Earlier I was just skeptical about it. I thought that any services offered such as passive income are nothing but fraud. Yeah, I thought it all was fraud. Perhaps, I had a sort of paranoia. Fortunately, over time I changed my mind. Perhaps, it was a lucky coincidence because by the time I discovered this company I earned more. I worked on two jobs. I invested in a portfolio. Now I'm waiting for results. I like that here it's possible to withdraw money at any time.

From my personal experience, i would recommend that people try investing first than trading. You can save more time analyzing markets, instruments, strategies or industry itself while your portfolio is in the right hands of relevant managers of isec wm who know how to invest correctly.

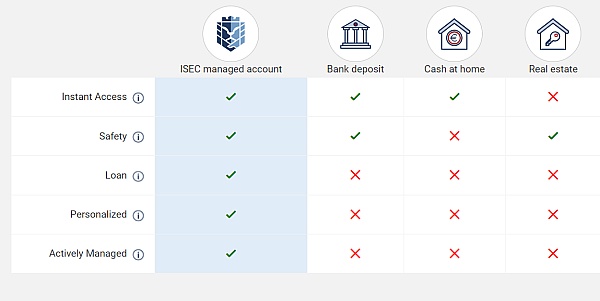

Portfolio investing option with ISEC seems very appealing, especially in this day and age, when you can't get a satisfying yield from the bank deposits due to the global economic situation.

Plus there are various portfolios up for grabs, with diversified rewards.

If you once have thought about becoming a true investor, then perhaps this company is something that you seek for. They perfectly handle their job and offer ou an opportunity to dive in to the world of investing with them.

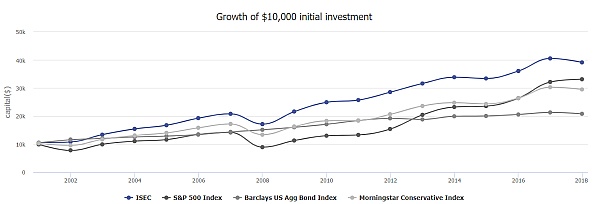

You can set particular goals and they will help you to to reach these goals via investments. You shouldn't pay for opening an account, however you should pay for portfolio setup and management, 0.5% and 0.265% respectively. One may claim that it's stupid to pay for investment management when you can simply buy snp index. Aha. I know a few people who tried that in person. Trust me, better leave it to professionals.

The goal must be precise in numbers, not vague "financial independence" or "not to need anything". And the goal should have a time horizon. By setting specific goals, ISEC WM decides what strategy to follow. YOu can't expect doubling the deposit over a year. 15-20% ROI is the yearly max I guess

ISEC WM is a nice investing company which gives an opportunity to invest your money for quite a long investing period in order to get more in the future.

I feel that nowadays it is vital to invest however not all of the people are ready to spend their time on learning and practising investing.

I don't like the management fee but oh well. That's the price we pay for ignorance about markets

ISEC wealth management has something to offer to people that don't want to dive deep into the trading industry and make trading decisions by themselves. Ultimately trading career is not for everybody.

ISEC on their part offers decent annual yield percentages for investments. Plus you can stacking up the deposit for more income.

The most important thing I realized after a month of investing is that this type of profit-making requires patience from the investor.

I understand that I will not make a huge profit in a few days. But at the same time it is clear to me that a source of stable income is available to me.

I am ready to wait. And it is important that my investments are in good hands.

This company destroyed my notion that investing is complicated. A few months ago I was sure of that.

But the managers and services of the company changed my mind.

For example, I can confidently say that the calculator they provide helps me understand how my investments work.

A very informative tool and at the same time clear.

I would rate Isec as an A+ company that provides the necessary diversity of investing opportunities.It has a very solid foundation and reliable enough infrastructure to consider it as a top-tier private wealth management entity.

I adore investing, but started to notice that everything goes wrong... It's not surprising actually, just look at the situation in the world.

Guys from ISEC WM helped me a bit to balance my portfolio and get stable profits.

ISEC has exceeded my expectations as a wealth management company.

From their responsible investing and personalized portfolio recommendations to the game-changing managed account solutions - I am thoroughly impressed by their professionality and knowledge.

