekingalpha.com

Best,

The Seeking Alpha Team

I'm not sure how I came across Seeking Alpha but Im glad I did!

This website has the ability to give you crystal clear pictures of "why now" and "why later"

Hi Lino,

Thank you so much for taking a moment to review us! Apologies for it took us this long to reach back to you.

We work hard to meet expectations like yours, and we’re happy to hear we hit the mark for you.

Best,

The Seeking Alpha Team

Seeking Alpha provides quality research and market insights at a very competitive price.

I am happy to recommend the service to others. Thank you to the Seeking Alpha Team for the top work.

Thanks for your wonderful feedback, Andrew!

It is always our endeavor to provide you with the best user experience, and we're delighted to hear that Seeking Alpha is hitting the mark for you:)

Best,

The Seeking Alpha Team

Saw article by Gefvert on 3/26/2013 where he was down on CPST. Shows in his profile he has a short position in that company, and that he will not write anything about a company unless he believes it will have an immediate impact on it's stock. It appears he may be trying to drive down CPST stock to cover a short position. Now, whwether or not Capstone's business is sound is another store. I have made money trading their stock, and currently have a small long postion, so this caught my attention. I have studied their financials myself, and if you are investing in them (or any other company) you should do your own due diligence. In the end, the market determines what a stock is worth. There are many highly over valued stocks when viewed from a fundamental perpspective, but they are what they are in the marketplace. I don't believe any person on seeking alpha or any other site should be able to try and manipulate a stock. I see this story as totally biased.

Hi there,

Thanks for your note and apologies it took us this long to reach back.

We strive to ensure all our articles are factually correct but we do not keep any biases towards anybody's opinion. Authors are allowed to publish bullish/bearish articles on stocks that are long/short (respectively), providing they disclose their bias. Active investors with "skin in the game" often have some of the most articulate opinions on a stock, and we encourage them to publish their opinions on Seeking Alpha.

If you find a Seeking Alpha article containing a material factual inaccuracy, you can dispute it using the following steps:

Submit a dispute by emailing disputes@seekingalpha.com. Please be sure to include a link to the article under dispute in addition to the above information.

Identify precisely which section of the article you dispute (quoting the text), and provide supporting evidence of your claim that the article is materially wrong.

(Please do not use the dispute process to disagree with the author. Everyone is entitled to his or her opinion about a stock; that's what makes a market.)

In any case, please always feel free to write to us at subscriptions@seekingalpha.com

Best,

The Seeking Alpha Team

I appreciate the well-organized, timely information about the dividend-producing stocks in my portfolio.

Thanks for your wonderful feedback, Mark!

It is always our endeavor to provide you with the best user experience, and we're delighted to hear that Seeking Alpha is hitting the mark for you:)

Best,

The Seeking Alpha Team

Q&A (12)

I renewed my seeking alpha subscription today but unable to access the site. How long will take to access the site after subscription renewal

Answer: Hi Ramakrishnan, thank you for reaching out! Can you please send us an email to subscriptions@seekingalpha.com together with your device model and OS version so that our tech team could investigate this further? Screenshots would also be most helpful, if possible. Thank you, Richard from Seeking Alpha Customer Service.

Of late I am unable to read your notifications because after reading one notification the rest of the notifications disappears.

Answer: Hi Ramakrishnan, thank you for reaching out! Can you please send us an email to subscriptions@seekingalpha.com together with your device model and OS version so that our tech team could investigate this further? Screenshots would also be most helpful, if possible. Thank you, Richard from Seeking Alpha Customer Service.

access seeking alpha members...seeking their advise.

Answer: There was only one question in the are of your question: it was do they work in eastern time zone? I'm in the Central time zone and all times reflect my time. Although I didn't see any option to change to Eastern time. If I had to guess, I would think it could set local to members because they got everything else so right.

Have a question?

Ask to get answers from the Seeking Alpha staff and other customers.

Overview

Seeking Alpha has a rating of 2.8 stars from 358 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with Seeking Alpha most frequently mention premium service, credit card and free trial. Seeking Alpha ranks 3rd among Stock Trading sites.

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Similar businesses you may also like

See more Stock Trading Businesses- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hi Douglas,

Thanks for your wonderful feedback - we're really happy to hear Seeking Alpha is able to help you make more informed investing decisions!

Best,

The Seeking Alpha Team