I have never faced portfolio management but I hope these guys help me, despite the fact of my personal quite high demands in case of goals achievement.

If you eagerly want to save your funds from rising inflation, then you should apply for services to this company! I've saved all my money and received an opportunity to multiply'em!

If we take the obvious, but the most significant feature in ISEC WM, which is important for customers, then I will immediately note the PERSONAL APPROACH.

Don't think it's just a pretty phrase.

After all, each of us has some expectations from investments. For example, many give it up - because the expectations do not match reality and the person feels disappointed.

Here you can immediately discuss everything with a real professional who understands WHAT IS WAITING FOR YOU AND HOW YOU WILL EARN

Believe me, it is better to understand such things right away, so that despite the help, you will understand exactly how your money works.

Investing is very interesting topic recently. I started investing in stocks long ago, yet the amounts were very small.

With small amounts you don't get much of the dividends and you don't get much of the savings. Only after I started saving 20-30% of the salary every month I could see the real result. Yet the other problem came.

I know the stock market is bulling now. But what happens to my saving if it goes bearish?

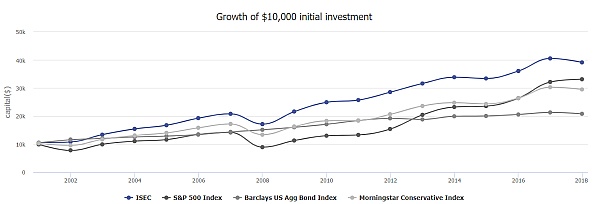

I didn't know the exact answer, but I knew I could not afford loosing my savings. I strated reading about investmetns, but all these alternative instruments and rebalancing seemed to be rather complicated. I don't want to get a new profession of a market analyst. This is why about a year ago I trusted my funds to be managed by professionals at ISECWM, which I have not regretted ever since. I know that now, in case of recession or market collapse my funds are not that much in danger as they used to be. The risk is always there, but better limit the risks if you can, right?

I wanted to find new sources of income long ago but it was not easy for me to cope with hesitation and doubt. It's hard for me to make the first move when it comes to trying something new. I think that it's my biggest personal shortcoming. I hope to get rid of this nasty thing over time.

Nevertheless, this time I managed to gather up enough courage to try a new thing in online money making. I'm talking about portfolio investment. I had extra money - about $2k and it's good that it was enough to get started with this company. I decided to try once I learned that it's regulated and even there's some solid guarantee that I can be refunded in case the company goes broke.

So, I deposited this amount and the company's experts helped me to build my first portfolio. It includes somethings I'm not familiar with, in particular, government bonds - I never dealt with this stuff when trading on Forex, although I heard about them from economic news. Portfolio investment is the thing when you need to be patient because some time should pass to let me see decent outcomes. So, I try to be patient and wait for about half a year to make the first withdrawal decision, although as I learned it's possible to withdraw money much earlier.

Honestly, I would not be making any investments rn if it were not for Isec. Apart from presenting such a convincing offer, it simplifies investing which is otherwise a complex thing.

I'm struggling to trade manually. So, I decided to find something that could back me up. I chose portfolio investment with this company. I already see gains.

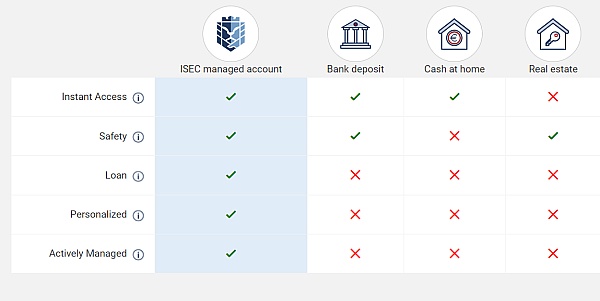

I liked the ISEC WM for its comprehensive investment approach. The very first thing I will start my story with is the legal conditions. ISEC WM has taken care to protect the rights of its clients. The company is regulated by CySEC. And as you know, this body has recently been making more demands on companies engaged in the custody of finances, loans, and investment management.

Next, let's take a look at how the company builds its relationship with its customers. Before investing, each client has to fill out an extensive questionnaire or have a video meeting with its manager. This will give a better understanding of the investor's situation and goals. And also to find out what strategy is best for him.

And the last factor is risk diversification. ISEC WM is built in such a way as to protect the investor from various risks. There are some strategies. It is possible to continually monitor the account and even withdraw funds for investors. So I'm satisfied with everything here. I think the company has a promising future.

I don't even see ISEC WM as a service provider that you purchase a certain expertise from. They are a reliable partner and a guide for me in the markets. I am a long term customer.

Although I do not operate with a large amount of investment capital, I still can take advantage of cooperating with the ISEC WM investment firm that helps me build a long-term strategy to retire early.