Earlier I never worked with wealth management companies. I even never put money on a bank deposit. Nevertheless, the future doesn't seem to be easy. So, I decided to back my living this way. At first I planned to attend trading courses, but then I gave up this idea. I don't want to risk my money. I'd better entrust my funds to professionals.

This company offers pretty unique services as far as I'm concerned. I believe it is called wealth management or something like that. Basically they take your funds and invest in the most liquid assets to ensure the chosen yield percentage.

It's a cool concept if you think about it. Especially nowaday when you are constantly thinking about options to save your hard-earned money.The profitability could be a bit higher for me. But I think if a company offers an interest rate higher than the inflation it's already great.

Over the years the idea of trying my hand at investing in various projects was never far from my mind. Right now I've got a ready portfolio of investments at ISEC WM company. And my interest exceeds the interest on the bank deposits. My friends often ask me whether forex is profitable? And which course of action to follow? At what points they should pay particular attention when starting investing?

I always tell them I didn't offer any advice on how to trade. But if you find yourself as a talented trader, it is 100% worth it. It's like being a doctor, if you have talent, all things are possible. And if you don't know how to do anything, you will only lose money.

Or you can do what I do - I invest in buying a portfolio of assets with ISEC WM. This is not a Forex. I maximize my results, minimizing risks. I get a good returns here.

I have never seen a company that allows non-wealthy people to become investors. ISEC WM is just such a company. If you have 1000 dollars, then you can start building your investment portfolio. Yes, now it is not necessary to have $ 100,000 to invest in stocks.

Have money for a new iPhone? Buy better than 5 Apple stocks. It will be better, trust me. Or spend less money on soda and other drinks and sweets and buy stocks of Coca-Cola. That's not exactly how it works at ISEC as they don't use stocks only to build up a portfolio but you've got the idea.

Investing is thinking about the future of your family.

ISEC WM will help you. Good specialists work here to help you create your first investment portfolio!

Pretty fascinating offer concerning the investment portfolio management. I have no deep knowledge in investing money, hence the best option for me is to outsource this task and for these purposes i have chosen ISEC.

These guys explained me everything concerning th opening of account and how will they manage the portfolio. They analyze all the risks, correct the portfolio in case my one is weak or incompatible with the current situation on the market and generate income.

I think there is nothing better than outsourcing tasks where you don't have knowledge or experience.

At some point, I was considering several investment ideas as I had to make my funds work for me. Money must produce a profit instead of laying in a box. I had several options to achieve the goal. Purchasing real estate and getting profits from rental services was not a great idea as I think that's quite a low-liquid investment. For example, if I decide to get my money out of the business quickly, what should I do? It's not easy to sell real estate at the same price. Bank deposits are not attractive due to low interest.

I came across the ISEC WM investment firm. The company experts offered several investment models to me. I decided to give it a try. So far, profits are even higher than I expected. I feel secure as the government bonds are the safest assets in the world. Conditions are transparent, and I can check what's happening in my account at any time.

An investment firm was something that I needed to manage my capital last year when I received free cash unexpectedly. I do not want to quit my job as I'm interested in building a career. So I did not have enough time to start investing professionally. I decided to entrust my capital to professionals, and I do not regret that decision. ISEC WM experts are tru professionals, they figured out my goals immediately, and offered a balanced investment model. I get a sustainable income, and I am not worried about the safety of my funds.

The company expects to know how to manage client funds. ISEC WM charges commissions for the active account management but it's reasonable and affordable even for small accounts. The requirement for the minimum investment amount is also reachable for many people. I started with a very modest amount but managed to build the account up by saving some money every month and adding them to the investment. The average yield is much more attractive than bank deposits offer.

Q&A (43)

What types of assets are included in ISEC WM portfolio?