It's a great option for investing goals. Affordable minimum deposit, so you can start small and grow it in the process.

I used to think that investment is for rich people. But I read about ISEC Wealth Management. The mission of this company is to help people like me invest. I collected only 2500 euros, and decided to contact them. I was told about investing in stocks and bonds so that I could understand everything. You can deposit only 1000 euros. It made me happy. I wanted my money to work for me and to be able to collect a child for the university. I was told that about 10% a year is expected (not promised though).

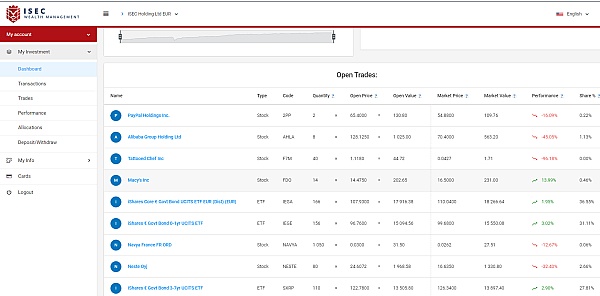

I also have access and can see what is happening with my investments.)) It's good that ISEC Wealth Management understands the needs of ordinary people and makes the world of investments accessible.

As for security, this company is a member of the Investor Compensation Fund and is regulated by the CySEC. Previously, I did not understand anything about this, but now I began to understand. I believe that in the person of ISEC Wealth Management I received not only an investment consultant, but also a new source of interesting information.

ISEC WM is an investment firm working with retail customers with the aim to build a long-term investment strategy and manage clients funds allocated in the financial markets. I was satisfied with the professional level of the consultant I spoke with. Besides a robust projected yield, I have several additional reasons to build my account up. Here they are:

Compound interest. I have an opportunity to leave the profits earned from the interest in the investment account, increasing the overall amount.

Add funds. Instead of increasing the savings account with no to little interest, I can add a part of my monthly income into the investment account.

Flexility. ISEC WM manages my account actively, informing me about potential changes in the market sentiment. I can request to re-balance the asset allocation in my portfolio.

Safety. The company ensures risk mitigation as most of the securities represent stable sectors of the financial market.

Transparency. I can monitor my investment account at any time, getting clear information about where my funds are allocated.

I believe that everyone should learn to invest. It is necessary to have more money and it is also necessary to be able to retire earlier. It's good, right. I think that one should not stand but move along the quadrant of money from Robert Kiyosaki. You need to get to the Investments square. This is what makes you feel free. The first step for this is to choose an investment company. The earlier the better.

But not all investment companies allow you to invest with little money. Therefore, I turned my attention to ISEC WM. Here you can become an investor if you have a deposit of $ 1000. Really. You can trust me. ISEC WM managers will tell you how you can better invest your money in order to get the best refunds. There are different risks. Of course. The higher the risk, the more money you get at the end of the year. But, I advise you to invest for a long period. Reinvest profits and add money to your deposit every month.

You will be surprised at how much more money you have. It will be more features!

I love this guys, and I trust them a lot. I have been researching good wealth management companies and ended up with ISEC WM guys. Now I have no problems at all.

Yes, it also has risks and may involve some difficulties. Life is not a fairy tale. But these guys really manage the risks instead of ignoring them.

I have never been interested in investments and actually I thought that it's an activity for slackers. However, when I understood the volumes which this activity has I started to think of the ways how to succeed at investing money. Ofc, it's super tough especially or such a novice in this activity like me, nevertheless I was sure that I might be suceeded at it only if I would have a free time... Unfortunately, I don't have such one :D

So, as the matter of fact, investing requires all the free time. Isec wealth management became for me a ticket to success. I found it accidentally, when I searched for various investing techniques and as far as I am concerned, it's full of real experts in the sphere of investments, so I applied to them and asked them to create, control and manage my portfolio. The initial sum for starting diving deep in investments is just 1k$ or equivalent in euros.

I explored the terms and conditions, explored the FAQ section in order to be ready for all the misunderstandings and started working with them. Nowadays my portfolio goes well, but I don't wanna guess what will be in future.

These guys will do everything for you to become investors and make money - true profis. Find your invest model and grow with it.

I am blessed to have a job that covers all my expenses and I aslo have some money to save left. Of course I could find the way to spend more money. Actually I used to do that and spent a lot on traveling. Covid has changed that unfortunately. Or fortunately. I am yet undecided)

Anyway, first I tried managing my saving myself. The first thought was to take the money to the bank. Ahahah, that was a silly idea. It turned out that bank interest rates don't even cover the normal inflation. People say compound interest does miracles. Oh well, perhaps it does when you get 5-10% ROI yearly, but you a doomed in case you use banks savings accounts for this purpose.

Next I decided to invest in stocks. The more I learnt, the more difficult the subject turned out to be. Technical analysis, fundamental analysis, etc. I could bareall that and it even was interesting! Yet, one day I undertood clearly that stock market is currently extremely overheated. THis is a bubble and I can actually lose more than I can earn if I invest it all in stock market.

There are the methods and the assets you can consider to diversify and stay profitable even when recession starts, but this was the point when I understood I'm stuck. My money were still there non-invested and there was too much to learn before I could invest.

This is when I decided to trust somebody who knows better. ISEC WM came in and now they manage my funds. So far all goes according to the plan. I understand that when recession starts I might go in red for a little while, but that's normal.

Wealth is not only about finance. That's why you better to think of wealth ASAP. Many thanks for ISEC to deliver me the proper idea on that terms.

Q&A (43)

What types of assets are included in ISEC WM portfolio?

Answer: Oh, there are lots of them. 1) Government bonds. These are the long-term investing instruments that particular countries issue to raise money. For example there are 5-years, 10-years and 30-years US treasury bonds. They have various yield rates. Government bonds yield is coupled with the national bank's interest rate. This type of asset is considered to be highly secure and conservative. 2) Corporate bonds. The principal of corporate bonds is the same as government bonds. It's the debt obligation of corporations. The main dissimilarity from stocks is that corporate bonds don't give you the part of a company. You get only interest from the bond, no matter how profitable the company is. 3) Equities of the companies. ISEC invests in shares of different companies with different yield ratios to diversify the overall assets in your portfolio. Therefore combining various instruments with various characteristics. ISEC wealth management using mathematical models achieves the required portfolio interest percentage.

What investment model ISEC WM would you recommend to retire earlier?

Answer: I, too, established the goal of retiring early. In the beginning, when I had free money. I start with F. I. R. E. movement, but once my income became bigger - I tired of FIRE strict rules. I chose ISEC WM Balanced investment model with a yield of 9-10% per annum as it is hard for me to think of investing each month and I'm okay to share some profit for service. And I'm Okay to work longer but spend life with a pleasure ;)

How should I build my portfolio?

Answer: You shouldn't. ISEC experts will do it for you. Which is a good thing because you have to delegate the responsibilities to those who are more competent in the sphere than you are. At least if you want to multiply your savings.

What is the minimum deposit that I am allowed to invest to work with ISEC WM?

Answer: The opening of an account starts from 1000 EUR or USD. So, you can be sure open an account whenever you want it and apply to this company in order to boost your funds. According to my exp, better to invest starting from 5k USD. Still, really depends on your goals.

What do you think of their portfolios and risks allocation?

Answer: I am certain that a diversity of portfolios provided by the team perfectly caters to the needs of various people with different risk toelrance. You know, there are those portfolios with the most moderate risks but proportionally small profitability %. On the contrary, if you wanna have more equities in the portfolio, rather high risks, you can easily opt for adventurous portfolio.

Do you think it is worth using their services if you are a total noob at understanding financial markets?

Answer: In this case, it is advisable to use the services of companies like ISEC WM instead of starting to invest on your own. The advantage of ISEC is that you can start with a relatively low investment

What are your main assets to invest in?

Answer: Assets which they invest money in depend on the chosen portfolio. Fixed-income securities, domestic & international stocks, government bonds and some others are mainly used by specialists.

I really don't know and I woud like to know, what plan did you choose for investing with minimal risks?

Answer: Well, I chose the best one. This is an adventurous plan which has the highest yield among other investment plans. Of course, I understand that risks are higher than usual there but it doesn't matter.

What is the best way to invest in ISEC WM, in one transfer or to invest additional money monthly?

Answer: Well, you need an initial deposit nonetheless, and it is a lot more advantageous to top up your account for greater yields on your account. It will help you reach your financial goals.

For anyone who has portfolio here, what assets do they invest in, exactly?

Answer: Number 1 thing that you should know: They always invest only in those assets that correspond to the chosen portfolio. For instance, if you opt for the safest option with the smallest yield rate, then fixed income securities will prevail. The more adventurous portfolio you choose, the bigger the potential yield, hence the more money they invest into domestic and international stocks and less money goes to government bonds. In fact, the range of markets is vast and you can track everything in the dash.

Have a question?

Ask to get answers from the ISEC Wealth Management staff and other customers.

Overview

ISEC Wealth Management has a rating of 4.7 stars from 103 reviews, indicating that most customers are generally satisfied with their purchases. Reviewers satisfied with ISEC Wealth Management most frequently mention wealth management, investment portfolio and long term. ISEC Wealth Management ranks 2nd among Financial Advisory sites.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members