Answer: Oh, there are lots of them. 1) Government bonds. These are the long-term investing instruments that particular countries issue to raise money. For example there are 5-years, 10-years and 30-years US treasury bonds. They have various yield rates. Government bonds yield is coupled with the national bank's interest rate. This type of asset is considered to be highly secure and conservative. 2) Corporate bonds. The principal of corporate bonds is the same as government bonds. It's the debt obligation of corporations. The main dissimilarity from stocks is that corporate bonds don't give you the part of a company. You get only interest from the bond, no matter how profitable the company is. 3) Equities of the companies. ISEC invests in shares of different companies with different yield ratios to diversify the overall assets in your portfolio. Therefore combining various instruments with various characteristics. ISEC wealth management using mathematical models achieves the required portfolio interest percentage.

What investment model ISEC WM would you recommend to retire earlier?

Answer: I, too, established the goal of retiring early. In the beginning, when I had free money. I start with F. I. R. E. movement, but once my income became bigger - I tired of FIRE strict rules. I chose ISEC WM Balanced investment model with a yield of 9-10% per annum as it is hard for me to think of investing each month and I'm okay to share some profit for service. And I'm Okay to work longer but spend life with a pleasure ;)

How should I build my portfolio?

Answer: You shouldn't. ISEC experts will do it for you. Which is a good thing because you have to delegate the responsibilities to those who are more competent in the sphere than you are. At least if you want to multiply your savings.

What is the minimum deposit that I am allowed to invest to work with ISEC WM?

Answer: The opening of an account starts from 1000 EUR or USD. So, you can be sure open an account whenever you want it and apply to this company in order to boost your funds. According to my exp, better to invest starting from 5k USD. Still, really depends on your goals.

What do you think of their portfolios and risks allocation?

Answer: I am certain that a diversity of portfolios provided by the team perfectly caters to the needs of various people with different risk toelrance. You know, there are those portfolios with the most moderate risks but proportionally small profitability %. On the contrary, if you wanna have more equities in the portfolio, rather high risks, you can easily opt for adventurous portfolio.

Do you think it is worth using their services if you are a total noob at understanding financial markets?

Answer: In this case, it is advisable to use the services of companies like ISEC WM instead of starting to invest on your own. The advantage of ISEC is that you can start with a relatively low investment

What are your main assets to invest in?

Answer: Assets which they invest money in depend on the chosen portfolio. Fixed-income securities, domestic & international stocks, government bonds and some others are mainly used by specialists.

I really don't know and I woud like to know, what plan did you choose for investing with minimal risks?

Answer: Well, I chose the best one. This is an adventurous plan which has the highest yield among other investment plans. Of course, I understand that risks are higher than usual there but it doesn't matter.

What is the best way to invest in ISEC WM, in one transfer or to invest additional money monthly?

Answer: Well, you need an initial deposit nonetheless, and it is a lot more advantageous to top up your account for greater yields on your account. It will help you reach your financial goals.

For anyone who has portfolio here, what assets do they invest in, exactly?

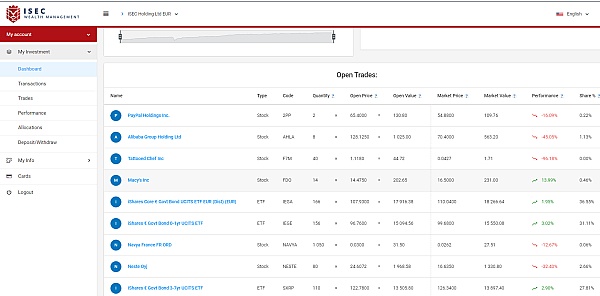

Answer: Number 1 thing that you should know: They always invest only in those assets that correspond to the chosen portfolio. For instance, if you opt for the safest option with the smallest yield rate, then fixed income securities will prevail. The more adventurous portfolio you choose, the bigger the potential yield, hence the more money they invest into domestic and international stocks and less money goes to government bonds. In fact, the range of markets is vast and you can track everything in the dash.

Have a question?

Ask to get answers from the ISEC Wealth Management staff and other customers.

Overview

ISEC Wealth Management has a rating of 4.7 stars from 103 reviews, indicating that most customers are generally satisfied with their purchases. Reviewers satisfied with ISEC Wealth Management most frequently mention wealth management, investment portfolio and long term. ISEC Wealth Management ranks 2nd among Financial Advisory sites.

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members